Fraudulent Micro Loan Apps Fooling & Spying on Pakistani Users

Commercial banks in Pakistan don’t provide trivial loans (PKR 10,000-50,000) to customers as it doesn’t benefit their business. In addition, the citizens must pass through a lengthy process for any loan. So, recently, a trend has started in Pakistan involving micro loan apps like PK loan personal online, Ai Cash, and many others. Apparently, the apps provide trivial or micro-loans to customers in a pretty convenient manner and the process is pretty simple. In return, the apps charge interest and set a specific deadline for the return of the loans.

However, there is a grim picture. We have researched and collected data from a number of sources and found out that the majority of these loan apps are fraudulent and some even spying on the users and collecting their personal data. Now, I am going to quote a number of feedbacks from the users who have accused these apps on different platforms. Some of these fraudulent apps are listed below:

- Ai Cash app

- PK Loan Personal Online

- Easy Loan Personal Loan Online

- Sarmaya App

- Fori Money Credit Loan

- Duck Loan App

- Didi Loans

- Barra Loans

A heartbreaking story:

I will start with one of the stories that have been recently published on BBC Urdu. Atif, a resident of Wazirabad, Punjab, was in dire need of money, as he had to pay money to the hospital for the operation of his son. Before he could borrow money from friends or relatives, he saw an ad on social media for a loan company offering ninety-day loans. Atif immediately applied for the loan and got the money within half a day. Atif contacted the hospital for his son’s treatment. Just six days after taking the loan, he received a call on his mobile phone from an agent of an online lending company saying that the loan was due. While talking to a media outlet, Atif said,

I took a loan of 27000 rupees from the online personal loan app and was supposed to repay 34200 in ninety days, but after six days I got a call from the company saying that you have to repay the loan. The app asked me pay the debt in ninety days, a discussion started with the recovery agent of the company and now the situation is that the recovery agent is even abusing me.

Then, he even paid around PKR 7000 as an extension fee for 10 days, and after that, the recovery agent started calling him again and threatening him to pay PKR 34200 or he will call his relatives. So, the extension money wasn’t even counted in the loan. The recovery agent after a day called Atif’s relatives and he had to face humiliation.

Simultaneously, now I am going to share screenshots of user feedback from the Play store and other platforms so you can have a better idea regarding these fraudulent apps.

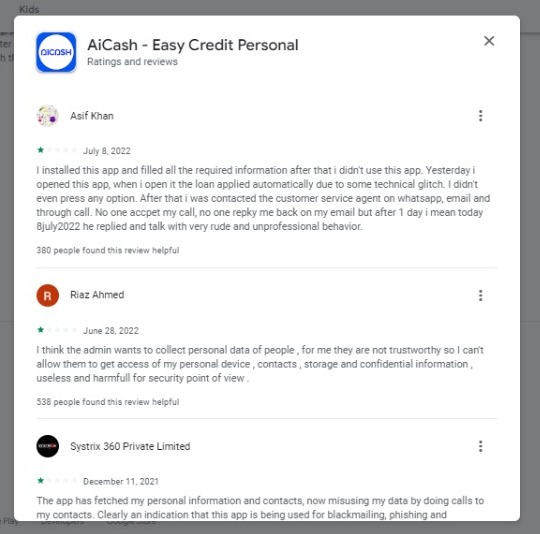

Feedback Regarding Ai Cash App:

As you can see, all the feedbacks regarding this app are pretty negative, and most users have alleged that this app is spying and collecting the personal data of the users. You can read further comments by clicking on this link, and should report the app so it cannot fool any users in the future.

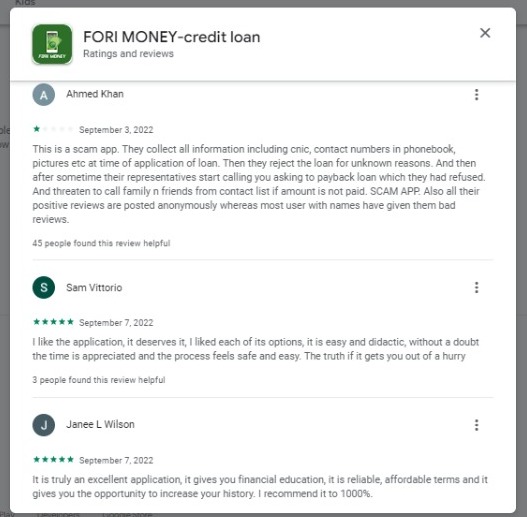

Feedback regarding Fori Credit Loan:

Look at this app, they have even posted paid reviews on the play store. Like why will Anglo Americans take loans from a Pakistani loan app? This is totally absurd. Only one of the reviews is real and has clearly written that it is a totally fraudulent app. Report this app by clicking on this link.

Other Apps:

Simultaneously, all other apps that we have listed above are involved in similar scams, and you can visit them on Google Play Store and report them. So, these apps can’t fool and steal the data of innocent Pakistanis in the future.

There are some credible platforms that provide micro-loans and can be trusted. These platforms are entailed as below:

- EasyPaisa app

- JazzCash app

- HBL Loan app

- UBL Loan app

Final Words:

The micro-lending apps have been the target of a barrage of criticism for some time now for being loan sharks. This word originated during the American Civil War and is characterized by lending at excessive interest rates and harsh collection techniques. It was labeled as such because loan sharking involves the lending of illicit funds and was a characteristic of criminal businesses, and hence operated beyond the scope of state legislation.

Due to the impossibility of enforcing legal contracts, lending such funds previously entailed a very high risk and carried extremely high-interest rates. Due to the impossibility of involving legitimate law enforcement systems in recovering such loans, collection procedures for such loans included the use of violent tactics. So, we advise that citizens of Pakistan must stay vigilant and avoid all such fraudulent platforms.

Check out? Stop Using These 5 Kinds Of Android Apps

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!

I need too much