How to get NTN number for Salaried Person or Business in Pakistan?

Everyone who generates income in Pakistan has to pay tax. While it is not a new concept, the PTI government has made tax collection compulsory and has made the tax collection more robust than before. By issuing warnings to releasing penalties, the Federal Board of Revenue is making sure that people in Pakistan either salaried or business person should pay due taxes at any cost by the end of the financial year. So if you have not become a taxpayer yet, you need to register yourself as a legal taxpayer in the Federal Board Revenue (FBR) system and for that, you need a National Tax Number (NTN). This blog shows step by step method for getting NTN number for Salaried person or Business.

NTN number for Salaried Person or Business in Pakistan

Before going into details on how to get the NTN number, let us go through some information associated with it.

What is NTN Number?

“National Tax Number, also known as NTN is a unique ID issued by the Federal Board of Revenue (FBR) – the tax regulatory authority in Pakistan, to verify the registration of business”. The NTN registration is required to carry on any taxable activity either business or salary transaction. Furthermore, your NTN is necessary for filing the tax return (sales tax, income tax, property tax, or any other tax) and one needs to have NTN registration for opening a business bank account and to make any financial transaction in Pakistan.

Why Do you need it?

If you are eligible to pay anyone of these taxes: income tax, property tax, or sales tax, you should have a National Tax Number (NTN) that is issued by FBR in Pakistan. By having this number, you will be known as a registered tax filer in Pakistan. Though people usually want to hide their earnings, but actually being a tax filer has several legal advantages. You have to pay less vehicle token tax, enjoy less tax rate on banking transactions, property matters as compared to those who are non-tax filers.

Coming to business owners, they have to register themselves by having National Tax Number- that is needed for filing tax returns. However, if you are a salaried employee, your employer can generate your NTN number from the FBR portal. Irrespective of your earning or profits, one has to file a tax return every year.

Acquiring NTN number:

These days the process of acquiring NTN is digitized. Previously you had to visit the Federal Board of Revenue office to get your NTN number. However, now you only need to have digital literacy and can do it online yourself. Keep one thing in mind: you only have to get an NTN number if your income is within the legal and payable bracket of taxable income.

Before we go into the steps, you need to have some relevant documents with you to smoothly complete an online process.

Documents required for Salaried Person’s NTN Registration

- Copy of valid CNIC

- Copy of recently paid electricity bill of the house

- Latest payslip.

- Contact Numbers (Mobile & Landline) and valid Email address

- National Tax Number (NTN) of Employer, Office Address, and valid Email address

Also Read: FBR Launches Automated System for Scanning Cargo at Karachi’s Ports

Documents required for Business’ NTN Registration

- Copy of valid CNIC.

- Copy of recently paid electricity bill of business location.

- Blank Business Letter Head.

- Property papers or Rental Agreement(Rental Agreement printed on Rs. 200/- stamp paper).

- Contact Numbers (Mobile & Landline), and valid Email addresses.

- Nature of Business.

To get NTN you need to create an account on the Federal Board of Revenue website. There is an offline process as well but we will guide you about the online process to get National Tax Number (NTN).

How to get NTN number for Salaried Person or Business in Pakistan?

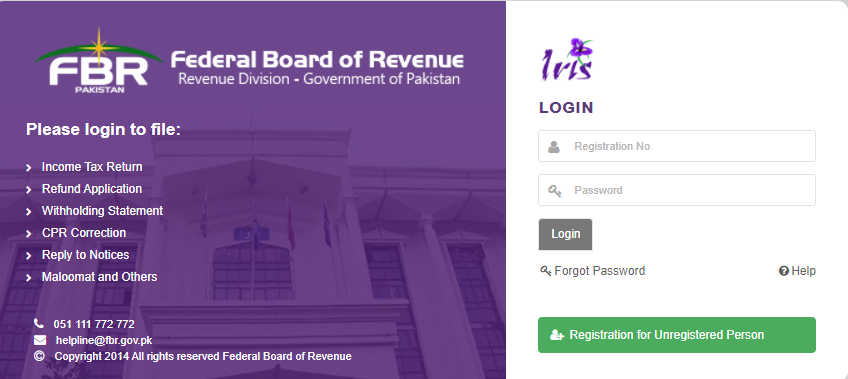

- Open FBR’s Iris portal. This screen will appear:

- Click the green tab on the bottom right corner, where“Registration for Unregistered Person” is written. Click it and the next dialogue box will appear.

