Featured Phone vs Smartphone Usage in Pakistan-Brand Share (Q2 2020)

In Pakistan, still, there is a vast majority of people who use featured mobile phones in place of smartphones in this era of technology. The feature mobile phone users are mostly comprised of adults who are digitally illiterate and prefer a simple mobile phone instead of a smartphone, So I will provide some figures related to feature phone usage and smartphone usage in Pakistan in Q2 of 2020, and I will also compare it with the previous quarters

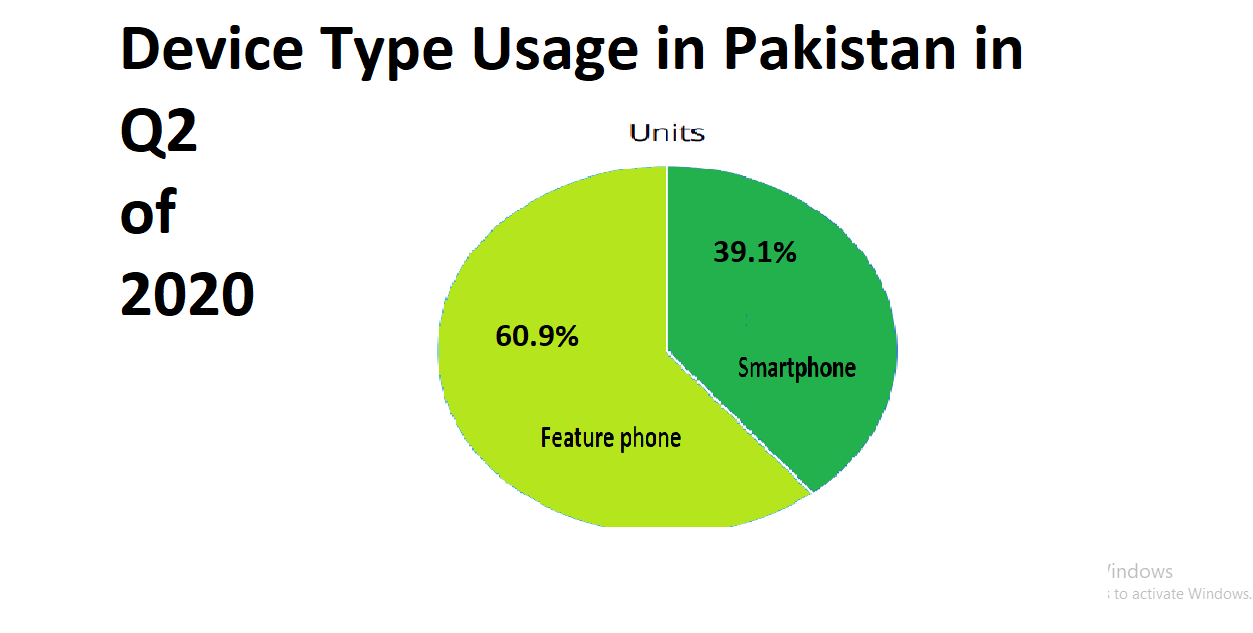

Now as you can clearly see in the graph. The feature phone usage in Pakistan stood at an astonishing 60.9% in terms of units while smartphone usage occupies 39.1% in Q2 of 2020. Now, I will quote the feature phone market share of all popular brands in terms of units in Q2 of 2020.

