FBR cuts sales tax on mobile phones-Shift burden on Mobile Operators: Consumer Still to Suffer

FBR cuts sales tax on mobile phones-Shift burden on Mobile Operators: Consumer Still to Suffer

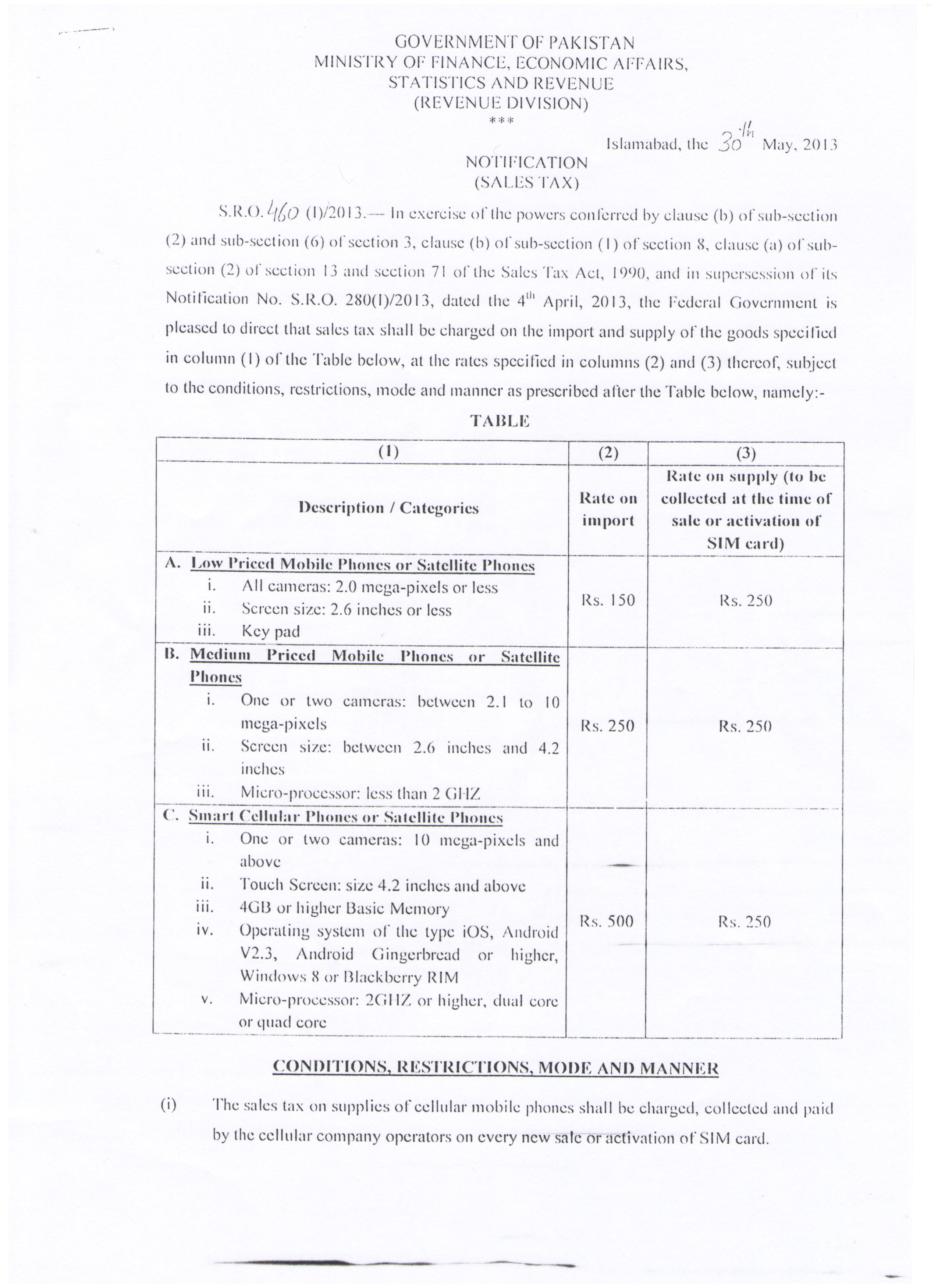

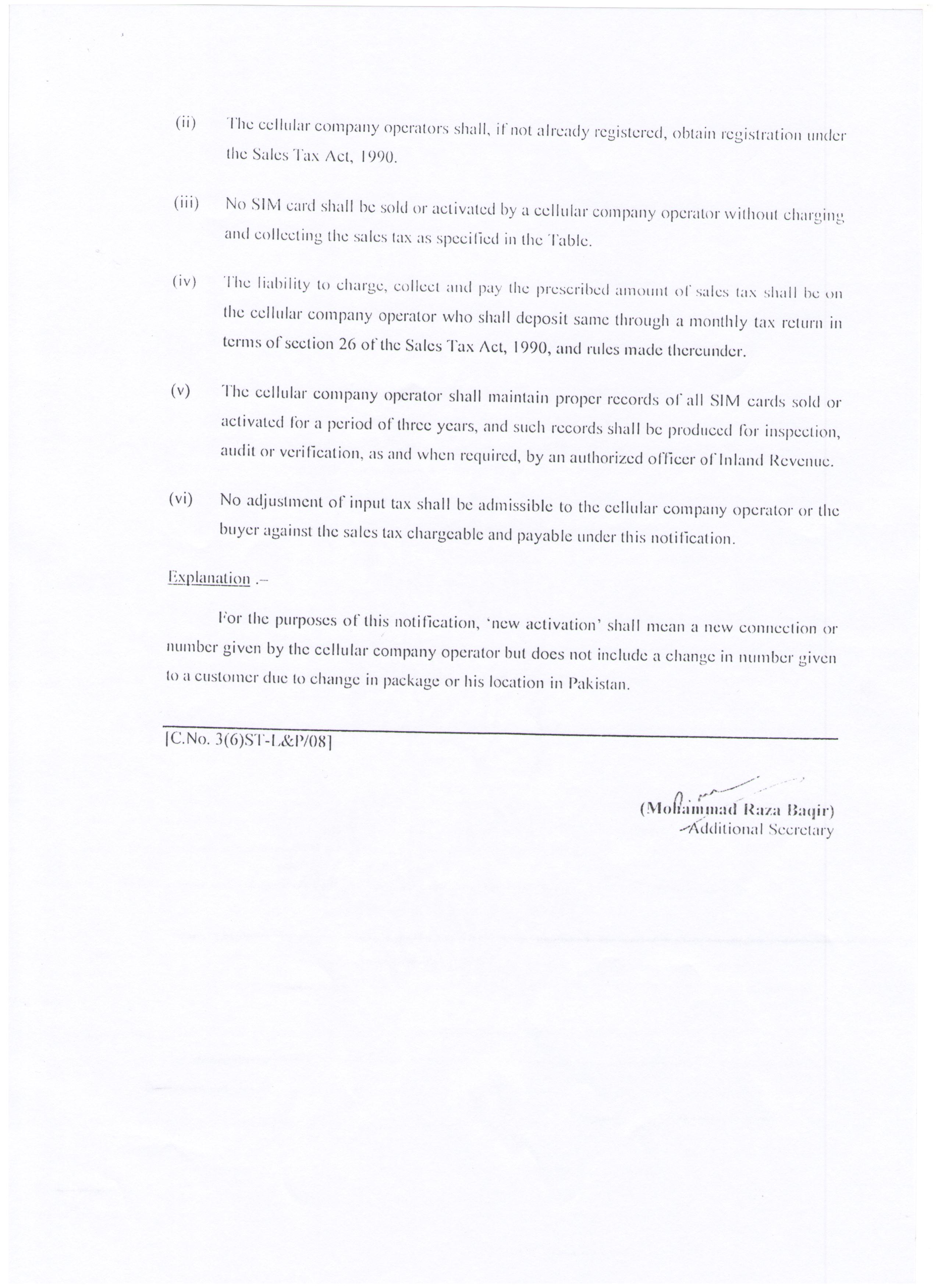

The Federal Board of Revenue (FBR) while has finally decided to reduce the sales tax on the import of mobile phones, including smart cellular phones and satellite phones as per SRO 280(I) 2013, it has in the same stroke imposed activation tax on the mobile operators-thus sparking another debate.

Traders all over the Pakistan had opposed and protested these taxes that increased prices for consumer by 60% specially for low end phones. Now, while the same has been reduced a bit- still the consumer will be suffer either it is on import or the SIM.

For a long time the importers’ and the distributor were protesting for the unprecedented rise and demanded of FBR to reverse the decision and reduce the rate of sales tax. FBR, while has lowered the rate of duty from Rs.500 on per cellular mobile phone to Rs.250, an additional activation tax of Rs. 250 for low priced mobile phones. Similar revision has been made on high end phones that will have little or no impact on the consumer.

[success]As per the new notification regarding Tax on Mobile Phones:[/success] [list style=”list11″ color=”green”]- Rs.150 Tax + Rs.250 SIM Activation Tax: Mobiles with 2 MP Camera, 2.6 Inches Screen

- Rs.250 Tax + Rs.250 SIM Activation Tax: Above 2.1 MP Camera, Screen 2.6 to 4.2 Inches Screen, Below 2 GHz processor

- Rs.500 Tax + Rs.250 SIM Activation Tax: Touch Screen, 10MP or above Camera, 4.2 Inches or above Screen, IOS, BlackBerry, Operating System, 2GHz or above Processor

[/blockquote]

The FBR also came up with flimsy excuse by trying to confuse the consumers in the garbe of GSM technology shift. This shows the apathy of the premier tax collection agency in Pakistan on how taxes are applied.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!