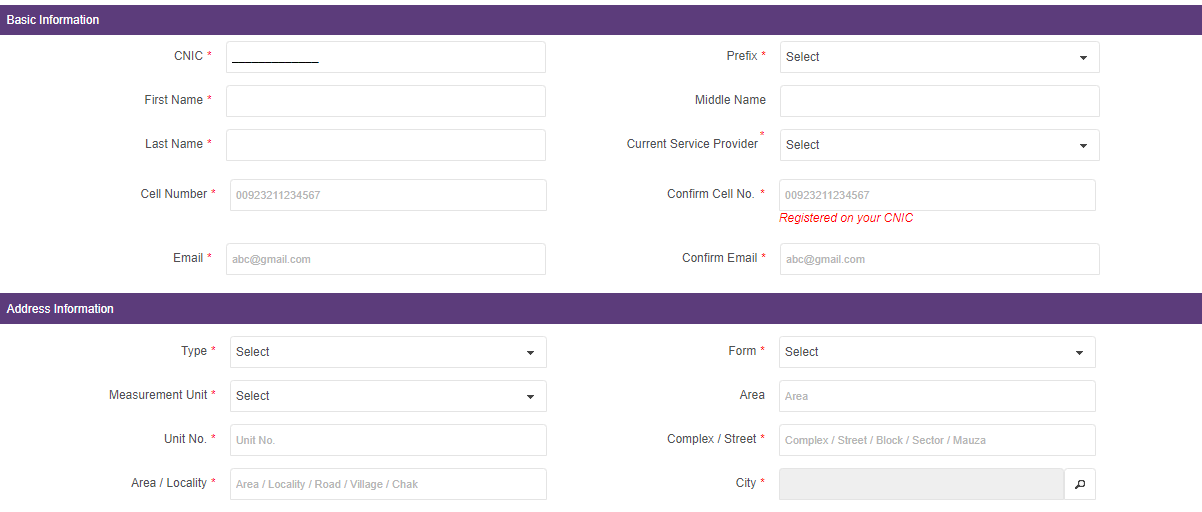

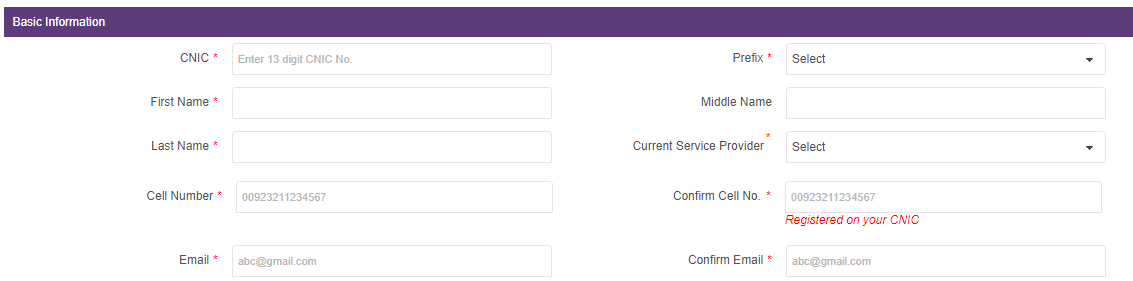

- Now, fill in all the basic information as shown in the above picture. The basic information asked includes

- CNIC number

- Complete name

- Prefix selection

- First, Middle, and Last names subsequently in the respective fields.

- Cell No

- Email Address

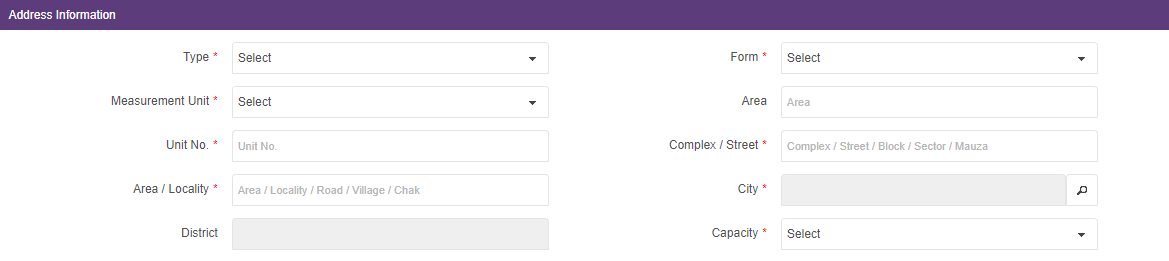

- Now fill in the address related information

- Type of property owned

- Measurement Unit

- Unit number

- District

- % share

- Form

- Area

- Street

- City

- Capacity

Now submit it

- Within 2 minutes, you will receive a 6 digit code on the cell number & email address.

