Taxation and its Impact on the ICT Industry: A Post Budget Analysis

Taxation and its Impact on the ICT Industry: A Post Budget Analysis. Taxation, “the levying of tax” by the government is a fundamental financial tool that has strong effect on almost every sector of a country. Also the budget allocated to each industry by the government demands a system of “check and balance” so that it is used in an effective way for the betterment of the entire nation as well as to benefit the industry stakeholders. Similarly, in Pakistan the start of a fiscal year i.e. 1st July is of critical importance as it brings some good or bad news for all sectors of Pakistan. The 2016-17 budget in Pakistan got mixed reactions from the ICT industry as it raised taxes on mobile phones whereas there was good news for IT sector in the form of tax exemption on software exports with reasonably good budget for development projects.

Taxation and its Impact on the ICT Industry: A Post Budget Analysis

The government was able to generate an all-time high amount of USD 1.1 billion alone from the sale of 3G/4G spectrum in 2014

Taxation holds great importance to run the affairs of the state as the amount is used to finance the country’s requirements. But over taxation can seriously affect the business environment and impede growth. High taxation has many adverse effects on the industry’s growth, some of which are as follows:

- Discourage investments in the network expansion that negatively impacts customer uptake.

- Increased taxes on handsets not only impact the mobile phone penetration in Pakistan but encourage continuous influx of grey channel phones in the country that are a serious threat to the national exchequer and security.

- Increase in network usage cost decreases network usage itself resulting in challenging ARPU/RoI.

Pakistan’s ICT Taxes: Soured Past

According to a GSMA study conducted in 2015, Pakistan stands in the category of the countries that have a very high tax on network usage and consequently contributed almost 7% of total tax in the year 2013. This sector has also quite high tax i.e. 30% as a proportion of Total Cost of Mobile Ownership that when compared with regional peers, makes it quite unattractive. Not much has been done over the past couple of years to remove this disparity as the Telco policy makers have little or no say when it comes to telecom sector taxation that is generally and arbitrarily set by Ministry of Finance or the Federal Bureau of Revenue (FBR).

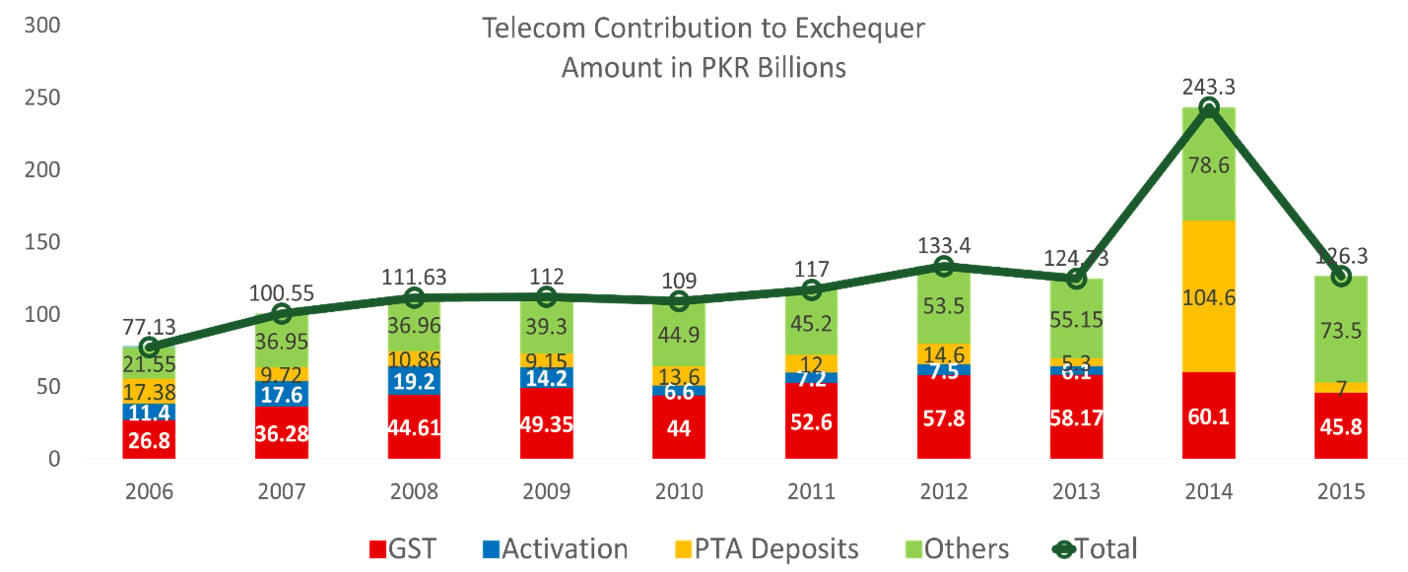

Before going into the details of fiscal budget 2016-17, one must understand the past patterns of ICT taxation in Pakistan. The past Telecom and IT sector tax regime with high tax ratio has no doubt stifled the growth of telecom sector specially the uptake of internet. The past trend of tax collected by the government from the telecom sector is shown in the graph:

