The Impact of Coronavirus on Smartphone Market in Q1 of 2020

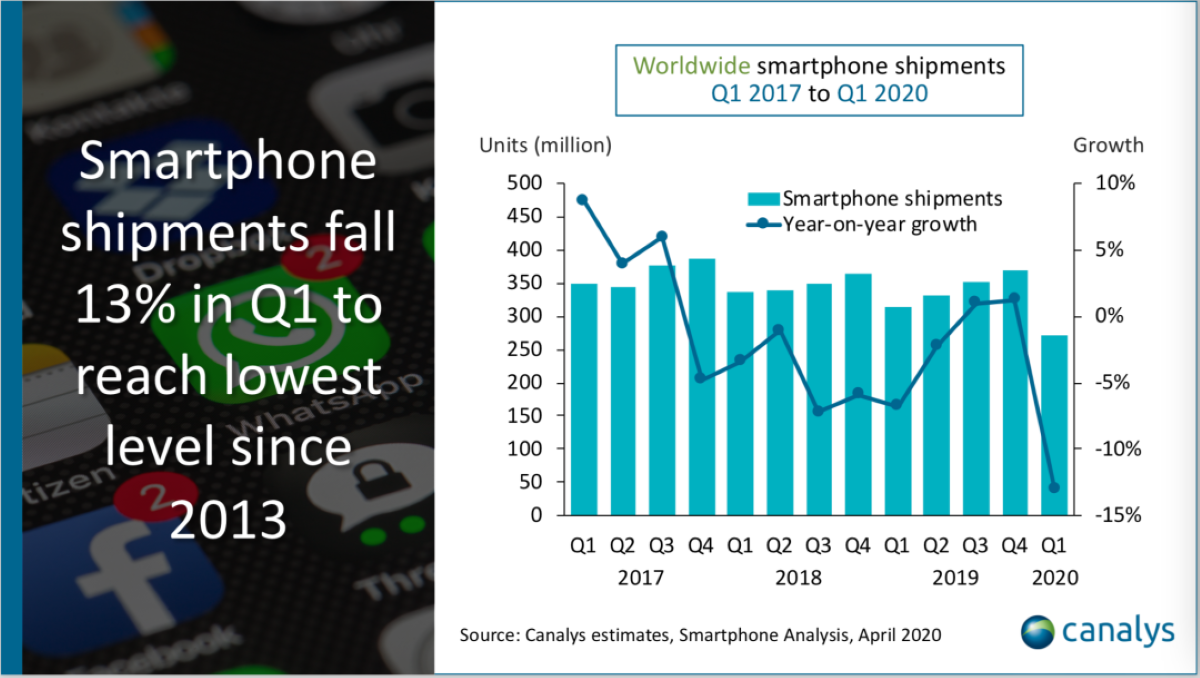

Some calamities can come from an unknown source and hit at uncertain times which can disturb the conventional ebbs and flows of life. Similar is the novel coronavirus. The COVID-19 pandemic has proven to be devastating for many industries and markets around the world. One of the victims is the smartphone market. Quarter 1 of 2020 has left many smartphone companies on the verge of decline. It has now become bitter and disastrous reality. The shipments have fallen 13% or 272 million units.

Though Samsung climbed to the top position, the company’s shipments witness a steep decline of 13% or 60 million units. On the other hand, Huawei shipped 49 million units, as its supply resumes to turn toward China and away from abroad markets because of its US Entity List status. The US tech giant Apple being the third-largest vendor also witnessed a downfall of 8% with 37 million shipments. The Chinese company Xiaomi, the most solid performer in the top five list, accomplished 9% growth to knock 30 million units, while Vivo ended on the fifth position with 24 million units, an increase of 3%.

The smartphone market started 2020 with a great boom, having just registered a couple of consecutive quarters of growth. “But demand for new devices has been crushed,” told by Canalys Senior Analyst @Ben Stanton. During Feb, when the COVID-19 was focused on China, merchants were essentially concerned about the manufacturing of sufficient smartphones to meet global need.

But, everything changed when the month of March came. The contemporary situation of the time flipped on its head. The smartphone manufacturing has now been revived, but as a significant portion of the world entered a lockdown, sales plunged. Weak business results, employee tautologies and furloughs are breeding a great deal of stress, anxiety and uncertainty. The smartphones are yet a requirement for most individuals, and smartphone availability in online channels has permitted those who demand to redeem a broken or lost phone to do so. But many buyers who would have bought a new device as a luxury have delayed that purchase.”

check out? MoITT to Propose Major Incentives for Smartphones Manufacturing in Pakistan

| Worldwide smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q1 2020 |

|||||

| Vendor | Q1 2020 shipments | Q1 2020 market share |

Q1 2019 shipments | Q1 2019

market share |

Annual growth |

| Samsung | 59.6 million | 21.9% | 71.5 million | 22.8% | -17% |

| Huawei | 49.0 million | 18.0% | 59.1 million | 18.8% | -17% |

| Apple | 37.1 million | 13.6% | 40.2 million | 12.8% | -8% |

| Xiaomi | 30.2 million | 11.1% | 27.8 million | 8.9% | +9% |

| Vivo | 24.2 million | 8.9% | 23.5 million | 7.5% | +3% |

| Others | 72.4 million | 26.6% | 91.6 million | 29.2% | -21% |

| Total | 272.5 million | 100.0% | 313.9 million | 100.0% | -13% |

| Note: percentages may not add up to 100% due to rounding Source: Canalys Smartphone Analysis (sell-in shipments), April 2020 |

|||||

The table clearly depicts that most of the smartphone countries have witnessed a clear shortfall and declining trajectory. Only two companies Xiaomi and Vivo have retained their positive trajectories.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!