Mobile Data services; The New Cash Cow for Telecom Industry

2014 was a historical year for the Telecom sector of Pakistan. The industry took huge leaps forward and achieved some major milestones, most significant being 3G/4G auction. According to the latest PTA statistics, Pakistan currently has a mobile penetration rate of 76% with more than 139.9 million users by the end of June, 2014 million; the predictions for the future are even brighter and the total mobile subscriptions would be swelling to over 190 Million by 2025 as per vision 2025 document released partly by PTA recently. Although, the market is going through a correction mechanism of SIM verification that seems to be benefiting now rather than damaging the industry.

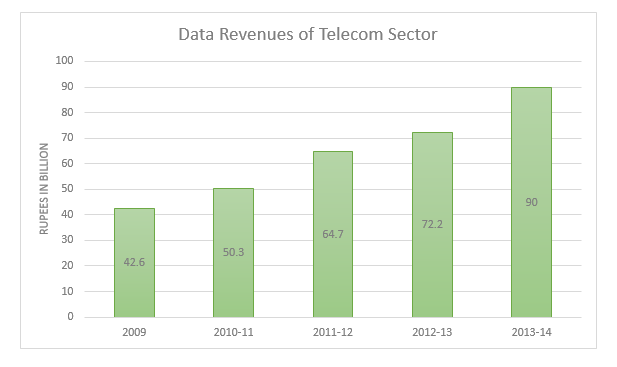

One of the major changes that are brought with the 3G/4G auction of April, 2014 is the increase in data revenue. During the Financial Year 2014, the telecom sector of Pakistan registered a growth of 24.6% that is more than double of 11.66% as of FY 2013. Rs. 90 billion of telecom sector depict that data services have become the new cash cow for the operators.

Pakistan a Smarter Society: Dream to Reality

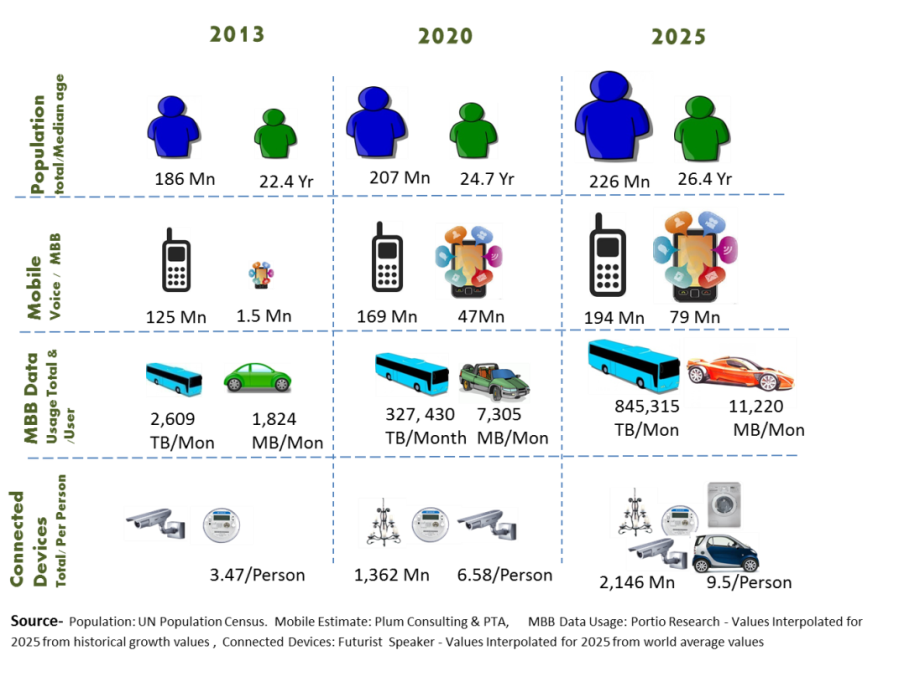

With the growth of mobile broadband technology after the 3G/4G auction, access to information and services will dramatically transform and will become a key driver of economic expansion. The innovation and vibrancy has just begun and the value it will bring to the socio-economic well-being of people will be massive. According to PTA’s Vision 2025 document, Pakistani population will reach 226 million in 2025 with a median age of 26.4, depicting that consumer appetite for ICT services will increase many folds creating numerous opportunities for service providers. The number of mobile penetration is expected to rise to 194 million – with still over 63million population under 14 i.e. under age for a mobile phone presents the idea that market has potential to rise and expand. Mobile broadband penetration should be able to reach 79 million by 2025, a MBB penetration rate of just 35% still a lot of opportunity for future growth beyond that period.