The government was able to generate an all-time high amount of USD 1.1 billion alone from the sale of 3G/4G spectrum in 2014. PTA further sold 10 MHz spectrum recently to Telenor for USD 395 million; which is not reflected in this chart. Besides, it also got an additional USD 39.5 million from Telenor as withholding tax; a huge amount by any means primarily contested by the operator. Moreover, the upward trend of tax collected over the years can be clearly seen in the chart.

The only amount that saw decline and was eventually removed is the “Activation Tax” from 2014 onwards which was tax on the sale of new SIMs being paid by the operators but now imposed on the consumers. Let’s analyze the taxes on consumers and the telecom industry separately.

The 2016-17 budget in Pakistan got mixed reactions from the ICT industry as it raised taxes on mobile phones but at the same time offered tax exemption to software exports with reasonably good budget for development projects

Consumer Related Taxes on Mobile Phones & Services

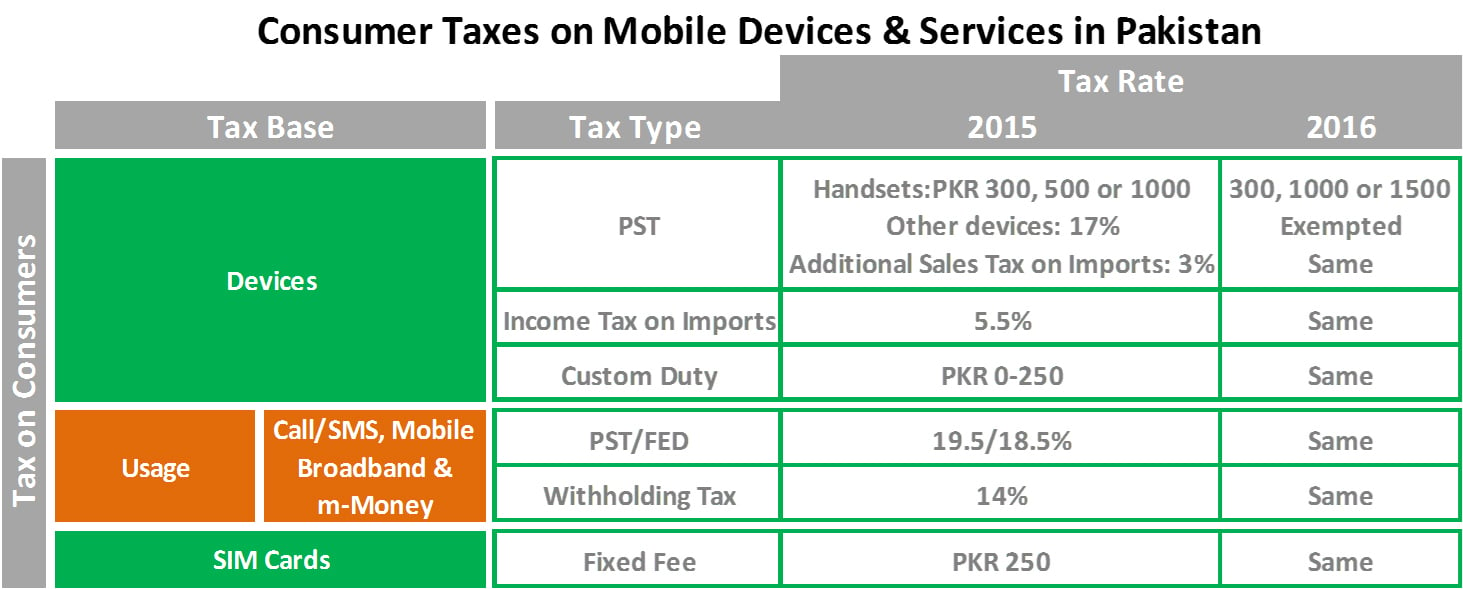

There are various types of taxes being collected from the consumers under different tax statutes. One can see the complete list of pre and post budget taxes paid by a Pakistani consumer for both devices and services in the following figure.

