The New Financial Phenomenon for Pakistani Entrepreneurs: Crowd Funding

Pakistan has enormous potential of starting its own sustainable, digital turnaround. The country is blessed with huge talent pool of competent and energetic youth which is its biggest strength. According to Higher Education Commission, Pakistan passes out over 25K IT graduates every year. The IT and telecom sector is going through an evolutionary process with new technologies and applications released every now and then. The country is now embracing digital technology as a powerful tool which is not just limited to simple communication anymore rather it has become a life-changing catalyst.

The talent and opportunities in the IT sector are boundless but one of the main problem that is being faced by many young entrepreneurs is the lack of funding opportunities. This problem is not just faced by local entrepreneurs but also effecting all the small businesses at international level. There are only limited options for young entrepreneurs and small business to get funding for their projects which are also time consuming and difficult to get because of various formalities.

In Pakistani banking system, micro finance loans do exist but they are hard to get as the formalities are complicated additionally all asking for an equivalent collateral of the loaned amount.

In Pakistani banking system, micro finance loans do exist for smaller projects but they are hard to avail. The formalities are so complicated which make it difficult to fulfill them with, most asking for an equivalent collateral of the loaned amount.

The Ministry of IT & Telecom through ICT R&D Fund and PSEB started offering Venture Capital (VC) Fund to support IT development in the country for young entrepreneurs but that is also quite difficult to achieve on the basis of the project. Additionally, the monitoring system is so complex that it has failed to achieve any substantial results over the past decade. The Government of Punjab through PITB and its incubation and acceleration programs such as plan9 and PlanX initiatives is trying to support and promote the young entrepreneurs in IT related projects but not everyone is able to reach these channels and secure funding. All of these issues create a huge barrier for young entrepreneurs to reach their true potential.

With advancement in the internet and IT technology, many doors to development are opening up. The traditional ways of doing things are either changing or have been changed already. In the financial domain, E-commerce and m-commerce has revolutionized the business world. It is also an emerging trend in business world specially for technology related industry is gaining momentum that is Crowdfunding.

Crowdfunding is a latest concept that has gained instant popularity among the tech-savvy people of the world. It is a process through which entrepreneurs use online platform to raise money for a specific project or business venture.

The Process of crowdfunding is quite simple. The fundraising is done through an online platform.

In Crowd Funding People visit fundraising websites and commit/donate specific amount for the project they like and often receive acknowledgement or reward in return for their committed amount/donation

The campaign advertises the project details including the nature of the venture, the amount required and the campaign’s fundraising deadline. People visit fundraising websites and commit/donate specific amount for the project they like and often receive some sort of acknowledgement or reward in return for their committed amount/donation.

Types of Crowdfunding: Crowdfunding can be distributed into three simple categories.

Reward/donation: In return of a donation a reward or incentive is provide to the donor of the project.

Lending: This comprises of peer-to-peer lending. Credit sites provide platform to connect borrowers and lenders over the internet for personal business loans.

Equity Crowdfunding:It can be further divided into two parts.

- Accredited Platforms These platforms are only open for accredited investors and proper investing process is followed to fund various ventures.

- Equity Crowdfunding This platform provides opportunity to invest to anyone, accredited or not.

Crowdfunding is a relatively new concept but over the years this industry has witnessed an accelerated growth. According to Massolution crowdfunding report of 2015, the global crowdfunding industry grew immensely in 2014—expanded by 167% to reach $16.2 billion, up from $6.1 billion in 2013. The industry raised more than double the funding once again and reached $34.4 billion, in 2015.

The global crowdfunding grew immensely in 2014—expanding by 167% to reach $16.2 bn. The industry raised more than double the funding once again and reached $34.4 bn in 2015.

The concept is especially popular in western countries where business ventures have raised huge amount of money. Recently, a Scottish interior design website, Houseology secured £1m crowdfunding where crowdfund investors will share an equity share of 11.17 per cent and a range of discounts on purchases. Similarly, The American Cancer Society is, for the first, time targeting millennial donors to give to cancer researchers.

Few years back, entrepreneurs were reliant on bank and Venture Capitalists (VC) for funding but the new digital age has created boundless business opportunities.

