Four Years in Auction- Where do we stand?

Auction and its eventual rollout of 3G/4G technology in Pakistan was a cornerstone in the development of the local ICT industry. This also created a lot of buzz in the country; many considered it a start of a new era of digitalization and technological revolution due to its important role in shaping the market. Economic Survey of Pakistan puts IT exports at more than 2.8 billion dollars in last one year whereas; total IT revenue is estimated to be around $3.3 billion for the same period. Additionally, revenues from the telco sector have touched USD 2.23 billion during the first two quarters of FY 2016-17. The growth in mobile subscribers also improved the total teledensity in the country that reached 72.36% by the end of March as compared to 70.81 % at the end of last year. The developing IT sector is also playing a vigorous role in empowering economies by creating businesses and generating new jobs through various new startups and services such as Uber, Careem etc. Pakistan has also managed to maintain its position in the freelancing sector. A report from Oxford Internet Institute (OII) stated that Pakistan is maintaining its position of being at No. 4 in the freelancing sector behind India, Bangladesh and the USA. Talking specifically about the telco sector, mobile network operators (MNOs) have made massive investments in spectrum acquisition and network rollout. This has been indicated in the Economic Survey of Pakistan 2016-17, according to which during first two quarters of 2017 alone, cellular mobile sector invested US $ 262 million which by any means is a very healthy figure. We can see the results of all this investment in the form of 44 million 3G/4G mobile broadband subscribers.

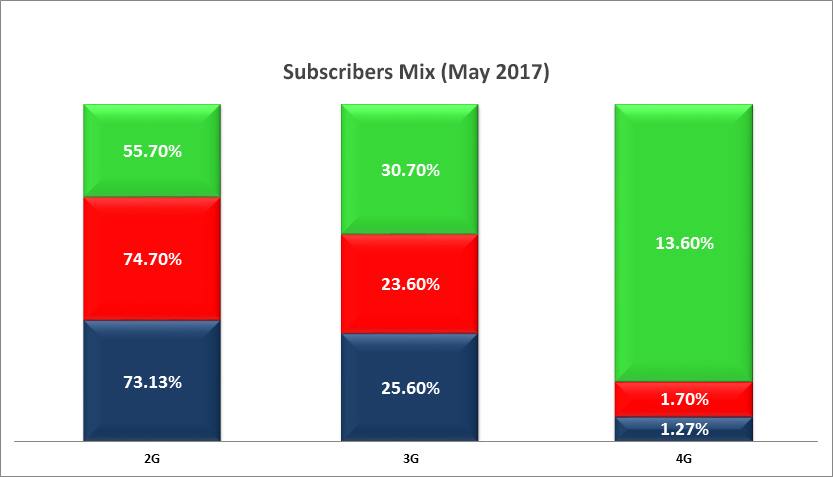

These statistics show a very promising development in ICT sector of Pakistan over the past few years. There is no doubt that Pakistan is far better positioned in the field of ICT industry than it was few years back. But still there is a long way to go. We have yet to reach the pinnacle of this growth, usage of mobile data continues to grow but there is still a lot of appetite for the growth. As per the recent census, the population of Pakistan has reached 207 million out of which there are only 139 million cellular and 44 million 3G/4G subscribers.uction and its eventual rollout of 3G/4G technology in Pakistan was a cornerstone in the development of the local ICT industry. This also created a lot of buzz in the country; many considered it a start of a new era of digitalization and technological revolution due to its important role in shaping the market. Economic Survey of Pakistan puts IT exports at more than 2.8 billion dollars in last one year whereas; total IT revenue is estimated to be around $3.3 billion for the same period. Additionally, revenues from the telco sector have touched USD 2.23 billion during the first two quarters of FY 2016-17. The growth in mobile subscribers also improved the total teledensity in the country that reached 72.36% by the end of March as compared to 70.81 % at the end of last year. The developing IT sector is also playing a vigorous role in empowering economies by creating businesses and generating new jobs through various new startups and services such as Uber, Careem etc. Pakistan has also managed to maintain its position in the freelancing sector. A report from Oxford Internet Institute (OII) stated that Pakistan is maintaining its position of being at No. 4 in the freelancing sector behind India, Bangladesh and the USA. Talking specifically about the telco sector, mobile network operators (MNOs) have made massive investments in spectrum acquisition and network rollout. This has been indicated in the Economic Survey of Pakistan 2016-17, according to which during first two quarters of 2017 alone, cellular mobile sector invested US $ 262 million which by any means is a very healthy figure. We can see the results of all this investment in the form of 44 million 3G/4G mobile broadband subscribers.