The first thing that we see here is the increase in sales tax of handsets categorically (explained later). While the tax on import of smartphones has increased, a welcome change is the exemption of sales tax on laptops and desktops.

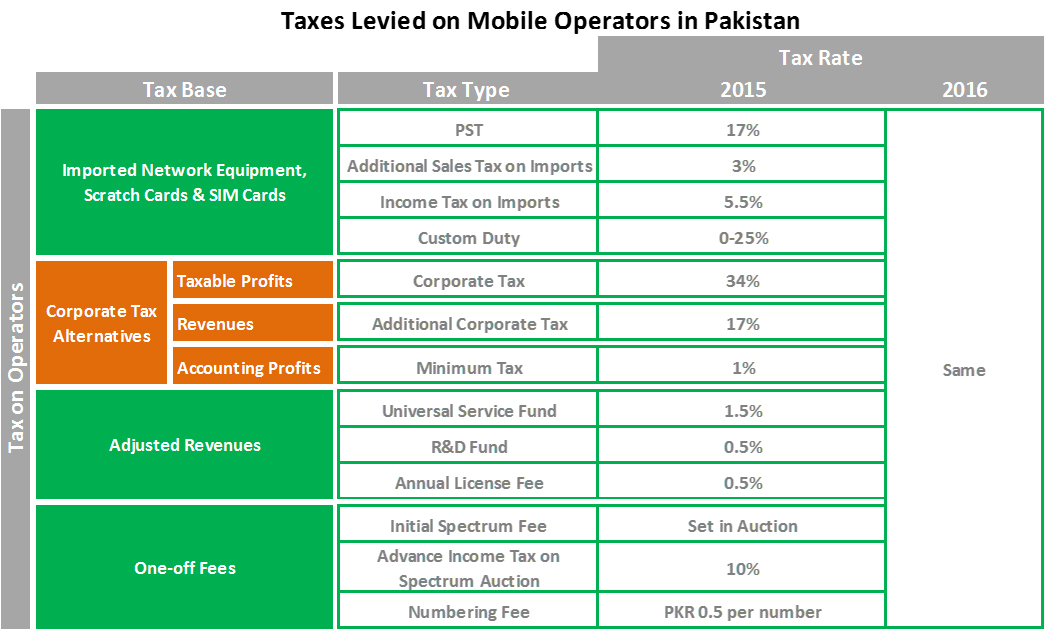

Industry Related Taxes on Telecom Equipment & Services

It is pertinent to mention here that the amount paid by consumers is directly proportional to the taxes paid by the operators. The higher taxes on operators, the more taxes will be imposed on consumers because at the end of the day, the operators are here to make revenues. Following types of taxes are paid by the Pakistani mobile companies:

As it can be seen here, there hasn’t been any relief given to the operators in this year’s budget again as was expected by the industry in the form of tax break.

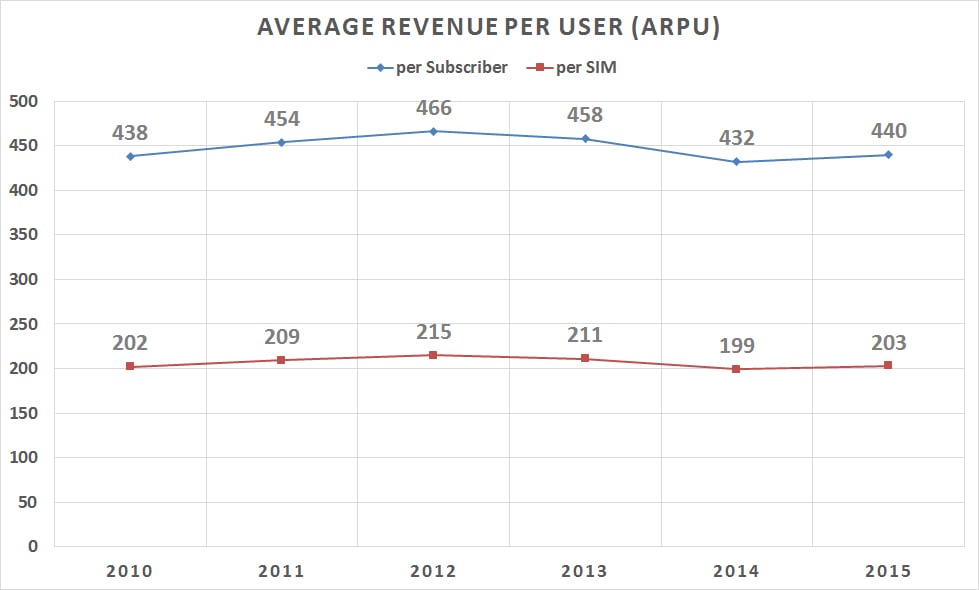

With the high taxes, the mobile operators are forced to other find ways to increase their profitability (or in technical terms, their ARPU (Average Revenue per User)). Below is a representation of the combined ARPU of telecom sector for the last 5 years.