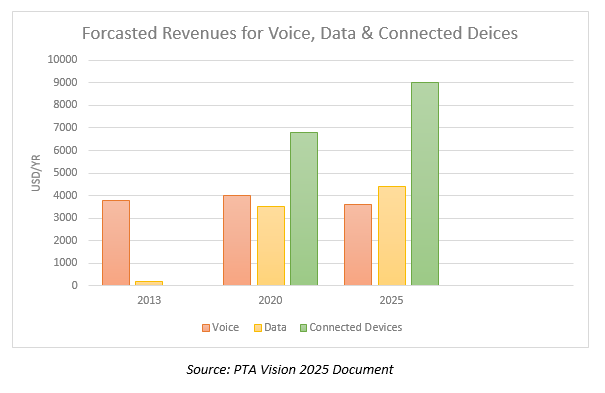

The PTA vision document emphasizes significance of the Internet of Things ecosystem that present numerous opportunity for the wireless industry revenues by 2025 in different industry sectors such as energy, healthcare, science, transportation, retail and others industries that will follow the international trends. The trends predicted for Pakistani market in Vision 2025 document by PTA could be quite conservative as the potential exist more for such growth in emerging market than developed once. It is therefore expected that massive expansion will be witnessed in public municipal services, health, education as well as security and public safety. But all of this will be only possible with expansion in Mobile Broadband. PTA’s vision 2025 document envision rapid expansion of MBB and rising connected community and devices that will result increase of 7 times in Data services by conservative estimates. The most important development will be availability of 2.1 billion connected devices in Pakistan with an average person connected to 9.5 devices- (this is also the global average for connected devices by ITU & IDC). This presents an 11 times bigger market opportunity than the mobile voice market. The Voice ARPU as is expected will probably result in downward trend presenting flat growth or maybe even decrease. According to PTA, the increase in mobile penetration will have little or no effect on voice revenues – rather it will see a decrease after 2015 and essentially somewhere in future it will also become more of a commodity. The report also expects that revenues from connected devices will surpass both the voice and Data by 2020 and their combined revenues by 2025.

The Changing Trends in Telecom Industry

As of June 30, 2014 data revenues account for 19.3% of the telecom sector’s overall revenue, up from 16.4% at the end of FY13 – the number for cellular segment, too, increased from 7.3% to 10.1%. According to PTA, the data revenue trend is likely to continue in the coming years.

“This is a healthy sign in the wake of 3G and 4G services in the country and shows that the use of internet and data services on the cellular mobile has been increasing,” the telecom regulator said in its annual report.

Data services have turned out to be the biggest strength for the telecommunications companies and the huge jump in the revenues is just a proof of that. By the look of it, this changing trend is going to accelerate further in the future. There are numerous reasons for the increase in data usage:

- Availability of 3G/4G networks

- Availability of more OTT services

- Affordability of Smartphones Increasing its penetration

- Availability of free and compelling Applications

Telecom operators are making huge investments to make available 3G/4G network to the consumers in Pakistan. As per State Bank of Pakistan, telecommunications sector attracted $856.7 million in gross FDI inflows, about 55 percent of Pakistan’s total gross FDI inflows in 1HFY15. The inflows are 755% more than same period last year. Moreover, net FDI inflows (gross inflow less outflows) were $100 million in this period, as compared to a negative $188 million a year-back for the same period. This investments into networks over the previous period shows the operators seriousness into expanding and improvement of 3G/4G networks for consumers.