- Enter the codes received.

- Now your NTN has been created and you will receive a password and pin from FBR through email and SMS. A user can use the ID and password sent to log in to their account.

Though the NTN is created, however, businesses need to register themselves in order to complete the process. There are two types of businesses Sole Proprietor and private limited firm.

Registration for sole proprietor:

A sole proprietor is a person who is the exclusive owner of a business, entitled to keep all profits after tax has been paid.

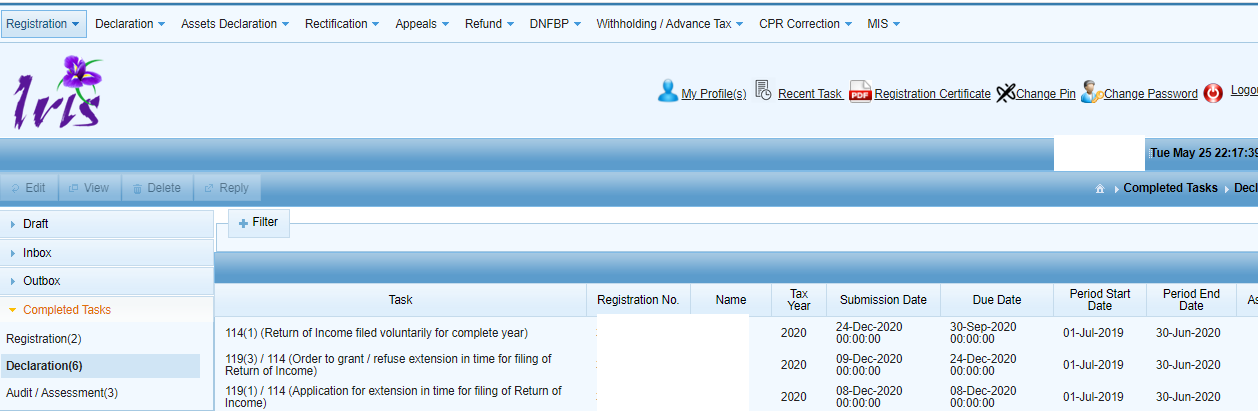

- To register a business, log in to the account by using the above steps. you will get a window.

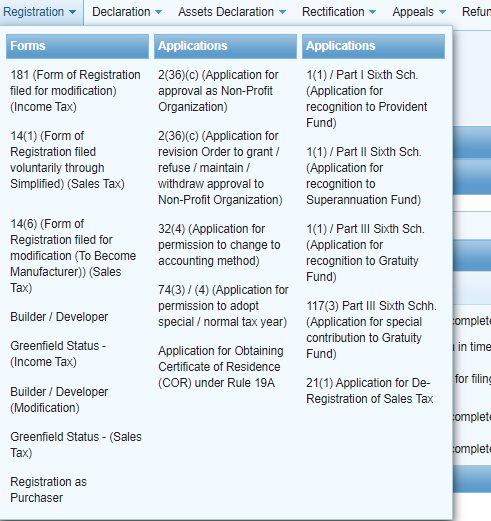

- Go to the registration tab on the top left corner shown above. A window will pop out

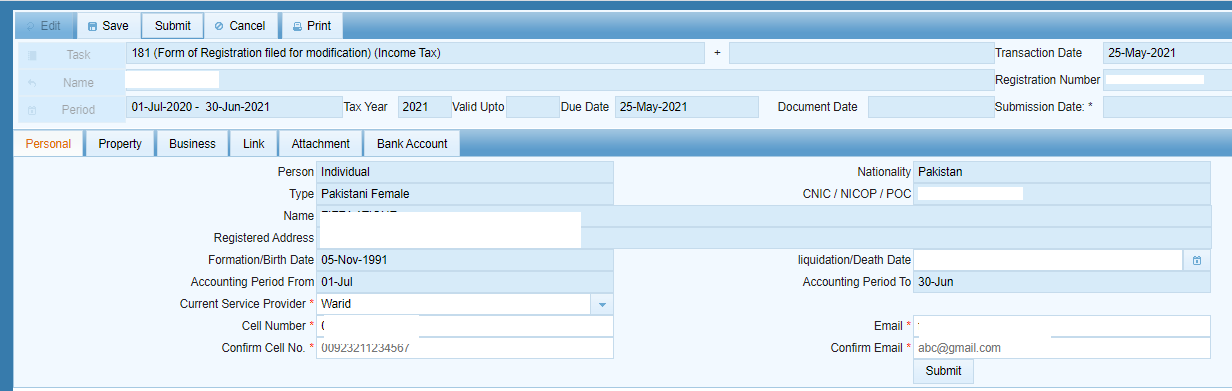

- Click on the first option i.e; 181(a form of registration filed for modification)

