Low ARPUs-Are MNOs up to the Challenge?

In fundamental analysis, Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA), debt/equity and free cash flow are important pieces of a company’s finances. Evaluating any stock also requires specific knowledge about the company’s sector and industry, as well as knowledge of the forces that affect companies in the same category. However, for a telecom company, measuring its profitability encompasses its most valued asset; its customer base. Customers are the bread and butter for any organization.

Low ARPUs-Are MNOs up to the Challenge?

For the telecom industry, a returning customer becomes a source of constant income and thus, companies look for ways to increase customer engagement.

Average Revenue per User (ARPU):

ARPU metric is quite important in the telecommunications industry, as it illustrates the company’s operational performance.

Despite all the efforts the situation is quite challenging for the investors as far as returns and profits are concerned, amid depleting value of Pakistani currency, low ARPU and tough economic conditions on top of energy crisis

The ability to maximize profits and minimize costs associated with servicing each end user is key to these companies. Since telecommunications companies are service providers instead of manufacturers of a product, investors want to measure marginal profit and cost on a unit level, revealing how well the company utilizes its resources. The higher the average return, the better. Generally, telecommunication companies that offer bundled services enjoy a higher ARPU.

Past ARPU Trends in Pakistani Telecom Industry:

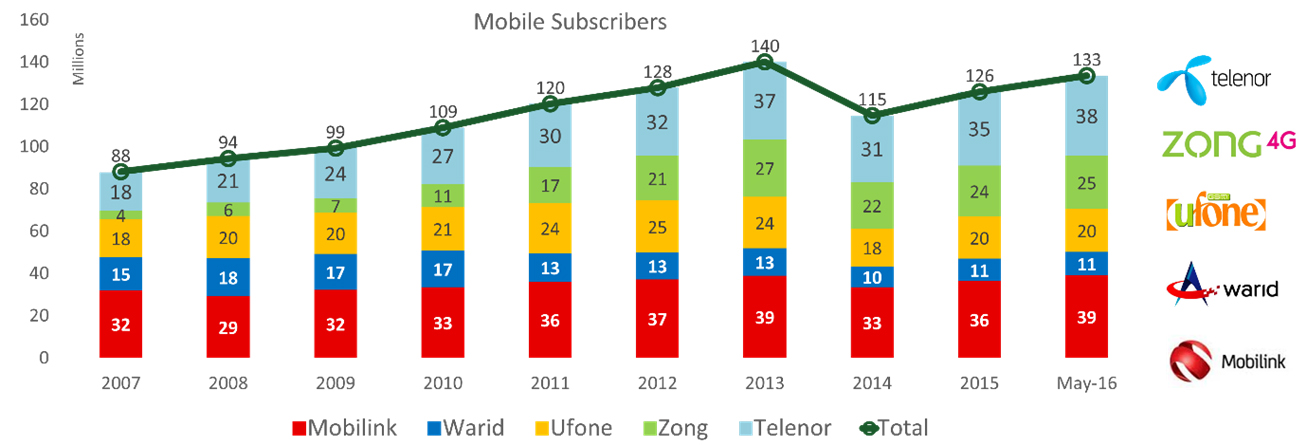

Like most emerging markets, the subscriber base grew exponentially in Pakistan however, the revenues of telecom operators didn’t go up in same proportion. Pakistan’s telecom market initially was largely relying on subscribers’ growth to stretch its revenues.

Generally, telecommunication companies that offer bundled services enjoy a higher ARPU

Despite all the efforts the situation is quite challenging for the investors as far as returns and profits are concerned, amid depleting value of Pakistani currency, low ARPU and tough economic conditions on top of energy crisis.

Naturally, the subscriber growth has been arrested in recent past due to attainment of sufficient saturation, which leaves operators with not many new sales (as compared to yester years). ARPU on the other hand was never worked upon by the operators and hence the growth in revenues is in shackles.