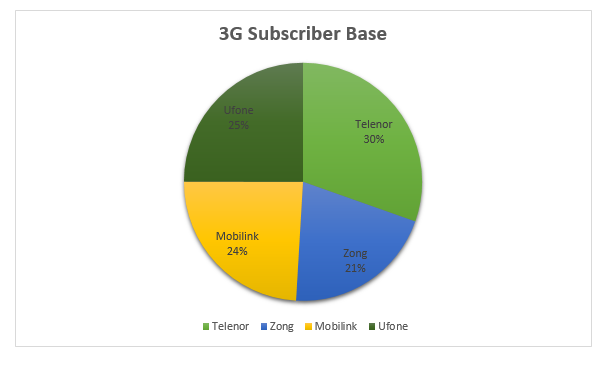

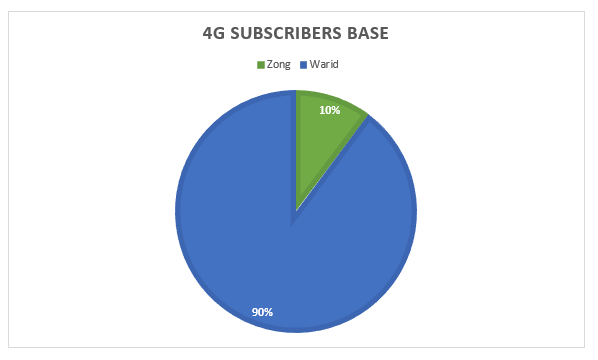

Consequently, with the introduction of 3G/4G services in the country last year, 3G connections has swelled to around 9.07 million in such a short time. Telenor leads the market with 2.74 million 3G users till the end of January 2014 whereas Ufone is at number two position with 2.25 million subscribers. Mobilink stands third with its 2.17 million subscribers while Zong is ranked fourth with its 1.85 million subscribers (although they were expected to do better-because of their purchase of largest segment of spectrum amongst all but this could just be the beginning). Warid has recently started its LTE services by reforming its existing spectrum for 2G while Zong started its services on the newly acquired spectrum at the end of last year. According to PTA, Zong almost doubled its 4G users in January 2015 to take the total count of its 4G subscriptions to 5,023 4G Users. Warid, on the other hands, recorded 44,075 LTE subscribers during the month of January (this could see drastic change in the coming months). Mobile broadband subscribers in the country are also expected to total 47 million by 2020 and 79m by 2025, according to the Pakistan Telecommunication Authority (PTA).

Major section of Pakistani population is the younger generation who want to stay connected and on the top of all happenings which makes the Pakistani market ripe for data interventions. With the increased use of 3G/4G services and rising influx of smartphones, the use of social media applications and over-the-top (OTT) services like Facebook, Viber, Skype, Tango and Whatsapp also amplified and the telecom sector witnessed a strong growth in its revenues from data services in fiscal year 2014.

More importantly, mobile phone retailers are also seeing more smartphone sales than feature phones. According to GFK’s latest data on smartphone penetration, more than 85% of Smartphones are now 3G/4G enabled devices. The consumers are now specifically demanding that their touch phones better not be just GSM but 3G/4G enabled showing more awareness and demand amongst the consumers.

Strategies by Operators to maximize Data Usage

In today’s competitive world companies face strict competition throughout all the phases of product life cycle. Telecom operators in Pakistan also made huge investments as we explained in securing spectrum, launching services, upgrading infrastructure and marketing their services. They are using different strategies to gain maximum number of customer base.

“The increasing use of smart communication applications via internet is slowly eroding the need for traditional SMS and voice calls,” said the Pakistani regulator PTA. “Therefore, it is imperative for the cellular mobile operators to focus on providing innovative data services and promote the use of mobile broadband that could help improve ARPUs significantly.”

Data Packages:

All four operators started their 3G services by offering variety of packages to attract highest number of users and came forward with variety of 3G packages for pre-paid and post-paid plans in order to cater to the needs of all customer types. The competition is quite tough in the ever expanding market and the biggest challenge for operators now is that how to make their Data tariff competitive, attractive and also profitable to get maximum users, as Data ARPU will have a profound impact on future revenues.

Operators have made customized data tariff plans keeping in mind the needs of all customers. Although most of the data users belong to the youth segment of the country with limited amount of money allocated for phone bills but it is also true that they are the ones who use maximum amount of data as well. So instead of comparing all daily, weekly and monthly packages offered by all operators let’s have a look at the monthly data tariffs.

