Pakistani Telcos: Who is the King of the Marketing Ring?

Marketing is a wide subject which covers or touches almost all the aspects of a business in one way or another. Marketing is defined by the American Marketing Association (AMA) as “the activity, set of institutions, and processes for creating, communicating, delivering, and exchanging offerings that have value for customers, clients, partners, and society at large”. To successfully run a business, it is very important to understand the complete marketing mix in order to make strategies to target a specific market. Since telecom is the most dynamic industry with an impressive growth and impact, the importance of sound marketing strategies have gained even more importance. The mobile operators in Pakistan i.e. Mobilink, Telenor, Warid, Ufone and Zong apply their own business vision in their marketing strategies to attain, nurture and retain their customer base. So let’s look at what and how our mobile operators are doing in terms of marketing.

Telecom is the most dynamic industry with an impressive growth and impact, the importance of sound marketing strategies

If we consider marketing as a political campaign and each telecom operator as a political party, then customers can be regarded as the voters. Each operator tries out a different campaign to win over maximum number of voters. Just like politicians who develop their party manifestos keeping in mind the needs of public, telecos analyze the needs of consumers and develop innovative products accordingly. Although, the important element for both politicians and telco businesses is how they pitch their manifesto/product in the market. Since their basic aim is to win the race for more votes/customers in the market.

Pakistani Telcos Who is the King of the Marketing Ring?

Mobilink leads the market with the highest number of subscriber base with 29% market share, while Telenor is at second position slightly behind Mobilink with market share of 28%.Zong that offers both 3G as well as 4G services has about 18.8% of the overall market share. Ufone with 15.8% and Warid with just 8.4% market share are at the bottom.

Importance of Marketing & Promotion

In order to gain a competitive edge in the market, operators ruminate complete marketing and promotion procedure that starts from idea generation to distribution and availability of the product/service. Anyone can have a creative idea, but the success of that idea is heavily based on how you present that idea to others. So the most important factor is surely the promotion aspect of marketing since it is the best way to put across the benefits of your idea or service to the customers. Therefore well-designed promotional strategies ensure long-term success and business profitability.

Recognizing the right target market is not only important in product and idea development but it is also important in selecting right promotional techniques. For example a product developed for youth segment will be promoted differently from a corporate product. This is the reason why promotional activities have taken up a vital importance in business activities.

Marketing and Promotion activities of Pakistani Telcos

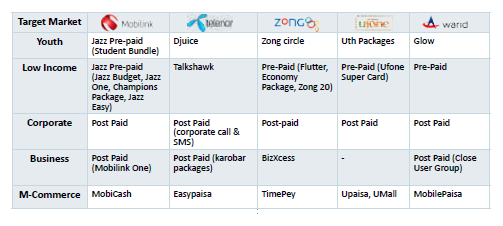

In order to penetrate in to a specific market it is very important to first gain an insight about the culture, taste, demographics and customers’ needs of that market, not only to design a product but also to develop its promotional mix strategies. Since telecom operators offer services for all market segments, they use different marketing and promotion strategies for each of their service.

Being the part of the most competitive industry each operator tries to bring some unique and out of the box service for is customers. The service portfolio of each operator is more or less the same so the thing that can and does make a difference is the marketing and promotional strategies each operator uses to build up their image and customer base.

In Television advertisement telecom industry is among the leading brands. According to the MEDIA BANK PAKISTAN report of 2015, telecom industry took hold of 20% of shares of total minutes of advertising and ranked 2nd in the top category list with Telenor, Mobilink and Ufone being the most active telecom players.

Social media and internet has become the most important medium to make a better position in the market and make your brand known in the market. Telecom operators of Pakistan are among the top brands on the internet. Each operator not only has an exclusive website but they are also quite active on all social media platforms. According to the social marketing report of 2015 by Zeesocial, telecom tops first five industries list on Facebook.

Mobilink ranks on no. 2 position in top five Facebook brands, whereas, the social devoted category is also dominated exclusively by the telecom sector. Not only on Facebook but Twitter also is dominated by the telecom sector.

If we look at the marketing and promotional strategies of all operators we see wide variation although the core business and services are same, which makes the ultimate difference. In the following article I have tried to critically analyze each operator in terms of their marketing and promotion strategies.

