Feature Phone Brand Share in Pakistani Market (2020)

In our beloved country, still, there is a majority of people who use featured mobile phones in place of smartphones even in this era of technology. The feature mobile phone users mostly consist of old age users who are digitally illiterate and prefer a simple mobile phone instead of a smartphone, So I will provide some figures related to feature phone brand share in the Pakistani market in all quarters of 2020.

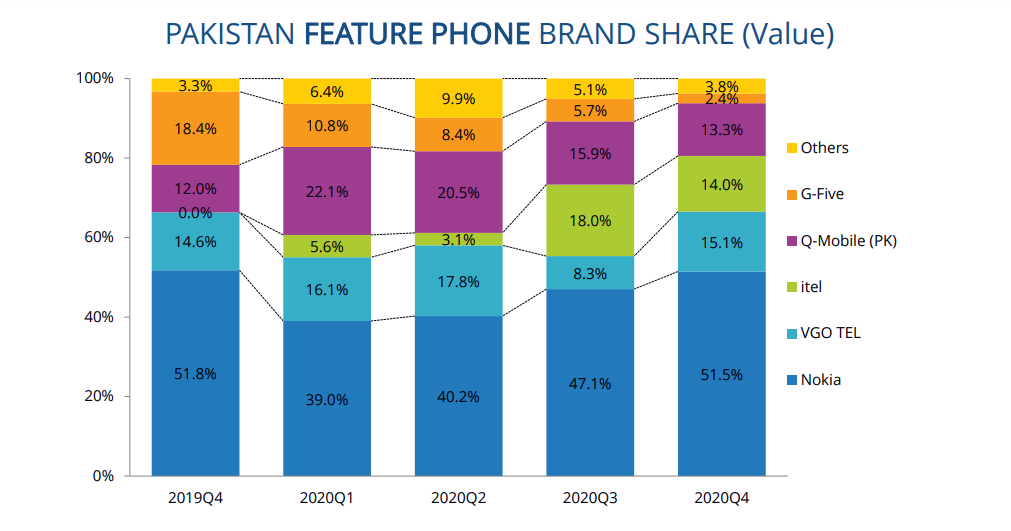

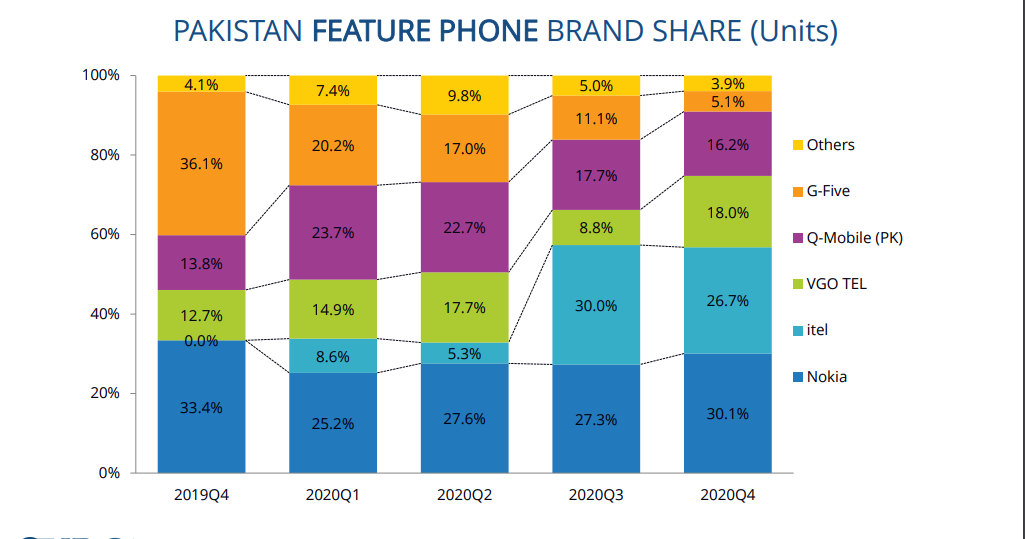

Nokia:

Despite Nokia’s decline in the international market, the company has been able to find a rising trend in the Pakistani market due to the excellent quality of its feature phones. Now as you can clearly see in the above-given graph that Nokia’s share in terms of units has witnessed growth throughout the year. It has been increased, from 25.2% in Q1 of 2020 to 27.6% in Q2 to 2020. Similarly, it lost a 0.3 % percent share in Q3 while the share increased in Q4 of 2020 to 30.1%. Simultaneously, in terms of value, its share increased in all quarters from 39 % in Q1 of 2020 to 51.5 % in Q4 of 2020.

Q-Mobile(PK):

Q Mobile has returned to the Pakistani market with a new license and assembly plan and aspires to strengthen its position in the local market again. However, in terms of value, Q Mobile has witnessed a downward trend as its share decreased from 22.1 % in Q1 of 2020 to 13.3 % in Q4 of 2020 as you can see in the above-mentioned chart. Similarly, if we talk about units, the company has followed a downward trend. Its market share decreased from 23. 7% in Q1 of 2020 to 16.2% in Q4 of 2020. The details for other quarters are given in the chart.

VGO Tel:

VGO Tel is comparatively a new brand but it has made grounds in the Pakistani market. The share of VGO tel in the Pakistani market has witnessed fluctuations both in terms of value and units. If we talk about the brand share value, its share first increased from 16.1% in Q1 of 2020 to 17.8 % in Q2 of 2020. In Q3 of 2020, its value fell to 8.3 % while it rose again in Q4 of 2020 to 15.1 %. Similarly, in terms of units, its share increased from 14.9 % in Q1 of 2020 to 17.7 % in Q2 of 2020. Its share fell to 8.8 % in Q3 of 2020 while it increased again in Q4 of 2020 to 18.0 %.

G-Five:

G-Five is another old brand in the Pakistani market and has a legacy of producing feature phones. However, it is also witnessing a downward trend both in terms of value and units. In terms of value, its share decreased from 10.8% in Q1 of 2020 to 2.4 % in Q4 of 2020. Similarly, in terms of units, its share decreased from 20.2% in Q1 of 2020 to 5.1 % in Q4 2020 as the company faces a steep decline. The details for other quarters are given in the chart.

ITel:

iTel is gradually evolving in the Pakistani market because of its affordable price and high-end featured phones. The trend remained mostly mixed. In terms of units sold, its share decreased from 8.6 % in Q1 of 2020 to 5.3 % in Q2 of 2020. Then, in Q3 it made a huge jump and its share rose to a staggering 30 % and 26.7 % in Q4 of 2020. Similarly, in the case of value, its share decreased from 5.6 % in Q1 of 2020 to 3.1 % in Q2 of 2020. Then it rose to 18 % in Q3 of 2020 and again fell back to 14 % in Q4 of 2020.

Others:

Other feature phone brands include Memobile, Club Mobile etc. These phones also followed a downward trend in the last two quarters of 2020 both in terms of value and units. However, their share rose in the Q2 of 2020. In terms of units, their share increased from 7.4 % in Q1 of 2020 to 9.8 % in Q2 of 2020. Afterward, their share fell significantly from 5.0 % in Q3 of 2020 to 3.9 % in Q4 of 2020. If we talk about the value, their share increased from 6.4 % in Q1 of 2020 to 9.9 % in Q2 of 2020 while their share fell sharply from 5.1 % in Q3 of 2020 to 3.8 % in Q4 of 2020.

Conclusion:

The data I provided has been taken from a very credible source and you will surely find it very informative. If you have any queries regarding the article, you can share them in the comment section.

Check out? Smartphone Brand Share in Pakistani Market (2020)

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!