3G Prepaid Monthly Packages:

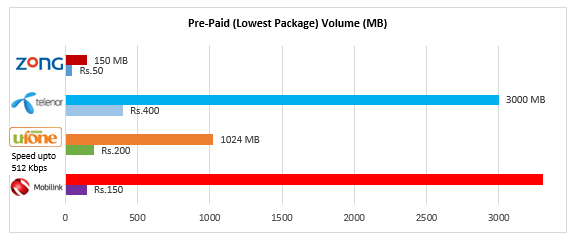

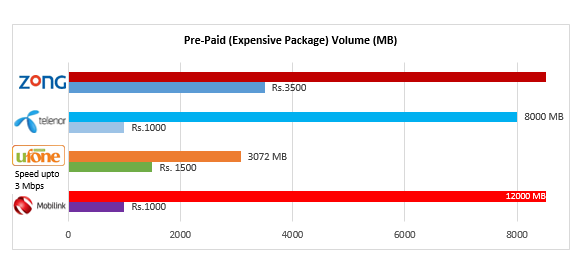

There are variety of data packages offered by all operators. Zong is offering eight different monthly packages for its prepaid customers starting from 150 MB of Monthly Mini for Rs. 50 to 30GB of Monthly Premium Plus for Rs. 3500. The best thing about Zong’s data tariff is that there is no speed limit on these packages. Zong customers can also buy add-ons on its packages to get extra data volume with 10 MB of free data.

Mobilink offers four monthly data packages starting from 3G Monthly Lite with 5,000 MB data for Rs 150. Its most expensive monthly package is priced at Rs. 1000 which offers 12,000 MB data. Mobilink is also offering a special Monthly Hybrid Package which includes 1000 Mobilink Mins, SMS & 2 GB data and costs Rs. 478. Ufone on the other hand has speed limitations on its packages. The most economical of these is the monthly 1GB data package that charges RS.200 and has a speed limitation of 512 Kbps. The most expensive data package offered by Ufone is the Monthly 3GB data package which costs Rs.1500 and has a speed cap up to 3 Mbps. Few more data packages are offered by Ufone but these packages are speed limited, from 512 Kbps to 3 Mbps. Telenor is offering two monthly packages, Monthly Bundle and Monthly Plus Bundle. Monthly Bundle is priced at Rs. 400 with data quota of 3,000 MB while Monthly Plus Bundle is offered at Rs. 1,000 with 8,000 MB of data.

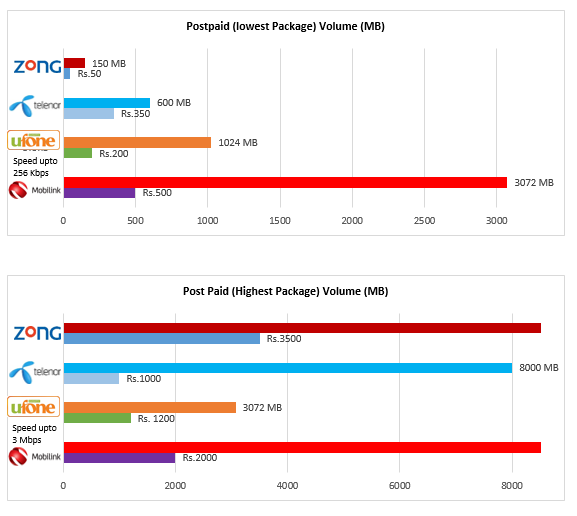

3G Postpaid Monthly Packages:

Zong is the only operator that offers same data packages for all customers. Its prepaid and postpaid packages are same. Whereas, Mobilink is offering three monthly packages for its postpaid customers.

- Monthly Mini – 3 GB – Rs. 500

- Monthly Max -8 GB – Rs. 1000

- 3G Monthly Heavy – 25 GB – Rs. 2,000

Ufone postpaid packages are available in 3 speed caps, 256 Kpbs, 512Kbps and 3Mbps.The most economic among Ufone data packages is the monthly data package of 1 GB which costs Rs.200 (speed up to 256 Kbps) and the most expensive data package offered is the monthly 3 GB which cost Rs.1200 (speed up to 3 Mbps). Beside its Smart Plans for its corporate customers, Telenor is also offering three monthly internet bundles for postpaid customers.