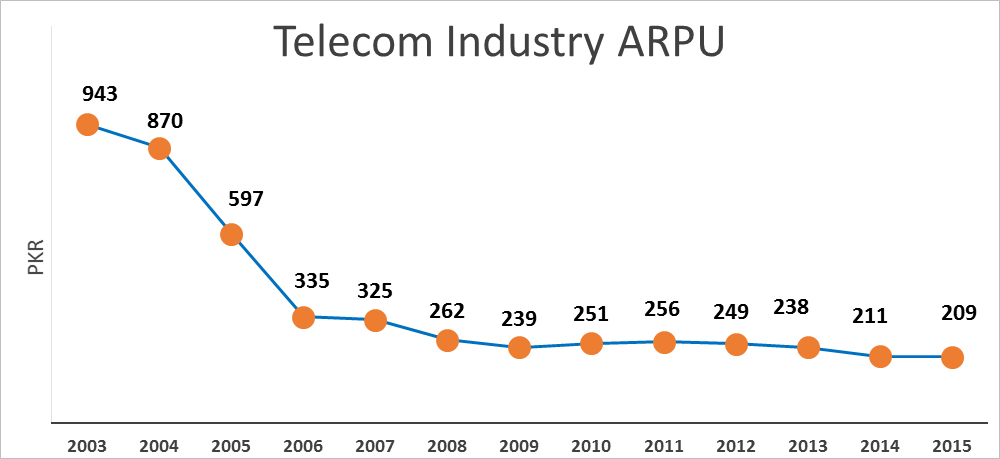

If we study the ARPU trends for past few years, then we might be able to understand the factors that hit the ARPU standings. Before we start our discussion, let’s have a look at ARPUs for past few years:

The graph clearly shows the saturation attained and slowly but surely this trend would continue downwards unless prevented.

Factors to Consider for ARPU Maximization:

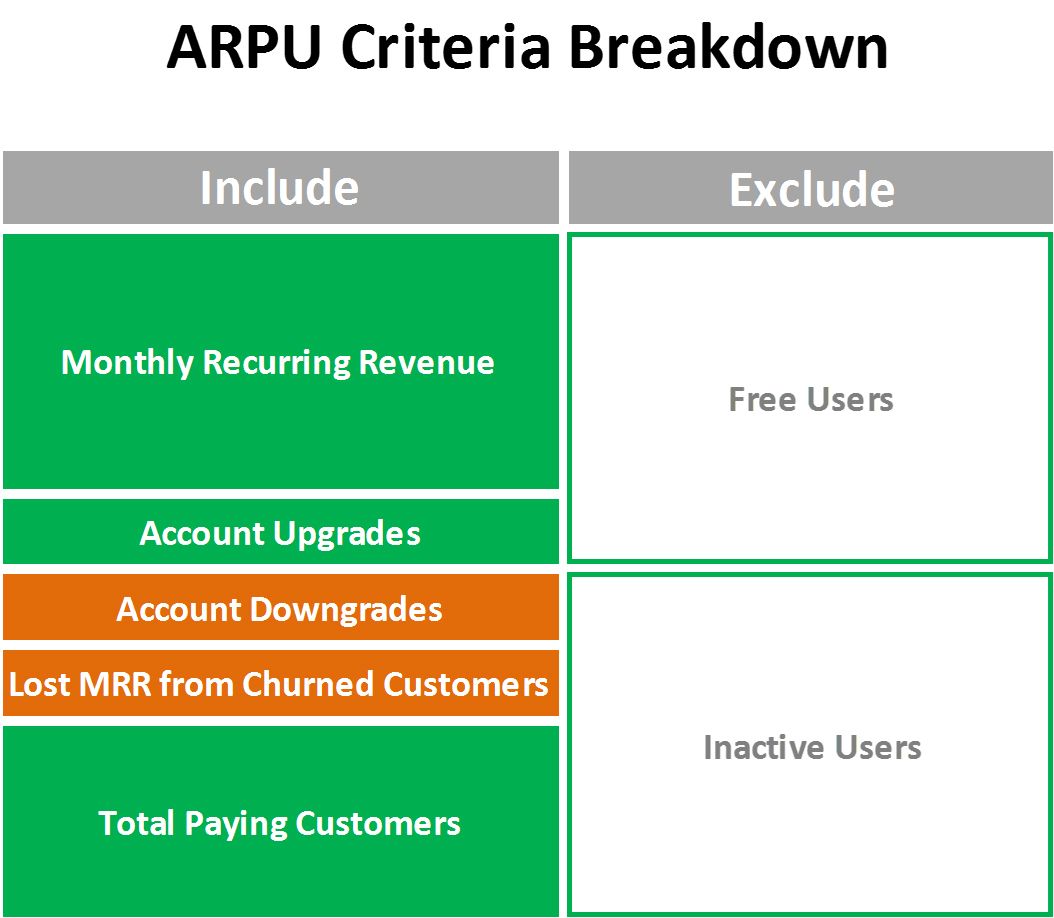

In order to improve ARPU, telecom operators need to closely understand the dynamics that affect their per user revenue, only then they will be able to device strategies that will improve their revenues. While calculating ARPU, one must understand the respective indicators that need to be included in the equation.

It would seem simple enough to divide the average revenue on a monthly basis by the number of subscribers, but the need arises to separate the profitable subscriber from the freeloaders. Other than the monthly revenue, account upgrades and downgrades are a vital part of the equation. This exercise is not merely to define the method to calculate ARPU, rather to identify the factors to consider when looking to increase ARPU.

The Unprofitable Customer:

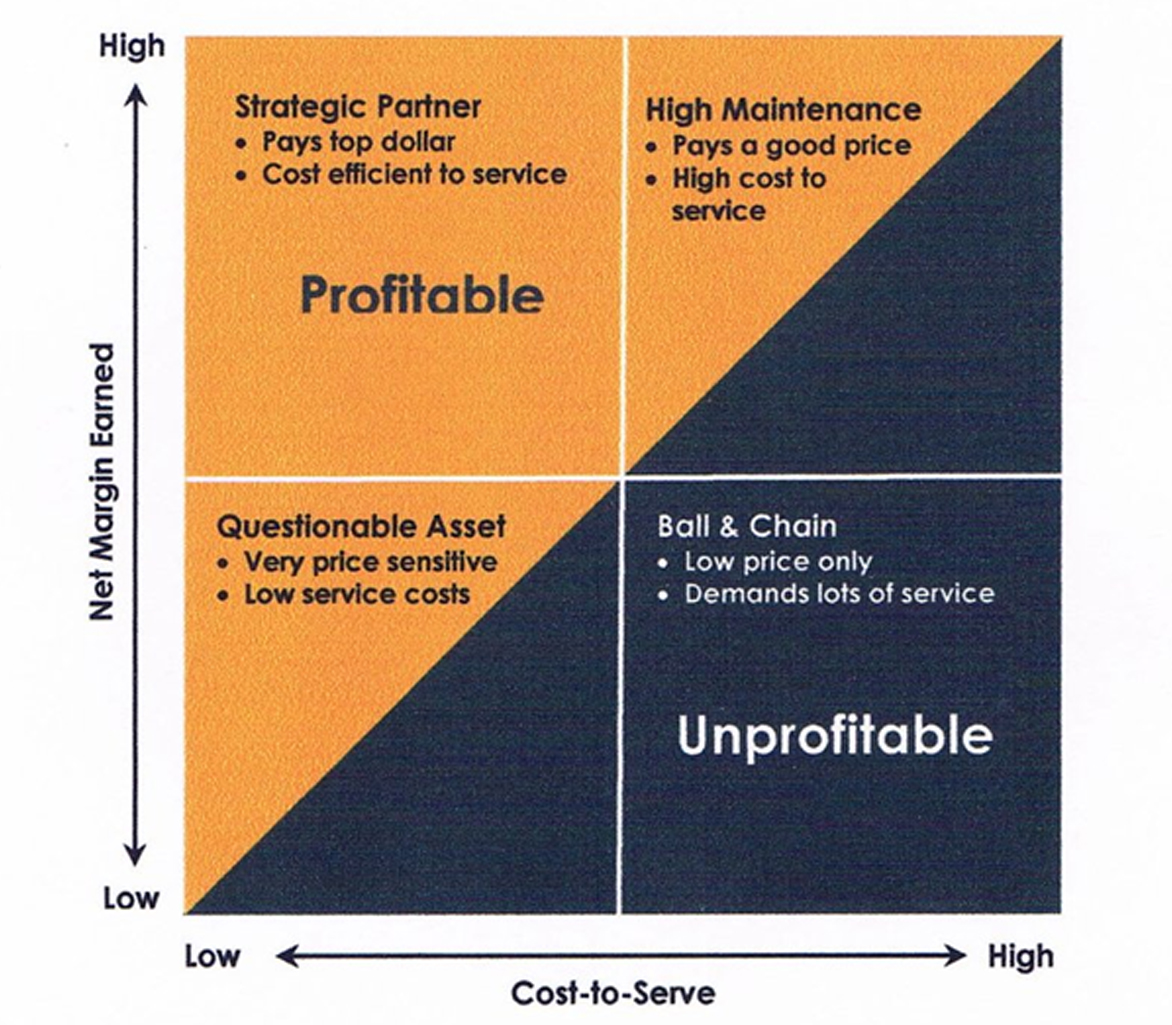

In the struggle to increase profitability, the most neglected aspect is the existence of the non-beneficial customers. This is one of the most difficult dilemma for any service provider. The fact is that not all customers are profitable. The Pareto principle (80/20 rule) explains this with respect to user consumption of bandwidth and limited resources, meaning that 80% of all resources are consumed by 20% of the subscribers.

The dilemma faced by operators in this situation is what to do with the subscribers or applications that are consuming a disproportionately large amount of resources compared to what they are paying for

The dilemma faced by operators in this situation is what to do with the subscribers (or applications) that are consuming a disproportionately large amount of resources compared to what they (or their customers) are paying for.

- i) Post-paid subscribers: Non-profitable subscribers can fit into several categories. The first group is the post-paid subscribers that consume a disproportionately large amount of resources compared to what they are paying for. This is a relatively common form of the dilemma and is particularly important for bandwidth-constrained operators, since a quick way to delay many network upgrades is to reduce the amount of bandwidth being used, so it follows that limiting (or reducing) the top one per cent of subscribers that are using a high percentage of bandwidth is a logical strategy for these mobile operators.

- ii) Pre-paid Subscribers: Another group of non-profitable subscribers are the prepaid subscribers who simply do not use enough services (minutes, messages or data) and hence generate very little revenue. These are typically the very low ARPU pre-paid subscribers that rarely use telecommunications services and therefore don’t need to top up very often. Introducing minimums or expiring unused pre-paid minutes and messages can resolve the issue for this group of non-profitable subscribers.

The chart explains the four categories of customers and how the cost to serve them can play a vital role in defining their profitability. The high revenue, low cost customers are your prime assets and companies need to take care in keeping them interested in their offerings. For high cost customers, you need to develop ways to bring the cost of the services they use to an affordable level.

For low profit category, the need arises to increase their use of services targeted to their specific needs. As for low profit, high cost subscribers, it is best to allow them to churn away.

How to Increase ARPU:

Once the customer types and preferences are better understood, only then will operators be able to develop strategies to improve their ARPU. Here are few of the strategies that can help operators in this regard.

