Zong Tax Certificate: How to Get it Online in 2022?

Many filers in Pakistan cant claim a waiver in their annual tax against their withholding tax deducted by the telecom companies because of two main reasons. First, they don’t have any valid information that they can avail such a waiver. The second reason is that most people aren’t aware of the procedure to get this type of tax statement from telecom operators. Well, they don’t need to worry, as we are going to mention a guide that will allow you to get your online tax certificate. So for all the zong users who want their tax certificate, we would mention how to get it online.

Zong Tax Certificate: How to get it Online?

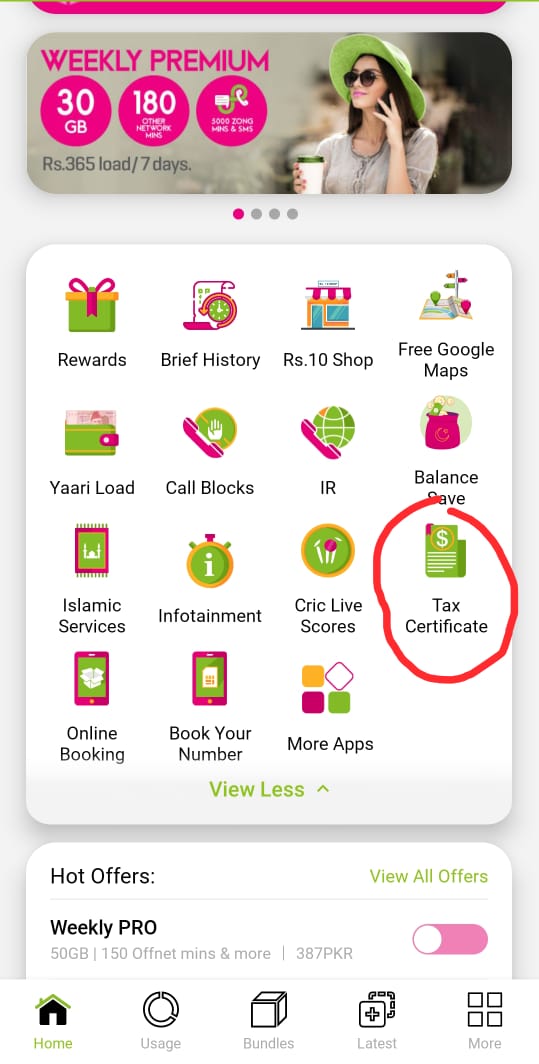

- First of all, open the ‘My Zong App’ on your smartphone.

- Afterward, on the main interface, you would be seeing the option of ‘tax certificate as illustrated in the image. Click on it.

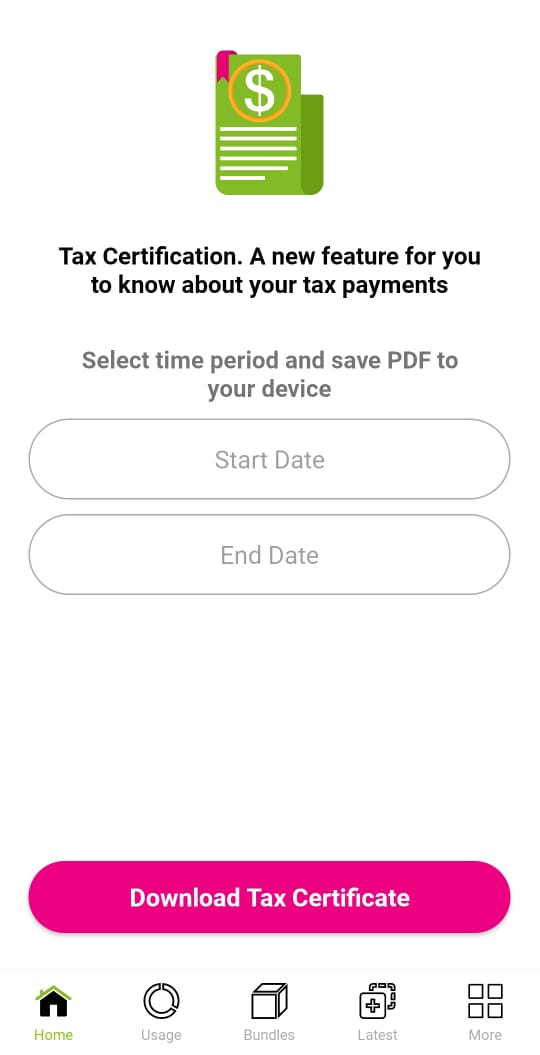

Afterward, enter the starting and completion dates of your choice and click on ‘download tax certificate.’

By following the aforementioned steps you would be able to get your Jazz tax certificate online. Furthermore, it would enable you to claim a discount in the annual tax against the withholding tax. It holds much significance in case you get into any inquiry or scam.

Read Also: How To Check Zong Number

Final Words:

The aforementioned informative guide will allow you to know how to get a tax certificate from Zong through the online method. If you like our article or have any queries regarding it, do mention them in the comment section.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!