PTA Annual Report Highlights Telecom Sector’s Progress in 2023

Chairman Pakistan Telecommunication Authority (PTA) Major-General (R) Hafeezur Rehman recently presented the telecom annual report for 2023 to Prime Minister Anwar-ul-Haq. The report highlights the prospects of the telecom sector together with all the problems that need prompt attention from the concerned authorities.

Telecom Revenues

The report unveils that the telecom sector generated Rs 850 billion in terms of revenues in FY 2022-23, showing a growth of 17% despite economic challenges. It is all due to the policies and measures taken by the PTA and the IT & Telecom Ministry.

The point worth mentioning here is that the growth was 17% in terms of rupees whereas in dollars, they decreased from $ 882 Million in 2018 to $ 762 Million in 2023. The lack of a conducive environment, lack of funds, and political instability have been the major hurdles in the way of telecom operators. Security challenges, including the risk of cyber threats and seizures of telecom infrastructure, have posed risks to the sector. Due to all these problems, foreign investment in dollars witnessed a massive decrease.

Some telecom operators are leaving the market despite growth opportunities. For instance, Warid merged with Jazz and now Telenor is leaving the Pakistani market. PTA conducted many surveys to assess the quality of service, they found it deteriorating over time. According to PTA, cellular mobile operators (CMOs) have skipped some of the key performance indicators (KPIs) set in their licenses and the applicable regulations concerning voice and latency. If we talk about other countries, some have successfully launched 5G but Pakistan is still lagging. It has deprived people of the benefits of the latest technology.

It is pertinent to mention here that internet shutdowns severely affect a country’s economy. The number of internet shutdowns in Pakistan has been increasing significantly for the past few years. When the government or other authorities cut down access to the Internet and mobile services, it impacts numerous sectors of the economy. As we all know, most of the businesses have shifted online. The network outages result in decreased production, and a lack of communication between customers, vendors, and partners resulting in decreased revenue. It also affects digital payments. Moreover, the internet outages also shake investor confidence. It is very important to have a conducive business environment for winning investors’ trust. However, network shutdowns may doubt the country’s stability due to which Foreign direct investment (FDI) and economic development might suffer as well. This is what happened with the telecom operators. The lack of investors’s trust has resulted in decreased revenue, particularly in terms of dollars.

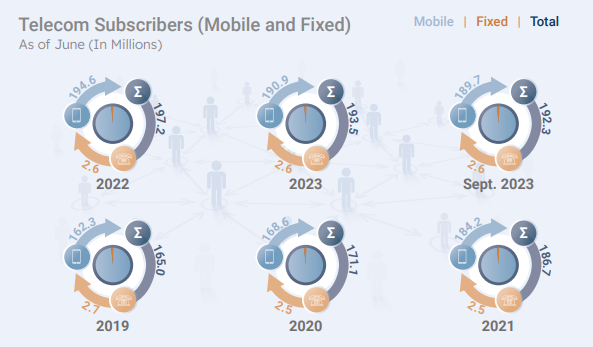

Number Of Telecom Subscribers (Mobile & Fixed)

The number of fixed telecom subscribers remained constant during FY 2022-23. It was recorded to be 2.6 million in number. On the other hand, mobile telecom subscribers witnessed a decrease from 194.6 million to 189.7 million during FY 2022-23.

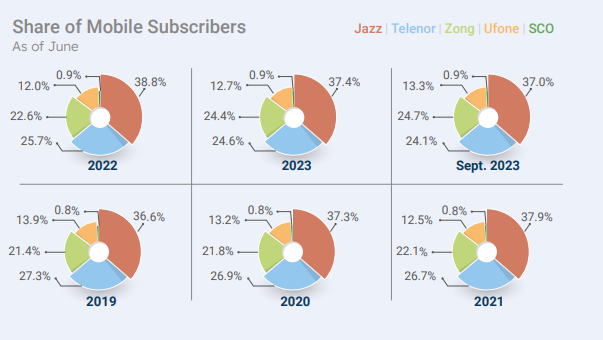

Jazz: The telecom operator emerged as a frontrunner with a maximum subscriber base overall from the year 2019-2023. However, for FY 2022-23, Jazz’s mobile subscriber share witnessed a slight decrease from 38.8% to 37%.

Telenor: For FY 2022-23, Telenor’s mobile subscriber share witnessed a slight decrease from 25.7% to 24.1%.

Zong: Zong’s mobile subscriber share increased from 22.6% to 24.7% for FY 2022-23. Zong showcased excellent performance in terms of consistency, and median multi-server latency during the fourth quarter of 2023.

SCO: If we talk about SCO, its subscriber base remained constant at 0.9% during FY 2022-23.

Ufone: Ufone subscriber share improved from 12% to 13.3% during FY 2022-23.

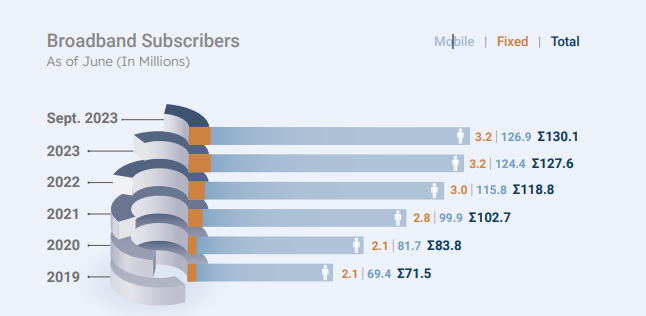

Broadband Subscribers (Fixed & Mobile)

The number of fixed broadband subscribers increased from 3 million to almost 3.2 million during the last year. On the other hand, the number of mobile broadband subscribers also jumped from 115.8 million to 126.9 million.

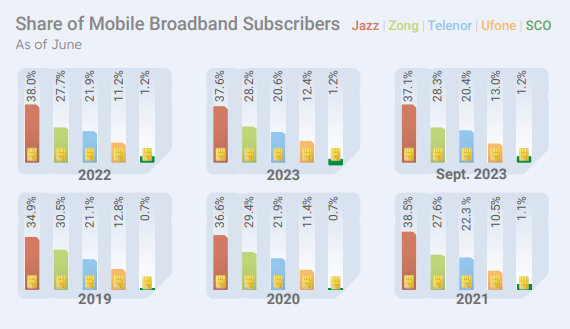

Jazz: For FY 2022-23, Jazz’s mobile broadband subscriber share witnessed a slight decrease from 38.0% to 37.1%.

Telenor: For FY 2022-23, Telenor’s mobile broadband subscriber share witnessed a slight decrease from 21.9% to 20.4%.

Zong: Zong’s mobile broadband subscriber share increased from 27.7% to 28.3% for FY 2022-23.

SCO: If we talk about SCO, its subscriber base remained constant at 1.2% during FY 2022-23.

Ufone: Ufone broadband subscriber share improved from 11.2% to 13% during FY 2022-23.

Overall, Zong and Ufone showed a slight improvement in the subscriber base during the last year. All the other operators witnessed a decrease in the number of subscribers. The telecom operators in Pakistan have been facing multiple challenges related to high taxation, the constraint on LCs, load shedding, high fuel prices, high power tariffs, and the lowest ARPU. It led to a decrease in the subscriber base raising concerns about the survival of telecom operators in Pakistan.

All stakeholders must get together for a brainstorming session on issues and prospects of the telecom sector in Pakistan. They should remove bottlenecks hindering its growth at the required speed. A lot needs to be done on the cyber security front as well as restoration of the confidence of prospective investors.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!