Limiting Unprofitable Users:

The first and most common solution used is to enforce usage-based charging where different traffic volumes are charged at different rates. This strategy or solution can become difficult for those operators that offer an ‘all you can eat” data plan. Another strategy is to de-prioritize certain traffic types (or applications that these subscribers are using). The de-prioritization can be done at specific times of the day or after a usage threshold is reached.

A final (and sometimes even more difficult approach) is to actually encourage the non-profitable subscriber to churn away. This is particularly difficult when a subscriber has an ‘all you can eat’ data plan which they are not willing to give up. This strategy of churning away unprofitable subscribers can also be particularly difficult for an operator with a revenue-driven culture.

Bundled Products & Services:

Telecom companies today are not just voice or data service providers, they aim to transform into digital lifestyle partners that have integrated into all vertical and horizontal businesses. The idea is not only to sell communication services, but also to provide the hardware to use those services and then the softwares to increase utilization of those services. An example of this is selling handsets. In most markets, handsets act as the sweeteners for acquisition purposes, wherein subscribers are lured to sign a 12 or 24 month contract in exchange for a free or discounted handset. Although this model is not as successful in Pakistan as in other countries due to the different market dynamics. But this trend is growing globally, with operators competing not just on price via their tariffs, but via the free or discounted handsets. The handset is essentially becoming a service offering of the telecom, part of the overall benefits a subscriber gets when he or she signs on to an operator.

Instead of that, our local mobile operators have come up with a different device strategy and has launched their own mobile brands. Recent examples include Mobilink’s Jazz X smartphones and Telenor’s Infiniti series handsets. Through these deals, the operators not only earn on the sale of handsets, but also through the use of the services on their bundled data packages. After the launch of 3G/4G services, operators have also launched 3G Wingles and Mi-Fi devices to tap in device market.

Utilizing 3G/4G Services:

With the auction of 3G/4G spectrum in 2014, the industry was anticipating a sizeable growth in profits. The auction organized by PTA gave the industry a much needed breather without which the potential growth of the sector was stunted. The operators contested for the available spectrum, hoping for the dawn of a new era of renewed gains.

However, such strategies have helped telecoms, particularly around the pursuit of two objectives – the increase of subscriber acquisition and the decreasing of subscriber churn. They barely, if at all, help in the pursuit of the third key objective, which is, existing subscriber ARPU growth. SMS addicts reduced their SMS usage via the discovery of SMS replacing apps like WhatsApp. Voice calling apps like Viber have replaced traditional voice calling – as such, pushing such services to certain types of subscribers that detrimentally affected ARPU. In the recently approved Telecom Policy, government has taken up an initiate to regularize these OTT services although, the hardcore steps have yet to be taken. Once that is done, it will surely improve market environment for operators as well.

Our local mobile operators have come up with a different device strategy and has launched their own mobile brands, recent examples include Mobilink’s Jazz X smartphones and Telenor’s Infiniti series handsets

The idea is to not only offer the best possible 3G/4G speeds, but also attractive soft products that would make the customers utilize the bandwidth that they paid for. Local operators have been doing a lot in this regard, like tapping into the banking sector, offering micro-financing products. Another example is the smart watch for kids that all operators have offered.

The watch utilizes active data connection to keep track of your kids thus, utilizing network resources. All operators offer a 1 time fee with a fixed monthly or yearly recurring fee. Another area where operators can tap is m-Health.

The ability of mobile phones to monitor basic human patterns using digital input from its user has allowed it to transform every aspect of human life. Given the mobile phone’s computing capacity and wide usage, it has recently been adopted as a tool by the global healthcare industry. Mobile Healthcare (m-Health) — the use of a mobile device to provide healthcare — has the potential to change when, where and how healthcare is provided with the help of mobile applications and services that include remote patient monitoring, video conferencing, online consultations and wireless access to patient records and prescriptions.

m-Health is the use of mobile technology to provide health care support to patients or technical support to health service providers in a direct, low-cost and engaging manner. Operators in Pakistan can collaborate with leading healthcare providers in the country to come up with digital healthcare solutions. Not only that, operators are also tapping in to other m-services as well which mainly includes m-education, m-agriculture and m-banking. These initiatives generally require mobile broadband, which consequently increases data usage hence, improving the ARPU for operators.