Crowdfunding is important as even within hours huge amount of money can be collected for a business venture. Few years back, entrepreneurs were reliant on banks and Venture Capitalists (VC) for funding but the new digital age has created boundless business opportunities. The World Bank estimated that crowdfunding will reach $90 billion by 2020. If the current trend of doubling year over year continues, we’ll see achieving the $90 billion mark well before time by 2017.

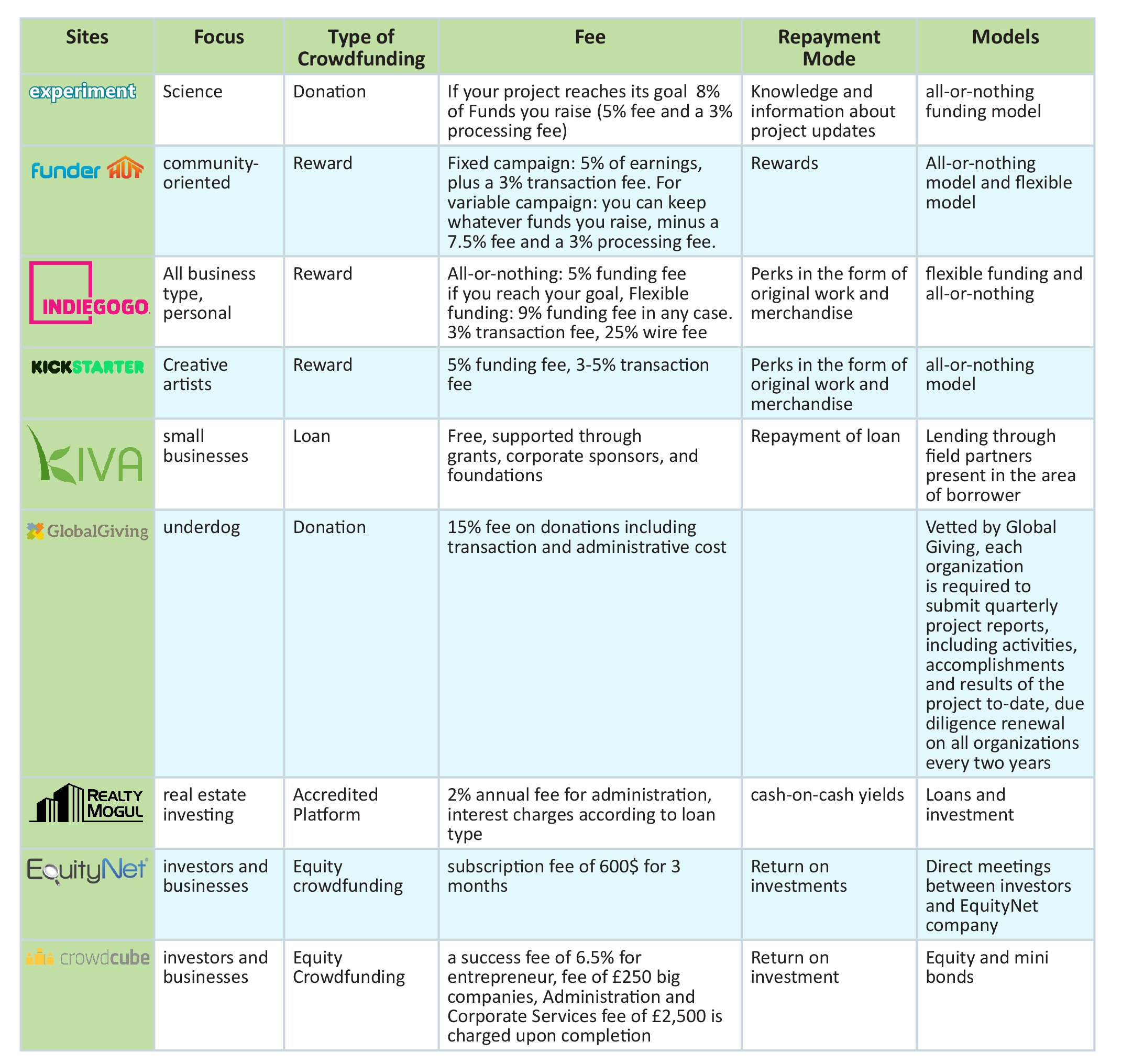

There are numerous crowdfunding websites that offer different types of funding options. These websites follow different models for collecting funding, some of them cater to specific industry. We have compiled a list of international crowdfunding websites that follow different repayment modes and process model.