The talks of 5G trials and its roll out are circulating the industry and now the government has announced policy directives for 5G introduction in the country as well

70% market of mobile users can still be switched to 3G/4G hence, proving that the potential for mobile services is still enormous. How mobile operators will expand their markets while maintaining their service quality will be a challenging task to manage and will require serious strategic approach.

The talks of 5G roll out and the policy for its introduction are circulating the industry, and the government has also now announced policy directives for 5G introduction in the country. This is where we need to understand how far we have come in terms of mobile broadband and subscriber uptake and what more can be done to harness the phenomenal growth potential that still exists. Although there is no single perfect recipe to maximize the uptake, however, we need to understand what value drivers are needed to be considered in order to increase the uptake in the country and get prepared for the next mobile broadband revolution. We have tried to outline some of the key drivers that play an important role in mobile broadband revolution.

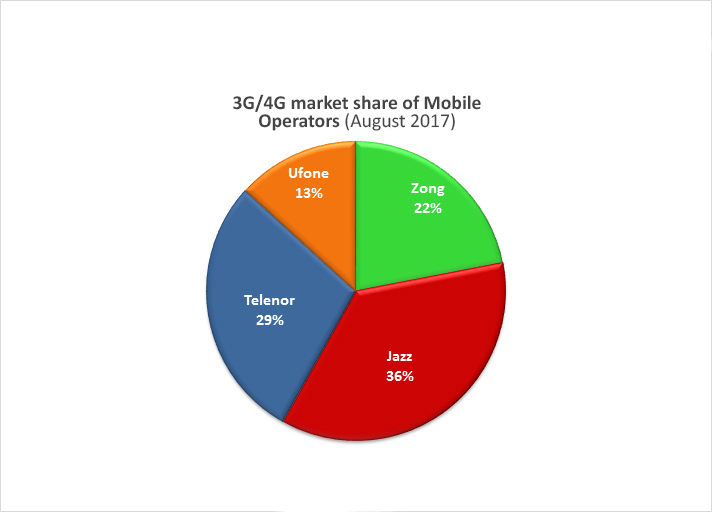

Spectrum management and Network Coverage: Spectrum is considered the most valuable asset for mobile operators due to its role in improving service coverage and capacity as data speeds has become the key driver for operators’ network strategies. For mobile subscribers too, average data speed has become the most important factor in assessing the quality of service offered to them by different operators. Currently, all mobile operators in Pakistan have the launched 4G services in the country except Ufone which is still a 3G operator only and that too on a very little scale. After the end of three NGMS auctions the current position of all four mobile operators can be seen on the following spectrum chart.

An increase in mobile broadband services and expansion in geographical coverage has consequently given rise to the need of increased network capacity. From spectrum perspective, all operators have been quite responsive to auctions in the past except Ufone.

For mobile subscribers, average data speed has become the most important factor in assessing the quality of service offered by the operators

Previously, Telenor had to acquire more spectrum in the unconventional 850 MHz frequency as the increase in 3G subscribers resulted in network congestion whereas, in order to improve its network coverage and service quality, Jazz first made the historical move of Warid acquisition and later on got 10 MHz in 4G spectrum. On the other hand, Zong emerged as the most successful player in first NGMS auction with 20 MHz spectrum for its 3G and 4G services but was not able to capitalize on that advantage initially but now alot of improvement can be seen in its service and network roll-out. While, Ufone is losing subscribers at an alarming rate due to poor coverage and service quality.

