FBR Announces Flat Rates On Mobile Phone Imports To Set Aside Ambiguities

Taxes On Mobile Phone Imports!

A few weeks back, we came to know that PTA mistakenly charged Rs. 45,000 custom duty on Rs. 3,000 feature phone. The custom duty on that feature phone was almost 15 times of its price which totally makes no sense. Everyone thought that the custom duties on mobile phones have just got skyrocketed. Due to this, everyone was losing their minds. So, in order to set aside any ambiguities, Federal Board Of Revenue has recently announced flat rates against various price segments on the mobile phone imports.

Government Imposes Taxes On Mobile Phone Imports Up to Rs 36,000

According to me, this is a very good step taken by FBR. These flat rates against various price segments will help in educating the public regarding the tax they would have to pay on their imported phones whenever they will return to their homeland, Pakistan.

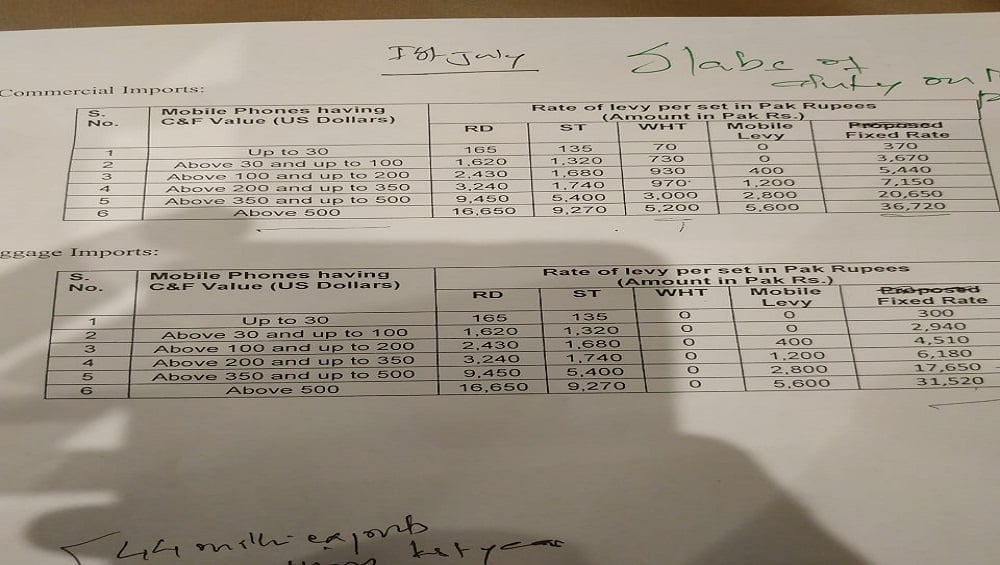

Now, let’s jump to the main topic of our discussion. According to the latest reports, FBR has divided the imported mobile pricing into two main categories:

- Commercial Imports

- Baggage (Individual) Imports

Furthermore, these two categories have been divided into 6 main pricing segments. First of all, have a look at the details for Baggage/individual imports.

- Smartphones priced below $30 will be charged a flat rate of Rs. 300.

- Phones priced between $30 and less than $100 will be charged Rs. 2,940.

- Handsets between the range of $100 and $200 will be charged a flat rate of Rs. 4,510.

- Mid-rangers between $200 and $350 will be charged a flat rate of Rs. 6,180.

- Handsets between $350 and $500 will be charged a flat fee of Rs. 17,650.

- Flagships and high-end smartphones will be charged a flat fee of Rs. 31,520.

Now, let’s head to the commercial imports. Have a look at that as well.

- Smartphones priced below $30 will be charged a flat rate of Rs. 370.

- Phones priced between $30 and less than $100 will be charged Rs. 3,670.

- Handsets between the range of $100 and $200 will be charged a flat rate of Rs. 5,440.

- Mid-rangers between $200 and $350 will be charged a flat rate of Rs. 7,150.

- Handsets between $350 and $500 will be charged a flat fee of Rs. 20,650.

- Flagships and high-end smartphones will be charged a flat fee of Rs. 36,720.

Furthermore, a decrease has been witnessed in the mobile phone imports during the First 8 Months of FY2018-19. It is appreciable as it will create Opportunities for Local Mobile Manufacturers. So, according to me, this is time for local mobile manufacturers to flourish their businesses and boost the local mobile industry.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!

What about the personal hand set, which is already in use not a box pack. And sencond thing awhat bout roaming sim ( if i will travel from uae to pakistan and i want to use uae sim in pakistan for that i have to register handset). Please explain