The service portfolio of each operator is more or less the same so the thing that can and does make a difference is the marketing and promotional strategies each operator uses to build up their image and customer base

Mobilink

Mobilink is the oldest and largest telecom player in the market with 38.1 million subscribers. It started its operators in 1994 after a joint venture between Saif Group and Motorola Inc. later on, Orascom acquired Mobilink and then after few years, sold it

to VimpelCom. Under the Orascom’s management, Mobilink had two main brands i.e. Jazz and Indigo.

Jazz was focused on the youth and low income focused brand whereas Indigo targeted the business segment. Since Mobilink is the oldest operator in the country, its sub-brands were quite well positioned in the market with great goodwill value. But when VimpelCom took over Mobilink few years back, it not only re-branded Mobilink but also merged its service portfolio under single brand name; Mobilink. Although back then most of the people thought of this re-branding move as disappointing since it didn’t bring any real value for the customers and considered

it nothing more than a new logo. Also according to experts, it was an inapt move because Mobilink Jazz and Mobilink Indigo were such strong brand names that customers were proud to be associated with them. Such strong positioning of Mobilink brands was the major reason for strong customer loyalty. Merging these brands under one name was considered stripping identity by many Mobilinkers, specially the Jazz users.

The management has finally understood the value of goodwill, which is considered the most important intangible asset of a business. Just recently Mobilink has reintroduced its Jazz brand. It has also rebranded Mobicash with Jazz cash and launched a device portfolio with the same name, Jazz X. So much hype was created when Jazz X was launched, although it did face negative criticism due to Nargis Fakhri and Mobilink brand ambassador’s bold newspaper advertisements. But in the marketing world, no publicity is bad publicity. Although they are overdoing it, still is a good move to re-introduce Jazz brand name because no matter how many years pass by, people will always remember Jazz.

If we look at the overall marketing and promotional strategies of Mobilink, the operators passes with flying colors. It has picked up some very famous names for its brand ambassador role, Shan, Ali Zafar and Nargis Fakhri to name a few. Mobilink has also won the PAS Awards 2016, organized by the Pakistan Advertisers Society, and one of the most recognized and prestigious award programme of the marketing and advertising industry. The award was given to

Mobilink in “Telecommunication Service Provider” category for its campaign “Call Drop”.

It is a good move to re-introduce Jazz brand name because no matter how many years pass by, people will always remember Jazz

Telenor Pakistan

Telenor Pakistan is the second largest player in the market with 36.7 million mobile subscribers whereas, the biggest 3G player in the market with 7.6 million subscribers. Telenor Pakistan has made a great name in the market in a very small time. It offers a

very rich service portfolio with sub brands like Telenor TalkShawk and djuice. In fact Telenor TalkShawk is the cash cow in Telenor’s portfolio since more than 80% of revenue is generated by Telenor TalkShawk brand.

In terms of strategy building, Telenor is perhaps the strongest operator In terms of strategy building, Telenor is perhaps the strongest operator. When Telenor went for just 5 MHz in April, 2013 auction of 3G and 4G, everyone thought that Telenor has become defensive in its strategy and has failed to see the future of mobile technology in Pakistan. But look at the market scenario now, Telenor has managed to grab the biggest chunk of 3G subscriber base. Like everything else, Telenor also makes very calculated moves in its marketing and promotion. Its services portfolio is much segmented, each of its brand targets a specific market and all of marketing and promotional strategies are designed accordingly.

When Telenor launched its TalkShawk “Sachi Yaari” campaign along with “Razia Ghundon Mein Phans Gai” series, it was heavily criticized for being shoddy and cheap. But Telenor took this criticism positively and now its TVCs have significantly improved despite same theme. Telenor 3G campaigns are also very impressive. The operator tried to create awareness regarding the uses of 3G. This perhaps is one of the reasons why Telenor is so successful in 3G market.

Zong

Zong was once considered the fastest growing mobile operator in Pakistan. But since the last auction, we see a downward trend in operator’s’ performance. Despite walking out with 20 MHz in 2013 spectrum auction with the strongest position, Zong has somehow been unsuccessful to capitalize on this advantage. One of the major reasons of this mischance is the weak and ambiguous marketing.