With sufficient spectrum available, Zong, Jazz and Telenor have become quite active in their network rollout. Substantial investments were made by all three operators and each of them followed an aggressive expansion and up gradation strategy. Zong has announced to re-invest all of its revenues in the network improvement. It also plans to upgrade all of its sites to 4G by the end of 2017; it already has the largest 4G market share which will further increase after the up gradation. While Jazz and Telenor are also quite aggressive in their network roll outs for 3G and 4G services in the country. Ufone, being the only operator with 3G services alone has also upgraded its 3G network in certain areas by refarming GSM spectrum. The operator uses 2×5MHz in the 2100MHz band for its wireless data services, but has now started to refarm its 900MHz frequencies for 3G allowing it to improve coverage, capacity and service quality for its customers. But there isn’t much Ufone can achieve through this move as it is in no position to compete with other players who have much bigger spectrum blocks in different frequencies.

Currently, Zong has been more successful in converting its customer base to 3G and 4G network. 44.3% of total Zong subscribers are enjoying its 3G/4G services as compared to 25.3% of Telenor and 26.86 % subscribers of Jazz. But since the network rollout is CAPEX intensive, it requires budget approvals. How operators will develop their future spectrum strategies is very important for their success in the market.

Mobile operators now need to look out for other ways to refarm and optimize their network capacity like adding cell sites, sectors and bandwidth. Adding smart antennas and improved air interface capabilities can also help in improving the network capacity.

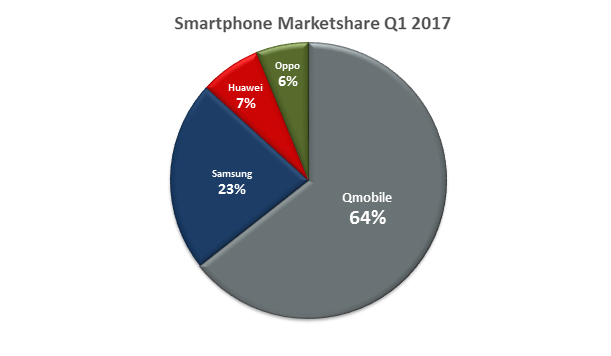

Eco System Enablement: By eco system enablement we mean the extent to which facilitation is provided by the most important ingredient i.e. the device eco-system especially for 4G as we are moving to higher level of MBB connectivity. Pakistan has become highly competitive smartphone market, the roll out of supporting infrastructure; improved offers from both local and international vendors and entry of newer brands have driven the smartphone demand in the country.

The 4G device market is getting better with shipments of these devices up to 189% YoY in Q1 2017 which implies that the potential of 4G devices is much greater in the market. Qmobile continues to lead the overall device market. Its share of the smartphone segment in Q1 2017 totaled 54.9%, with Samsung (19.1%), Huawei (6.1%), and Oppo (5.2%) rounding out the top four. Mobile operators like Telenor, Zong and Jazz have also launched their own low priced 4G devices.

According to the latest figures announced by International Data Corporation (IDC), smartphones accounted for 50.3% of overall mobile shipments in Q1 2017 , leaving a large portion met by feature phones. Being a price sensitive market, high price of smartphones is the biggest hindrance in smartphone penetration and consequently 3G/4G data and subscriber uptake.

OEM-carrier Collaborations and Data Plans: Pakistan has very different market dynamics as compared to other countries. We have an open market where OEMs have to take care of device distribution on their own. With recent OEM and operator collaboration trend, both parties now got a chance to offer their products and services together.