- Internet 350 – Rs. 350 – 600 MB

- Internet 600 – Rs. 600- 4,000 MB

- Internet 1000 – Rs. 1000 – 8,000 MB

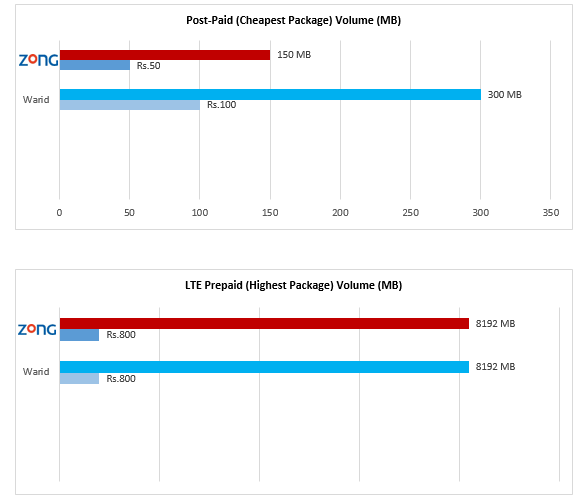

4G LTE Monthly Prepaid Packages:

So far Warid and Zong are the only two players in the LTE market. Although Zong is the fastest growing mobile network of Pakistan but in LTE market, Warid is miles ahead of Zong in terms of subscribers’ base. Both operators are offering special LTE tariffs for their customers, Warid is offering five monthly plans for its prepaid LTE customers with data limit starting from 300MB at Rs. 100 to 8 GB for 800 Rupees. Zong on the other hand is offering eight monthly 4G packages. The packages are same as its monthly 3G packages but obviously better and faster speed. In addition to 4G- enabled data bundles, customers can also subscribe to 4G enabled hybrid bundles separately. There are two monthly hybrid bundle offers, Monthly Home 1 and Monthly Home 2, each bundle offers a special deal for customers which includes:

- a) Unlimited on-net voice (24/7)

- b) 500 FREE SMS /day

- c) Data

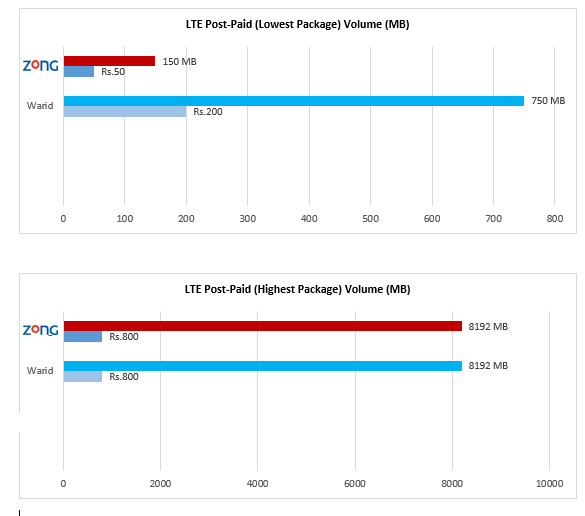

4G LTE Monthly Postpaid Packages:

Warid’s monthly LTE postpaid packages start from 750 MB for Rs 200 to 8GB for Rs 800, there are four monthly packages available in total for postpaid customers. Whereas Zong offers same packages for its postpaid customers as it offers for prepaid customers.

Zong, Telenor, Mobilink and Warid are also offering mobile broadband on 3G and 4G devices with special packages that are becoming quite popular among the data users. The prices of these dongles/Wingles start from Rs. 2500, each device capped with specific data speed and bundle offer. Mifi devices that are currently being offered by Warid and Zong are comparatively expensive and start from more than 48, 00 Rupees.

- Speed:

One of the biggest factor of Telenor’s success is that it offered cheapest and simplest pricing options in the market. However, effectiveness of speed is also a strong factor when considering 3G subscription. Although Ufone is the only operator that has capped its data speeds, probably due to the spectrum limitation but it is also the most transparent with declared speed bands. Mobilink and Zong are also getting good customer feedback as they have the maximum spectrum at hand. Zong also hold strong position in 4G service now that Warid has also started its 4G services. However speed variations are currently an issue across the country and user experience varies as the operators are still going through roll-out phase.