The Concept of Hard Bundle:

The increasing penetration of smartphones and data services has an adverse impact on legacy service revenue. Typically, a decline in usage of legacy voice service occurs when smartphone penetration in the network reaches a critical mass of 30–40% of active connections.

As discussed earlier, increased smartphone penetration leads to the adoption of data and OTT messaging services (such as WhatsApp), which in turns enables substitution of voice calls with messaging over IP – in effect the need to make voice calls declines. This emerging scenario leads to the risk of decline in overall legacy revenue, which may lead to decline in ARPU. In addition to OTT cannibalization, operators in prepaid-dominated emerging markets also face the challenge of how to increase ARPU among low-end or low-usage subscribers to drive revenue and improve profitability.

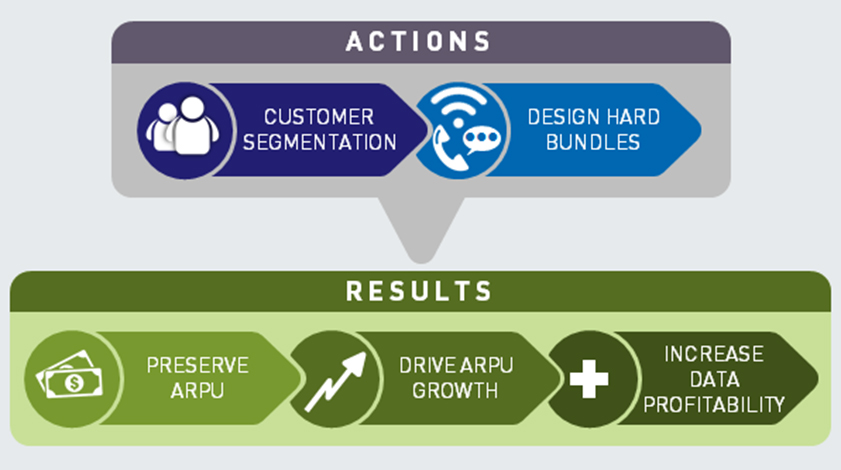

To address these issues, local mobile operators have started to move towards hard bundles. A hard Bundle is defined as a fixed amount of data, voice and SMS for a fixed price. Offering hard bundles targeted towards different customer segments to facilitate service arbitrage (offering more services that a certain customer group actually uses), which helps to preserve or increase ARPU.

Most operators now offer separate packs for voice, data and SMS, which enables end users to select packs according to their requirements – thus optimising their usage – leaving no or very limited room for service arbitrage.

Customer segmentation is important for understanding revenue concentration and measuring profitability for each segment. This includes assessment of usage pattern (historical and current) of each customer segment. Further categorising segments into multiple user profiles (such as high voice and low data, and low voice and high data) based on the level of voice and data usage can help operators understand customer behaviour.

Increased smartphone penetration leads to the adoption of data and OTT messaging services (such as WhatsApp), which in turn enables substitution of voice calls with messaging over IP – in effect the need to make voice calls declines

Hard bundles are designed keeping in mind the historical and expected usage pattern of different customer profiles within each segment. Hard bundles are generally designed to provide more of the declining services (more voice minutes, more text messages) and current levels of services for which usage has been increasing.

However, the following three factors in predominantly prepaid and low-ARPU emerging markets complicate the implementation of hard bundles.

- Multiple top-up frequency among users with similar usage behaviour: The complexity of designing hard bundles increases when top-up frequency of users with similar usage behaviour (voice, SMS and data) varies significantly

- High number of user profiles to address because of the size of the market: It is easy to design hard bundles when 10–15 user profiles cover most of the market (60–70%). However, in a market with a large number of user profiles (more than 20), designing hard bundles targeted towards each user profile increases in complexity.

