Branchless Banking Transactions Witnesses Growth of Rs. 133.7 Mn during Q4, 2016: SBP Report

With the launch of 3G and 4G services in the country, Pakistan has achieved milestones in many sectors including e-Commerce, m-Health, m-Education, digitization of Govt organizations and even branch-less banking. This could not have been achieved without the increasing Mobile Broadband (MBB) penetration in Pakistan. Pakistan today has around 39 million 3G/4G users; this makes the dream of making Pakistan a true digital country more realistic while achieving the Vision 2025 as well. Branchless Banking Transactions Witnesses Growth of Rs. 133.7 Mn during Q4, 2016: SBP Report.

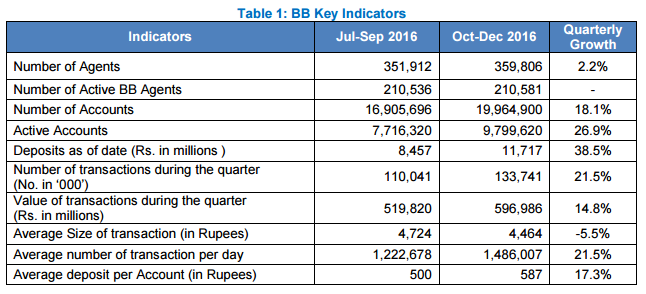

Branchless Banking (BB) industry has showed growth in some of the key indicators during the quarter Oct-Dec 2016. Significant rise have been observed in number of transactions, number of accounts and average deposits per account increased by 21.5%, 18% and 17% as compared to previous quarter.

Branchless Banking Transactions Witnesses Growth of Rs. 133.7 Mn during Q4, 2016: SBP Report

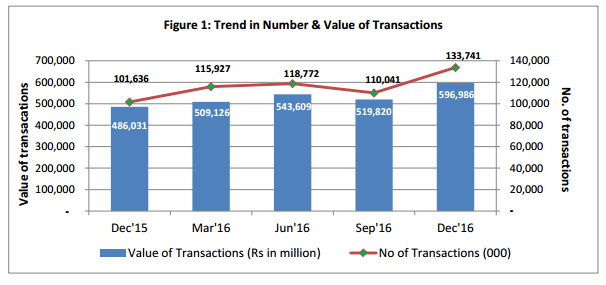

During the current quarter, Branchless Banking transactions grew to 133.7 million valuing Rs. 596.9 billion, which is 21% higher in volume and 14.8% higher in value in comparison to the previous quarter.

The numbers of BB accounts have also increased to 19.9 million in the quarter Oct-Dec 16.

Volume of Branchless Banking Increases by 21 Percent: SBP Report

Similarly, the number of Agents of the BB industry grew by 2.2% during the quarter, reaching to 359,806 by the end of current quarter. The share of agents in the market continues to be dominated by the main players like Easypaisa (30%), Jazzcash (19%) and UBL Omni by (12%).

The penetration of BB players has been observed in all provinces of Pakistan including remote areas. For future, BB service providers need to develop business strategies in line with demographic and geographic requirements of the country especially to reach out to financially un-served areas.

Let’s look at the figures of other “Key Indicators” of Branch-less Banking:

M-Paisa of branchless banking is taking over the fundamental role in banking sector across the globe. Countries like Tanzania got fully interoperable Mobile Money System. Hence, Pakistan must also increase the pace to maintain and increase its efforts in this regard.

To Read Complete Report Please Visit: State Bank of Pakistan

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!