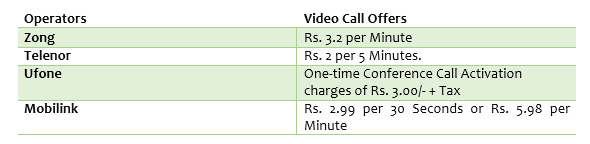

- Video Calling:

Video calling is the most prominent feature and major attraction of 3G facility. It is much better and simpler than phone call and text messaging and requires high speed internet. Although users can opt for OTT services for free video-calling service but all operators are offering special charges on their video calling facility. Mobilink is charging Video Calls on a 30 Seconds Basis whereas Telenor and Zong are charging Video Calls on a 5 Minutes and per minute bases respectively. Ufone has opted a different approach and is offering conference call option in which up to 6 members can talk at the same time. Ufone has also started video sms service for 3G users. This offers will allow 3G consumers to send and receive video messages. The receiver will be able to play the video SMS instantly however in case he/she does not have video call enabled smartphone, an SMS containing a URL will be sent by the company which can be utilized later. The users will be charged Rs.1+Tax per minute for sending the video SMS to the desired number.

- Social Media Pack:

Social networking websites and applications are the most widely used activity of internet these days. This is the reason why all operators are trying to cash this opportunity by offering variety of social media packages to increase data usage.

Zong Social Pack

Zong is offering use Facebook, Twitter and WhatsApp with 500MB worth of 3G/4G data with its Social Pack for a cost of Rs 10/Day.

Ufone Free Facebook Offer

Ufone has also started a free Facebook offer for both 2G and 3G customers that too without any subscription charges.

Telenor Social Media Offers

Telenor is the one operator that has offered maximum number of social media offers.

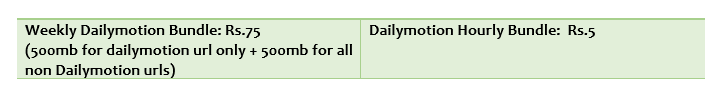

a. Daily Motion Bundle

Telenor offers free browsing of Pakistani classifieds site asani.com.pk under the daily fair usage policy of 5MB per subscriber.

c. Social Pack

Under this offer Telenor is providing free access to Facebook, Twitter & Whatsapp but with 100 MBs data limit for this bundle.

d. Free LINE

Telenor also offered limited time offer on LINE Messenger with zero subscription charges.

e. Free Twitter

Telenor also started Free Twitter offer for its pre-paid customers with zero subscription charges and default activation.

f. Urdu Point

Telenor also gives free access to its prepaid customers to the latest news, poetry, sports and entertainment in Urdu at UrduPoint.com, the largest Urdu web site in the world.

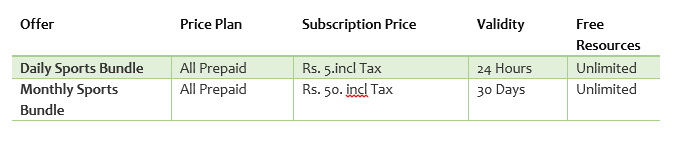

g. Sports Bundle

Telenor’s sports bundle is meant for the Football lovers. Under this offer customers will also get free football update anytime by activating the live score web-pass on Opera mini browser.

Mobilink Social Packs

Mobilink is currently offering 2 Social Bundles:

- Daily Social Bundle with unlimited browsing on Facebook, Wikipedia, Twitter and Whatsapp for Rs.5.

- Social Bundle with unlimited browsing on Facebook, Twitter and Whatsapp and 300 for 3days charged at Rs. 10+ Tax.

Mobilink is also offering free unlimited browsing with its Wikipedia Zero package and unlimited access to Nimbuzz messenger with its Nimbuzz bundle offer priced at Rs. 12/weekly. Its free social media Offers also include: Free OLX and Free Twitter.

Mobilink Web Pass

Mobilink and Opera Software have introduce a new service, Mobilink Web Pass, for the very first time in Pakistan’s market. Mobilink Web Pass allows users to purchase data bundles and browse the mobile internet on the Opera Mini browser. With Mobilink Web Pass, mobile customers can easily buy time-based or content-based mobile data packages through a simple, one-click purchase, similar to how users buy apps today. There is no subscription string for these Web Passes; they can only be purchased online through Opera Mini browser.