Although Zong has huge spectrum for 2G, 3G and 4G at hand and it also offers very simple and variety of internet packages, it still didn’t manage to capture the attention of mobile phone users. Zong picked up the strategy to differentiate itself from its other 3G competitors and launched “Super 3G” campaign. The overall campaign was quite good, huge and innovative. LED sign posts were put up in major cities of the country but results were not as impressive as expected. Also the campaign was unsuccessful in creating the awareness among consumers regarding the 3G technology and specifically Zong’s better 3G

service quality due to its bigger spectrum chunk. Same is the case with its 4G promotions. In a country where technology literacy rate is very low, the need of the time was to educate the consumers what 3G and 4G technologies actually are. This is one aspect on which all operators didn’t perform up to the mark, but Zong which had the strongest competitive edge at the start especially failed.

Although Zong has huge spectrum for 2G, 3G and 4G

at hand and it also offers very simple and variety of

internet packages, it still didn’t manage to capture

the attention of mobile phone users

The overall Zong promotional campaigns are also nothing out of ordinary. The TV campaigns have almost all the basic ingredients but lack the wow factor, which is most important in today’s competitive market. But now it seems Zong is also trying to pick up its game as just recently Zong has also rebranded its 4G services with a new logo. What Zong needs to do right now is to use this rebranding move to create awareness about 4G especially quality of their own service. If Zong wants to take over market, it should let people know the distinct factor of Zong’s 4G.

Ufone

Ufone is all over the place not only in marketing and product development department but also in promotional aspect. The performance of the operator has been quite unimpressive for the past few years now, though initially it was the second largest telecom player in the market. The biggest problem with Ufone is that it doesn’t have any targeted brand for any segment of the market. Mobilink has “Jazz”, Telenor has “djuice” and “TalkShawk”, “Zong” has “Circle” and “Flutter”, even Warid has “Glow”. But despite being in the market for over 10 years now Ufone still didn’t launched any such brand. Although Ufone does offer various packages for its pre-paid and post-paid users but there is no clear target market for Ufone, which is quite surprising.

Ufone does offer various packages for its pre-paid

and post-paid users but there is no clear target

market for Ufone, which is quite surprising

If we talk about the marketing campaigns of Ufone in general, we can consider them quite popular. Ufone adverts are the most talked about commercials and are equally liked by Ufone and non-Ufone users. But in terms of profitability, Ufone did not managed to gain any benefit. People watch and like Ufone TVCs because of their entertaining and humorous aspect which diverts the attention of viewers from service offering to storyline of the commercial. Ufone did manage to get two PAS awards for its marketing campaign but has been ineffective in attracting potential customers.

What Ufone needs right now is a strong service portfolio and effective media campaign to make it known. Although current Ufone marketing campaigns have become a signature style of Ufone but trying something unique and out of the box every once in a while can definitely be a game changer for Ufone.

Warid

Warid has never been an aggressive player in the market. Although it offers all the services that its competitors offer and it has better network in terms of service quality but still it is far behind in the market. One of the reasons why Warid’s marketing hasn’t been as aggressive as others’ is because a major chunk of Warid’s subscriber base is its loyal postpaid customers who mainly belong to the business class. This segment of the market is more conscious about the quality of service rather than the cost. So attractive and eye-catching marketing campaigns are not important to attract these type of customers.

Warid did try to expand its market when it introduced its Glow brand which is also quite successful. But for even Glow brand Warid didn’t try frequent marketing campaigns. Now that Mobilink and Warid merger is finalized, we can expect major turn of events in marketing and promotion strategies for Warid.

Warid has never been an aggressive player in the market. Although it offers all the services that its competitors offer and it has better network in terms of service quality but still it is far behind in the market

Telecom industry has always been ultra-competitive, be it tariff war, data deals, coverage, VAS or latest handset exclusives, the competition has always been fierce. In order to make these services known to consumers and get an edge over other players

telco players, each MNO has tried to go an extra mile on marketing and promotional front as well. Today, digital transformation has further intensified the challenges as consumers are far more connected and aware about services and quality offered by all telecom operators. Some of the operators have been quite successful in coping up with challenges while others really need to step up their game. Because in today’s fast paced and connected world, out of sight literally means out of mind…..!!!!!

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!