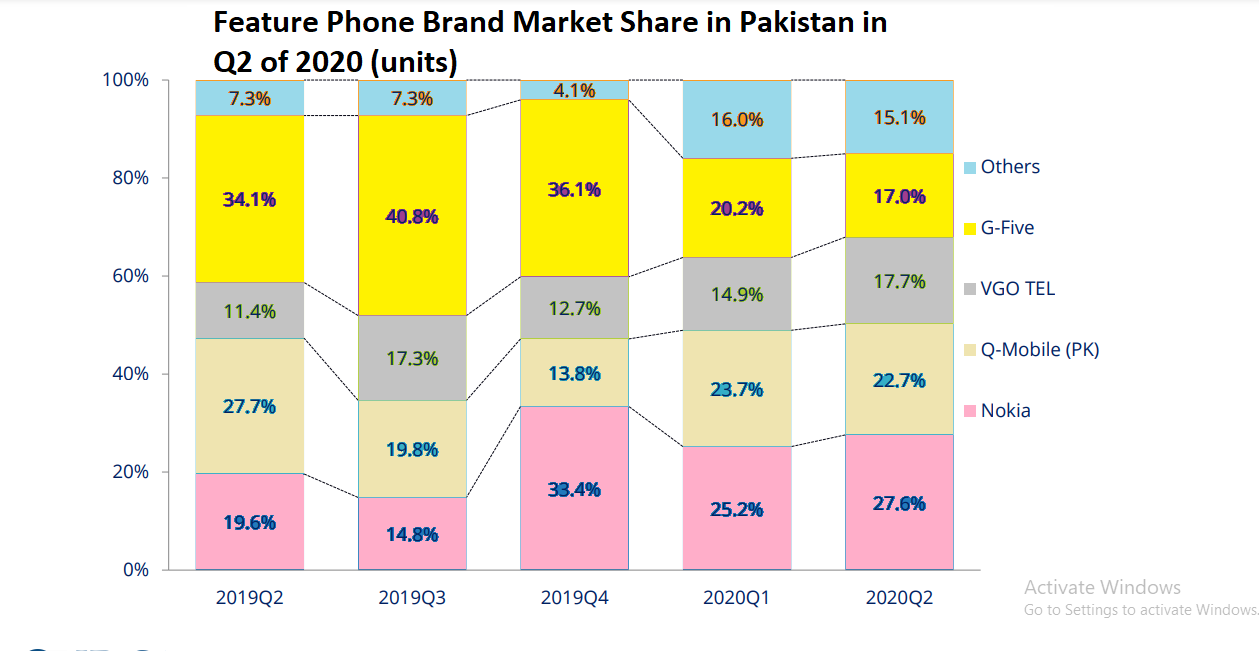

I will start with Nokia.

Nokia:

Despite Nokia’s decline in the international market, the company has found a rising trend in Pakistan due to the splendid quality of its feature phones. Now as you can clearly see in the above-given graph that Nokia’s share has been increased, from 25.2% in Q1 of 2020 to 27.6% in Q2 to 2020.

Q-Mobile(PK):

Q Mobile has returned with a new license and assembly plan and wants to strengthen its position in the Pakistani market again. However, its share has been decreased, from 23.7% in Q1 of 2020 to 22.7 in Q2 of 2020.

VGO Tel:

VGO Tel is comparatively a new brand but its rising in the Pakistani market at a rapid pace. The share of VGO tel in the Pakistani market rose from 14.9% in Q1 of 2020 to 17.7% in Q2 of 2020.

G-Five:

G-Five is another old brand in Pakistan and has a legacy of producing feature phones. However, it is also witnessing a downward trend as its share decreased from 20.2% in Q1 of 2020 to 17% in Q2 of 2020.

Others:

Other feature phone brands include Callme, Memobile, Club Mobile etc. These phones also followed a downward trend. Their share decreased from 16% in Q1 of 2020 to 15.1% in Q2 of 2020.