- Working out the appropriate bundles for each user profile (bundle pricing and the relative size of voice, text and data limits within each bundle) and providing incentives for consumers to migrate from their established plan to a hard bundle is another complexity operators need to address.

The key to successful implementation of hard bundles lies in understanding the evolving usage pattern of different customer segments and designing bundles to ensure that customers perceive value in subscribing to the specific pack designed for a particular usage profile.

In Pakistan, all operators have been offering bundled services, yet they seem to apply to a very few set of user profiles. Pakistan mobile operators need to identify more user profiles and specifically target the low end users and design bundles targeted specifically for them.

Creating Value for Customers:

Customers, without any doubt, are the lifeline of any business. Given the significant transformation in the telecom industry, with sales volume and ARPU static or on decline, telcos have started realizing that the only way to increase revenue is by building strong customer relationships. Miss the deadline, don’t follow through, or never call back, and you can lose your customer for a lifetime. Therefore, it has become an important pre-requisite to invent new ways to build brand loyalty.

Given the significant transformation in the telecom industry with sales volume and ARPU static or on decline, telcos have started realizing that the only way to increase revenue is by building strong customer relationships

Though constantly innovating new products and services require a lot of money and R&D efforts, delivering a great customer service experience is well within the reach of every telecom service provider, big or small.

Provide multi-channel customer experience:

This works on a simple principle – ‘Delivering the right content to the right people through the right medium’. Through behavioural targeting and personalization, you should try to find out what your customers actually want. Though ‘voice’ still rules the charts, as a telco you should also try to invest in different OTT services to tap profitable service opportunities and increase sales and ARPU.

Offer best-in-class purchase advice:

Become your customers’ most trusted advisor. Carefully select top quality services for them (from the bunch of services that are offered) and then personalize those services to meet customers’ needs. Through personalized and targeted execution, operators will be able to quickly and more effectively boost customer loyalty.

Reduce costs and improve service:

At times, when most of the OTT players are offering free of cost services, charging hefty amounts for deliverables could do more harm than good. Therefore, operators should try to bring the cost of services down while improving customer service experience. This will help in increasing customer base and in turn boost sales revenue.

Fix problems before they happen:

Try following a proactive approach rather than a reactive approach. So, instead of solving problems, identify the potential issues and solve them before they become a problem. Proactive customer support allows a company to deliver highly differentiated services that reinforce the company’s brand identity and customer value proposition. As a result, telcos will attract a loyal following of buyers who appreciate being consistently treated like valued customers.

Be prepared to go the extra mile for your customer:

Going the extra mile for your customers is the easiest way to build an everlasting relationship. Doing this will boost customers’ confidence and they will stick to you even when competitors knock on their doors. In fact, creating loyal customers starts with the minimum – meeting their expectations. Your happy customers are your best PR agents, and it is far less expensive to nurture them than convincing and converting a new prospect.These five customer retention strategies will not only strengthen your client relationships, but will also help you boost your company’s bottom line.

The situation in Pakistan is not that bleak. The stagnant revenues are mostly the result of the delayed 3G/4G auction and high taxation, after which, operators are showing really good signs of utilizing the new technology and coming up with products and services that are changing traditional practises and introducing digital cost effective and efficient solutions that have the potential to increase customer engagement and therefore improved ARPU levels.

Operators are also tapping in to m-services as well which mainly includes m-education, m-agriculture and m-banking. These initiatives

generally require mobile broadband, which consequently increase data usage hence, improving the ARPU for operators

Pakistan is going through a digital transformation. Once this transformation is complete, it will surely open up many doors of growth and profitability for various businesses especially telecom sector, since all the latest consumer services will be dependent on mobile broadband. The question here is, will the operators be success in cashing this magnificent opportunity?

Writer: Sufiyan Bin Azam

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!