We can see a downward trend in the ARPU and despite the inclusion of more productive 3G/4G users and data being the new means of generating earnings of the future, it hasn’t seen any substantial increase. However, the 2016 and beyond figures may see some growth in ARPU levels.

Consumers will pay more call set up charges despite the annoyance shown by PTA not to burden the consumer

Another step taken by the mobile companies to increase their profitability is that they have increased their tariffs of call set up charges. Consumers will pay more call set up charges despite the annoyance shown by PTA not to burden the consumer. This year in July, Zong has increased its call set up charges from 10 paisas (inclusive of taxes) to 15 paisas following the footsteps of Telenor and Ufone; that have already increased these charges in March 2016. Mobilink and Warid, probably busy with their merger details, are the only ones left to increase the call setup charges.

Explanation of ICT Budget 2016-17

Tax Exemption on IT Exports

The good news in this year’s budget came for IT companies in the export business as the government extended tax exemption on IT services and products till June, 2019 as the IT sector of Pakistan is in its infancy stage and requires support. However, IT companies that are availing the tax exemption will have to remit 80% of their revenues to Pakistan through banking channels while they can retain 20% of the revenues outside of country for meeting their expenses.

The previously imposed 8% minimum tax on service provider companies remain the same which was previously scheduled to be reduced to 2% by the government. The Software industry showed its disappointment on retaining this tax as they believe that this situation is actually forcing IT companies to shift their sales to foreign countries in order to evade taxes.

Public Sector Development Program

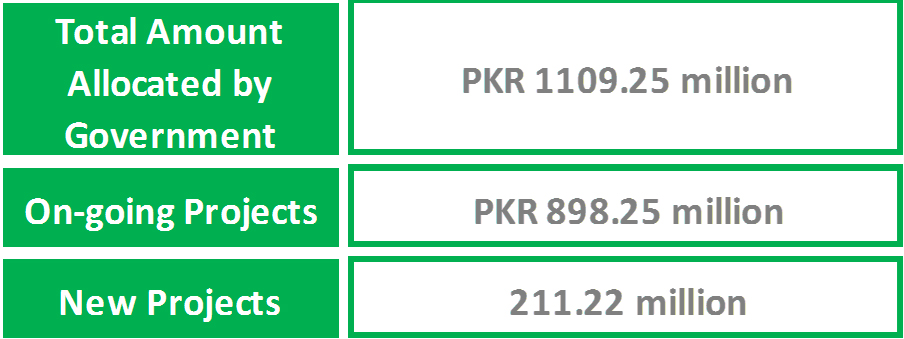

Public Sector Development Program has been allocated Rs. 1.10 billion for ongoing schemes and new projects for Telecom and Information Technology.

Out of this allocated budget, Rs. 938 million will come from Federal Budget and Rs. 171 million will come through foreign aid. Rs. 898.25 million will be utilized to complete ongoing projects, whilst Rs. 211.22 million will be invested in three new projects to be launched in the coming fiscal year.

Some of the development projects under the umbrella of PSDP are as follows:

- Rs. 230 million for Pak-China Fiber Optic Cable.

- Rs. 50 million for Pakistan Software Export Board for enhancing IT Export.

- Rs. 10 million for replacement of GSM network in Gilgit Baltistan and Azad Jammu Kashmir.

- Rs. 50 million for GSM coverage on Karakoram Highway.

- Rs. 151. 23 million for technology parks in Islamabad.

It is important to note that Rs. 800 billion in total is available for public sector development program in budget 2016-17 while a total of Rs. 260 billion has been allocated from Transport & Communication and IT & Telecom fund. It’s no surprise that construction of roads is taking 99% of this fund.