According to Alliedcrowd statistics, Pakistan currently ranks 22 among developing countries on the crowdfunding market with annual estimated business of $5.4M.

Everywhere in the world the biggest hurdle that most businesses face is lack of investment capital. Therefore, like everywhere else in the international markets, crowdfunding is gaining popularity in Pakistan as well. The young and entrepreneurial population of the country is budding with new business ideas but they are struggling to initiate and expand their businesses because of no or very few source of funding is available. Although many industry giants have started various initiatives to support young entrepreneurs in their respective sector but only few out of thousands get the chance to secure sponsors and VC for their projects.

While some provincial Governments such as Punjab government have started interest-free karobar Loan Schemes, also National Bank of Pakistan and Punjab Bank have started similar financing initiates, but the facts remains that the same strict regulations are a hurdle and it is almost impossible to fulfill these regulations for start-ups. In such an environment crowdfunding can be very beneficial for Pakistan as it will not only create more jobs but will also improve general quality of life for the people.

According to Alliedcrowd statistics, Pakistan currently ranks 22 among developing countries on the crowdfunding front with annual estimated run rate of $5.4M. Kiva, LendWithCare, GlobalGiving and YouCaring are among the top crowdfunding platforms. Seedout is also a non-profit organization and a charity based crowd-funding platform that provides small funds to young entrepreneurs. Transparent Hands is a health based crowdfunding platform which was incubated in 2014 by Lahore-based Plan9. The donations collected through this platform are used to provide health services to the poor. Since its launch, Transparent Hands has facilitated over 200 surgeries.

There are not much local crowdfunding websites in Pakistan but once the concept is popularized, it may change the financing scenario for the start-up community in the country.

Although there are not much crowdfunding websites in Pakistan right now but once the concept is popularized, it may change the financing scenario for the start-up community in the country. The budding startup culture can be further benefitted by crowdfunding and many new inventions and businesses will finally see the light of the day. The concept no doubt has huge growth promises but there are many hurdles that effect the success and failure of crowdfunding in any country including Pakistan. First of all, fundraisers do not conduct comprehensive research regarding crowdfunding platforms, they are also not aware of the marketing plan they need to follow for their projects. One other big challenge for crowdfunding in many countries including Pakistan is the lack of rules from corporate regulatory agencies. But just recently Securities and Exchange Commission of Pakistan has revamped its regulatory structure for non-banking finance companies. Under the new regulatory regime, micro lending has become a regulated activity and all the entities other than microfinance banks undertaking microfinance business will have to get a license from the SECP to undertake the same. So this will surely create more finance opportunities for entrepreneurs in Pakistan.

The prospects for crowdfunding are quite positive in Pakistan as small businesses and young entrepreneurship is gaining popularity in the country but lack of finance poses biggest hindrance for middle class population. Therefore, the ground is quite fertile for crowdfunding as it can act as a catalyst to promote businesses in the country. Although accredited crowdfunding require new set of regulations from the government which will take time to be introduced but other types of crowdfunding can still be introduced in the country. The process that EquityNet follows could be adopted in Pakistan as this model directly connects fund seekers with potential investors. It works on the same model as OLX which connects buyers and sellers who meet each other directly after getting linked through the website.

Although accredited crowdfunding require new set of regulations from the government which will take time to be introduced but other types of crowdfunding can still be introduced in the country.

Until local-based crowdfunding platforms are introduced in the country, the local entrepreneurs can use international crowdfunding platforms to attract funding for their ventures. But it’s not just about starting a project on crowdfunding, one have to do a lot of homework to polish the idea and most importantly to protect it with legal backing before exposing it on the internet. Where there is a will, there is a way, so if you think you have worked out everything regarding a project and only lack finance, then crowdfunding is the option for you.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!