4G subscribers are likely to reach 16 million by the end of 2018. These figures can improve even further if all stakeholders in the industry come forward and devise a mutual strategy to create awareness about 4G services

The basic idea behind OEM and Carrier collaboration is a unique business approach to improve mobile subscribers for network and smartphone penetration simultaneously. Mobile operators and OEMs co-launched their products and services by offering smartphones along with an affordable network package. These packages include data bundles, call minutes, SMS and social network packages collectively that has helped the telecom companies to increase their market share especially in 3G/4G business whereas, it also provides a strong platform for OEMs to sell their devices and plays an effective role in controlling grey channel, mobile theft while establishing better device insurance policies. Jazz and Telenor have not only launched their own 3G/4G branded devices but have also collaborated with Nokia, Lenovo, Alcatel, Vivo, Moto, Samsung, Xiaomi, Oppo and Apple. While Zong and Ufone have also launched exclusive offers for selected smartphone brands. This continued momentum around carrier and OEM collaborations have played a very positive role for uptake of 4G LTE device penetration.

Similar kinds of partnerships are also taking place between carriers, banks and OEM. The results will be even more fruitful if other sectors are also involved in the collaborative network like education, agriculture, health etc. This way, not only the uptake of smartphones and data will increase but development of local content will also transpire.

The roll out of supporting network infrastructure; improved offers from both local and international OEMs and entry of newer device brands have driven the smartphone demand in the country

The competition in the mobile market has increased many folds. The ARPU of mobile operators is now highly based on data rather than conventional call and SMS services. This has also led operators to offer variety of data plans, and that too at an economical cost. Besides the regular daily, weekly and monthly packages, operators are also offering social media packs and all-in-one plans. After the launch of mobile number portability service operators have become even more mindful about their data packages in order to retain their existing customers and attract new ones.

Where do we go from here?

Internet has become such an important part of our lives that now it has become quite hard to imagine a world without it. In the country of 207.8 million people with median age of 27 years, the potential for broadband and subscriber uptake is unlimited.

Real uptake of data will only start when data acts as something that can improve the living standards of the people

However, the transition to smartphone base and 3G/4G subscriber uptake could have been much faster if further facilitations were provided to the industry players. Keeping in view the organic growth trends, 4G subscribers are likely to reach 16 million by the end of 2018 whereas, overall internet subscribers will reach 85 million in 2019 and 136 million by the end of 2022 thus, ending at 60% mobile internet penetration by 2022. The figures can improve even further if all stakeholders in the industry come forward to devise a mutual strategy and create awareness about mobile broadband services. Increased mobile data penetration in Pakistan requires a lot of efforts from all stakeholders of the industry. Improved quality of service, vast coverage and availability of affordable smartphones are some of the key factors that need to be worked on. But besides these direct factors there are also some indirect elements that hold equal importance. The government has managed to curb grey trafficking to a greater extent but still the taxation imposed on smartphone imports is the major challenge limiting the faster smartphone uptake. Being a price sensitive market, OEMs are especially focusing on bringing low cost smartphones priced below $100 but higher taxation is a huge hurdle in achieving that. Another inhibitor in faster smartphone adoption is the non-availability of 3G/4G services in the whole country. Development of localized innovative content also remains at nascent stage which is limiting the need for data.

In the country of 207 mn people with median age of 27 years, the potential for broadband and subscriber uptake is unlimited

Real uptake of data will only start when data act as something that can improve the living standard of the people. Consumers need to know what internet and related technologies offer to them and how it will change their lives. For that, creating awareness about 3G/4G and now 5G is very important. Calls have taken an integral part in our work lives and provide the bases for communication with everyone; data needs to play a similar role in our lives and has to become truly indispensable. With enabling infrastructure and resources put in place, we can expect to see more people using not only voice and data services, but also data-enabled services.

Now that Internet of Things (IoT) has become the new tech phenomenon, mobile applications m-services like m-health, m-education, m-agriculture, m-government etc. are gaining popularity. Such applications have the potential to drive up the internet penetration at a greater pace. To promote such digital services in the country, telecom regulations are also needed updated and a more holistic and flexible regulatory approach is required keeping in account all the aspects of the market and new technological trends. This will not only increase the broadband uptake in the country but will also set the stage for 5G….!!!!

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!