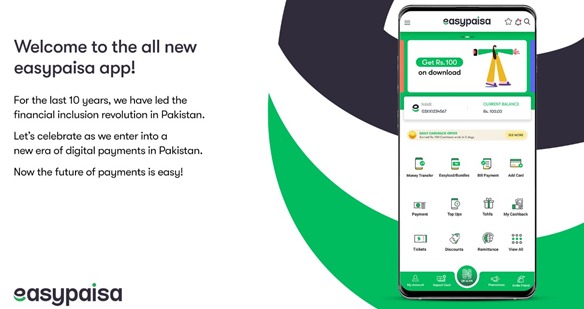

10 years on,Easypaisa’s FinTech revolution continues

In today’s increasingly digital world, it’s hard for most of us to even imagine living without a financial account and ability to access credit, insurance, and transaction facilities. Yet, the numbers of people completely cut off from formal financial services ran in tens of millions a decade ago. Resultantly, over 100 million Pakistani adults excluded from the country’s formal financial system, were forced to resort to informal, unscrupulous, means of financial support or services. Even for those who owned a financial account, everyday transactions were full of hassle and traveling long distances to bank branches and standing in long queues was unavoidable for all, including women and senior citizens.

10 years on,Easypaisa’s FinTech revolution continues

The underprivileged segment of the population was the worst hit as opening an account in a conventional bank was complicated and full of hassles. Tedious paperwork and distance to the nearest financial institution remained top barriers to opening a formal financial account. Things needed to be drastically simplified in order to bring financial inclusion to the masses and ease their lives. Easypaisa, the country’s first ever branchless banking service, resolved this by enabling account opening and sending and receiving money simply through a basic mobile phone. It enabled a common man to open a bank account straight from their basic mobile phones, and send and receive money from loved ones and other entitlements with ultimate ease.

The revolutionary mobile banking service leveraged Pakistan’s healthy teledensity, which stands at a promising 77% today, to deliver financial services straight to users’ mobile phones. In a very short time, a network of Easypaisa retailers and franchises mushroomed across the country, serving millions of customers each day. This triggered the digital transformation of Pakistan’s financial landscape with branchless banking becoming the cornerstone of Pakistan’s National Financial Inclusion Strategy of 2015. A number of banking and nonbank financial institutions came forward with their own mobile money products built on Easypaisa’s model. This gave Pakistan’s weak financial services ecosystem a robust footing that it was in a dire need of.

Facilitating everyday life, access to formal financial services helps families and businesses plan things better, be it long-term goals or unforeseen emergencies. Being able to have access to a transaction account to store money, send and receive payments, and access viable credit is the basic building block to manage our financial lives.

“I’m a food lover and frequently use Easypaisa’s QR feature to pay with ease and get amazing discounts on food deals at my favourite eateries,” shares Haniyya Aleem, a final year student of BS Food & Nutrition program. “It’s also very convenient when you get Pizza Hut orders delivered straight to your hostel room and pay through the Easypaisa app. The app facilitates me in other things too like subscribing my Ufone super card directly from the app. Easypaisa is truly a lifesaver,” she adds.

Retailers too continue to benefit from Easypaisa’s transaction volumes and its swift and secure platform.

“Easypaisa has added up to the earnings of my shop,” says the owner of Abbasi mobile shop in F-8, Islamabad. The devices and systems are very advanced and responsive so the customers place a high degree of trust in transacting through Easypaisa. The biometric verification system also makes Easypaisa the securest and most trusted money transfer option for customers. On my shop alone, hundreds of customers come to send and receive money and they have never reported a problem. They also love Easypaisa as it has rid them of standing in long queues to pay their utility bills – they can now easily pay their bills using Easypaisa from my shop or many other Easypaisa retailers in the area,” he adds.

For many years, convenient financial services had been a privilege limited to a select group of people within Pakistan. Easypaisa revolutionized the industry by bringing the same feasibility to anyone who owns a smartphone. From bill payments to cash transfer and a host of other services, Easypaisa allows an average consumer to experience a hassle free life just like that of people with active bank accounts. As smartphone usage grows, the circle of people who are able to experience this freedom will grow. It is the perfect combination where technology is used to bring ease and accessibility to the financial system for the country. Easypaisa looks to deliver these services in a way where everyone has equal opportunity to benefit from it.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!