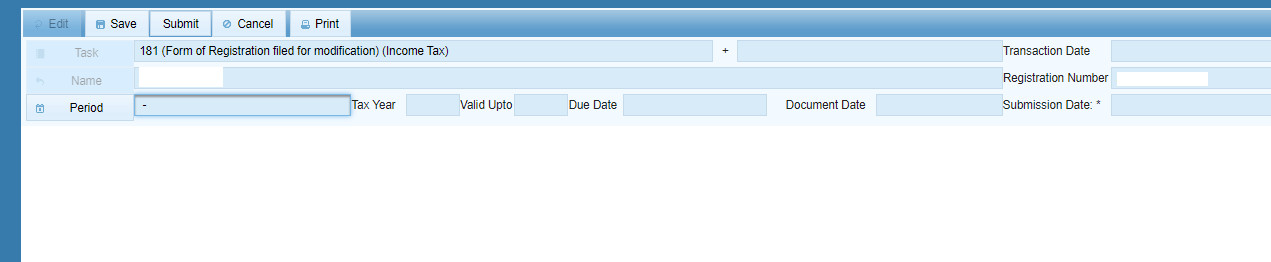

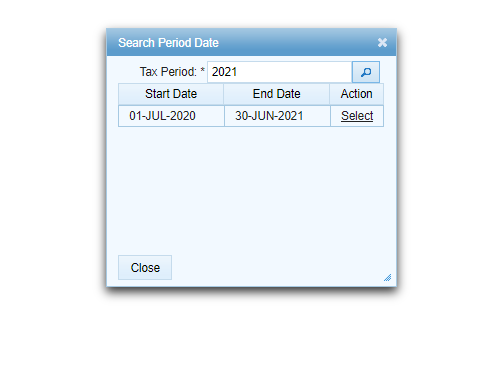

- Now click on period and select relevant tax period (e.g for current tax year 2021)

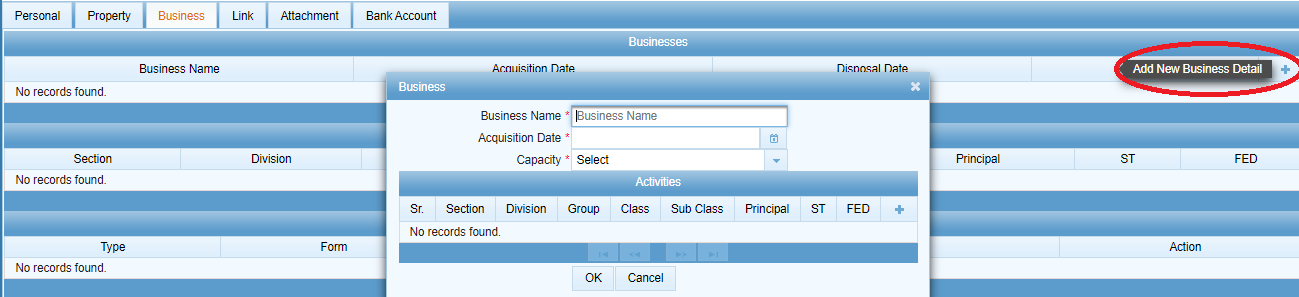

- A new window will appear. Click on the third tab ie; Business

- Click on + sign and add the business

- Add all the relevant information as shown in the image above

- Now click on the Attachment and add all the relevant documents mentioned below:

- Business Letterhead

- Evidence of tenancy/ownership of business premises

- Paid utility bill of business premises not older than 3 months

- Now submit this document and you are done.

Registering Private Limited Company:

Registering a Private limited company online is not possible yet and for this, you have to visit the FBR office. Documents needed for it are the following:

- CNIC of all Partners

- Paid Electricity Bill, not older than 3 months

- Rent Agreement / Ownership Documents

- Letterhead

- Form C / Firm Registration Certificate (ONLY For Registered Firms)

- Partnership Deed/ Agreement

- Authority Letter in favor of one Partner, authorizing him to present firm before tax authorities for registration and to receive enrollment particulars ( User ID, Password, and PIN)

This was the overall process. I have tried to make the document easier however if you have any queries feel free to ask in the comments section below.

Also Read: FBR to launch Online Electronic Hearing of Tax Audits

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!