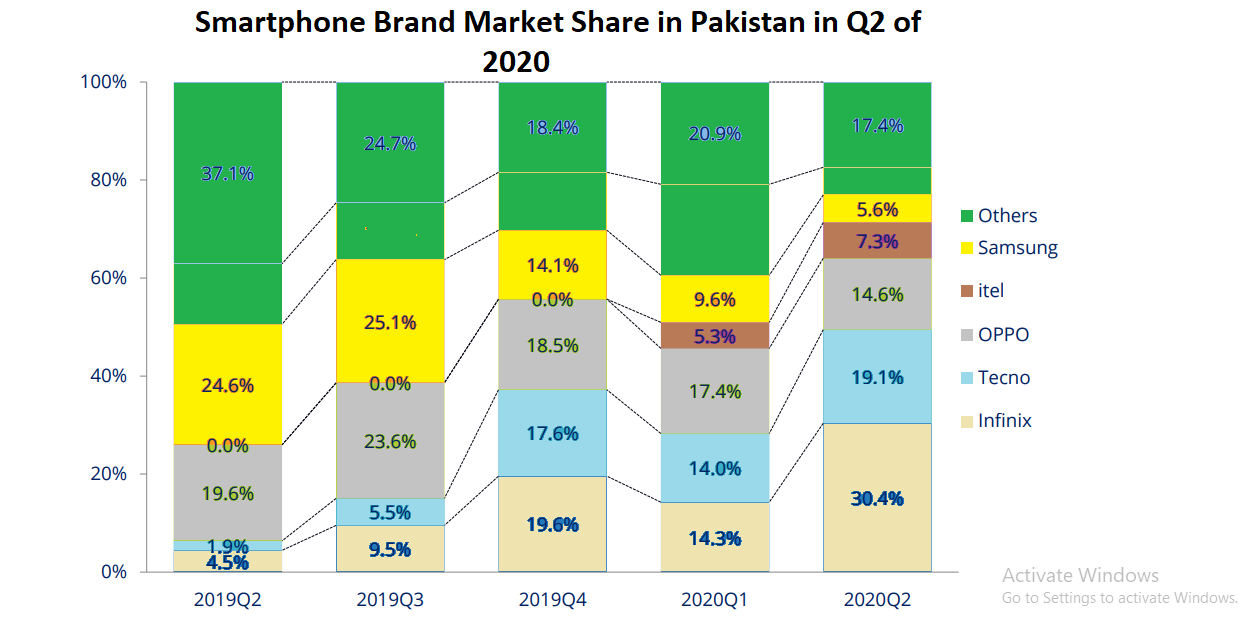

I will start with Infinix.

Infinix:

Infinix smartphones have become famous for providing quality products with brilliant specs and features in an affordable price, Due to which, it has witnessed tremendous growth in the Pakistani market. Its share increased from 14.3% in Q1 of 2020 to a staggering 30.4% in Q2 of 2020.

Tecno:

As Tecno and Infinix are subsidiaries of the same parent company, So the notion is the same, providing quality products at an affordable price. Therefore, its share has also increased from 14% in Q1 of 2020 to 19.1% in Q2 of 2020.

Oppo:

Oppo is famous for rendering best camera phones. It has been witnessing a rising trend before but this time around its share has fallen from 17.4 % in Q1 of 2020 to 14. in Q2 of 2020.

iTel:

iTel is making some ground in the Pakistani market because of its budget price. Its share increased from 5.3% in Q1 of 2020 to 7.3% in Q2 of 2020.

Samsung:

Unfortunately, the tech giant Samsung is following downward trend in Pakistani market since Q2 of 2019, as you can see in the above mentioned graph. Its share has decreased from 24.6 % in Q2 of 2019 to a shocking 5.6% in Q2 of 2020.

Others:

The other smartphone brands include Xiaomi, Realme, Huawei, Apple etc. These brands are also witnessing a decline in Pakistani smartphone market. Their share decreased from 20.9% in Q1 of 2020 to 17.4% in Q2 of 2020. The tech-giant Huawei due to non-availability of Google service has literally vanished from the Pakistani market.

Check out? The Impact of Coronavirus on Smartphone Market in Q1 of 2020

A senior research analyst at IDC, Says Taher Abdel Hameed stated,

In Q2 2020, the Pakistan smartphone market defies COVID-19 concerns to post 23.9% quarterly growth to a total 3.6 million units. This great momentum for smartphones is driven by the supply-side. “Transsion brands (Infinix, Tecno, and Itel) have shown remarkable growth in shipments to Pakistan. Thanks to their new cheaper models, supply availability while other brands were on shortage, and demand on a smartphone that increased over feature phones during the lockdown.

Conclusion:

The above-mentioned data is updated and taken from a very credible source. If you have any queries regarding the shared data, you can tell it in the comment section!

Source: IDC

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!