Warid Social Pack:

Warid has finally started its LTE services in the country and great deal of efforts can be seen its marketing and promotional strategies. Like other operators, Warid is also offering free Facebook and Whatsapp package to attract the youth segment of the country.

- Coverage:

Coverage is a very important factor in maximizing the subscription base, 3G roll-out plans of all operators are under progress right now. Zong is providing its 3G services in more than 30 cities and on Motorway I and II now while Telenor has 3G coverage in 72 locations including Motorways. Ufone has so far 27 location with 3G coverage Mobilink on the other hand, has 3G coverage in 34 cities and at 4 location on Motorway.

- Marketing:

The success of a product or service is dependent on its marketing more than the product/service itself. This is the reason why each of the operator is using variety of techniques to market their data services. Although their marketing campaigns did manage to attract lot of customers but better result could have been achieved if the campaigns were aimed with spot-on message as early impressions of customers to the 3G services were less than satisfactory. Experts believe that slow early uptake of 3G services was due to telco’s mishandled advertising campaigns. Telecom companies concentrated to build their brand rather than the product itself, leaving many customers uneducated with regards to the actual benefits of 3G services.

Although operators have now finally started to change their approach in marketing campaigns and came forward with simple and to-the-point advertisements that are triggering massive response. To further maximize the date usage operators need to engage the customer by making them aware about the actual product experience which obviously cannot be conveyed to customers through models dancing upbeat music on TV screen with cell phones in their hands. Rather what is needed right now is to provide information about how data usage can revolutionize one’s lifestyle.

Another thing that all operators need to consider is that there is a huge population in the country that hasn’t used internet so far. Although it is quite understandable that due to selected network deployments during early stages, operators are eyeing high-demand user base only. But there is also no denying the fact that these first time internet users can become potential users if given an opportunity. Creating awareness about the role that 3G services can play in their life could be very helpful for the operators and customers alike.

- App Stores:

Another strategy carried out by operators to increase their data revenue and attract more customers is the App stores that give access to thousands of apps that can be downloaded directly to the handsets. All five operators are currently providing online app portals that offer variety of applications to the users including entertainment, infotainment, religious, social network, education and business solution applications.

Through these value added services operators not only facilitate their customers and increase their satisfaction level but also bag high revenues; a win-win situation for all.

- Smartphone Promotions:

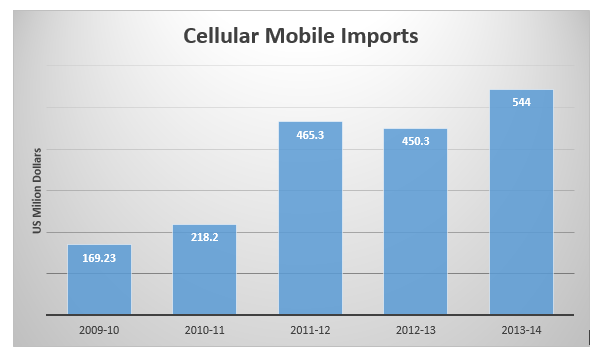

Another strategy used by all operators is the 3G enabled handset promotion. To increase the 3G/4G penetration in the market, operators are now offering different local and international smartphone brands at special prices and 3G bundle offers. In post 3G/4G scenario most of the mobile users were using feature phones, so this is a great strategy to attract customers to 3G services. The overall imports of 3G/4G enabled handsets has also increased after the auction and many international brands like OPPP, Apple and Lenovo have also entered the market.

Future Prospects

Pakistan’s telecom market is considered one of the most competitive telecom market with more than 140 million customers and ranked as 8th largest market in the world. In a scenario where even half of 140 million customers are unique active subscribers then it is expected that 70 million strong base can potentially join Data in coming years, ranking Pakistan among Top 5 internet market of the world.

Pakistani are tech-hungry by nature this is the reason why technology adoption is relatively high in the market. Therefore, in due course of time Data boom is expected in the market but there are certain factors that also stakeholders need to work upon:

- Coverage

- Device Availability

- Ecosystem building

- Customer awareness

If done appropriately, next generation technologies especially data services & connected devices or IOT can turn out to be the biggest strength of telecom operators. But for that every stakeholder needs to play its part to ensure that industry flourishes in the right direction and benefits are reaped by all.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!