Taxes on Smartphones:

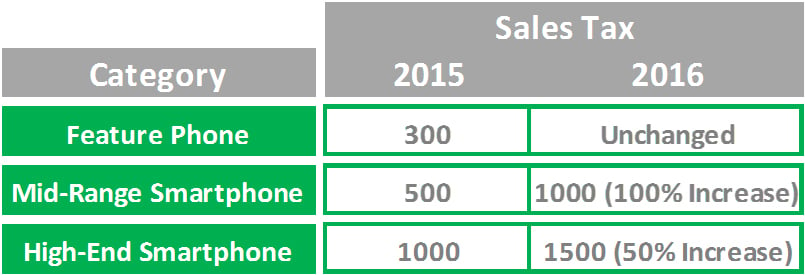

This year’s budget didn’t provide any relaxation to the mobile phone importers and subsequently the consumers have to pay more as the government has raised taxes on the import of mobile phones. The following list briefly illustrates the increase in taxes on mobile phones that was announced by the government in the fiscal budget of 2016-17.

The current sales tax rates of Rs. 500 and Rs. 1,000 have been doubled and increased to Rs. 1,000 and Rs. 1,500 for medium and high-end mobile phones, respectively. Whereas the tax on low category mobiles remains the same i.e. Rs. 300.

Increasing duties on the mobile phones will not only slow up the mobile broadband penetration rate but severely impact the business of the existing mobile phone importers. The industry has shown dismay at the Government decision for such steps and strongly reacted to the proposed hike in duties on import of phones.

The industry experts sight high taxation as one of the reason that could result in slowing up the industry to achieve exponential mobile broadband growth that we saw in the initial period soon after 3G/4G auction. The tax at the import level increases the cost of entry that has negative impact on the growth specially for bringing in new broadband customers.

The tax at the import level increases the cost of entry that has negative impact on the growth specially for bringing in new broadband customers

Also cumulative tax percentage are as high as 33% i.e. broken down into 14% with-holding tax and 19.5% GST on mobile and fixed line internet connections over 2Mbps. Below is the tax grid on consumer for WHT & GST for each province:

Unfortunately, this means that the case of taxation on mobile card recharge is made more adverse in this year budget as now the user will only get Rs. 64 out of Rs. 100 on recharge.

Pakistan’s Failed Tax Collection System Punishes Honest Brokers

Unfortunately, the system of tax collection is not effective in Pakistan, it puts a lot of burden on the honest brokers i.e. a very efficient mobile industry is now seen as an extension of Pakistan tax collection machinery. The mobile operators’ capacity to collect and decently handover the taxes to the federal government has now ranked them as the second largest tax paying industry in the country.

The system of tax collection is not effective and puts a lot of burden on the honest brokers i.e. a very efficient mobile industry which is now seen as an extension of Pakistan tax collection machinery

Due to the country’s defective tax collection system, there is no incentive for people to proactively participate in the tax return exercise. Hence, they indulge in tax evading practices putting pressure to introduce higher indirect taxation such as the one being collected by the mobile operators and other utility companies.

Government needs to collaborate with the relevant stakeholders in the telco sector so that it can be taken to the next level

The Federal Board of Revenue collected Rs. 43 billion on account of withholding tax during 2014-15. Only 0.9 million out of 120 million total users deposited tax return claims and got back what they paid in advance. The remaining amount of more than Rs. 40 billion was automatically taken by the government at the end of the financial year. Comparing the last year mobile card recharge tax with this year, one could be easily convinced that mobile taxes are higher than any other of taxes.

It must be mentioned here that Pakistan is currently embarking on a smartphone uptake frenzy. The influx of smartphones in Pakistan is on the rise as many international and local brands have entered Pakistani market. Smartphone penetration has doubled to an estimated 35 to 40 percent in less than two years after the start of 3G and 4G services in the country.

Government needs to realise that high taxes on the ICT industry will only add to the woes of the users and damage the overall growth of technology in Pakistan

This influx has enabled Pakistan to lead in MBB penetration growth rate in the region according to the GSMA Intelligence report i.e. 19%. The country was also recently ranked as 6th on the list of top smartphone markets for growth by value. There is no doubt that the government has well realized the potential of IT industry and that is why it has especially worked on the taxation regime this year. Therefore, the government needs to comprehend that high taxes on the entire ICT industry will only add to the woes of the users while damaging the overall growth of technology in Pakistan. The government further needs to collaborate with the relevant stakeholders in the telco sector so that this sector can be taken to the next level. Some development projects that have been allocated budget in 2016-17 are also quite interesting and need to be successfully implemented by the ministry to realize any positive changes in the industry this year.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!