Competing for Spectrum: 4G Auction Considerations

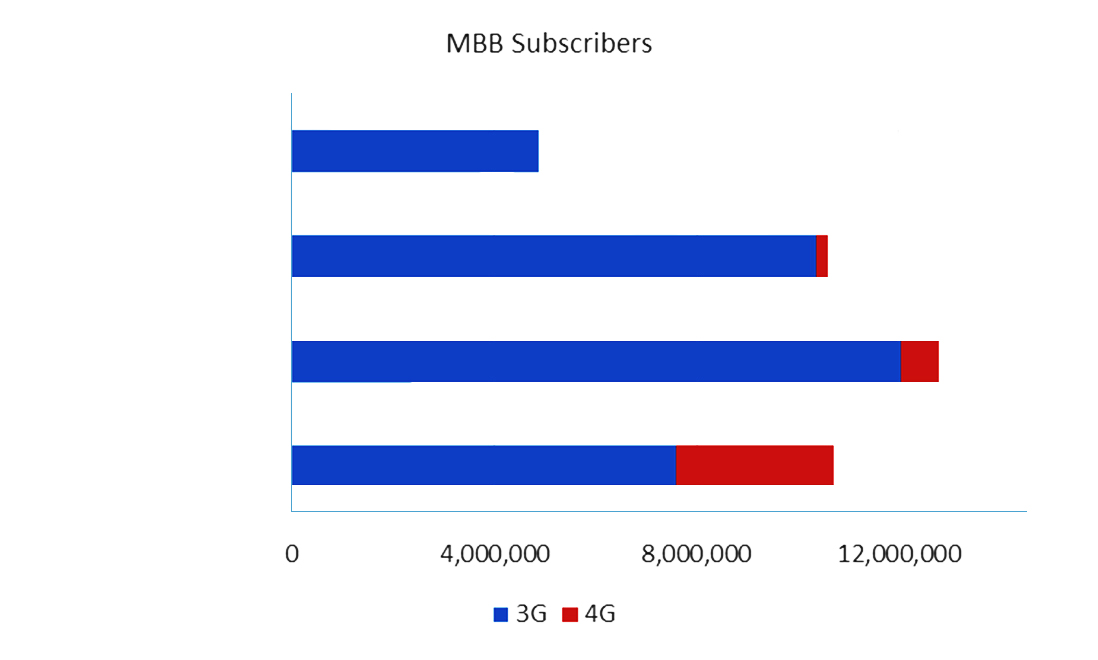

Pakistan’s swift journey from 2G to 4G is certainly an inspiring feat. It has been only three years since the first Next Generation Mobile Services Auction (NGMSA) but the number of 3G/4G subscribers has already crossed 38 million where three out of four mobile operators are 4G LTE service providers. The next round of auction for the last chunk of 10 MHz in 1800 MHz Spectrum from the NGMSA is soon to take place that will further change the future position of each mobile operator.

The upcoming spectrum auction is not only important due to its role in the conclusive journey of 4G but also for the fact that it will also shape the way for eventual evolution to 5G

The upcoming spectrum auction has its importance due to various considerations and weightage for each operator. Primarily, this is not just due to the conclusive journey of 4G services but any additional spectrum may also shape the way for eventual 5G evolution. Operators’ response towards the approaching spectrum auction will also reveal their framework and plan for the future.

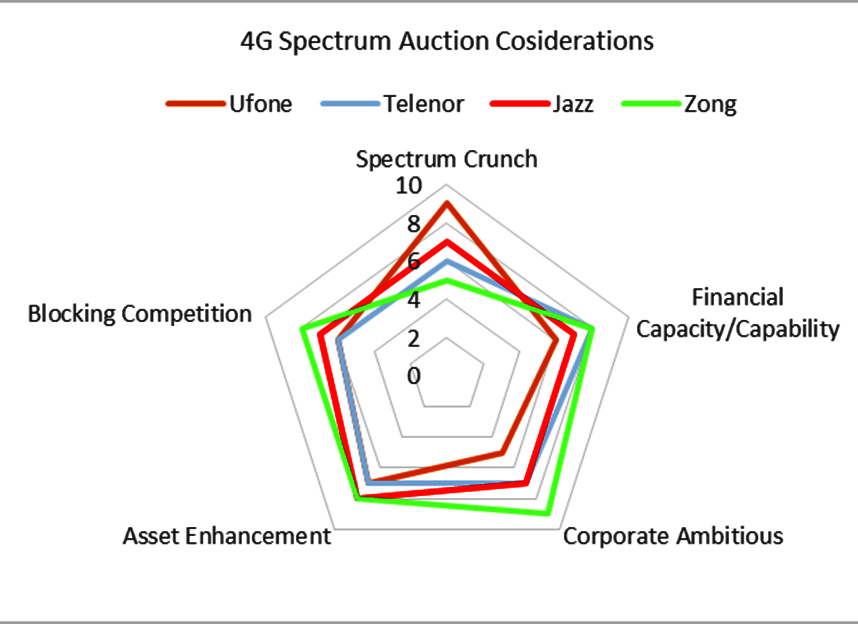

We have tried to elucidate the current position of each operator, its spectrum mapping and the value this additional chunk of 10 Mhz can bring for each operator with the help of these five parameters i.e. Spectrum crunch, Financial Capacity & Capability, Corporate Ambitions, Asset Enhancement and the need to contain the Competition.

Spectrum Crunch:

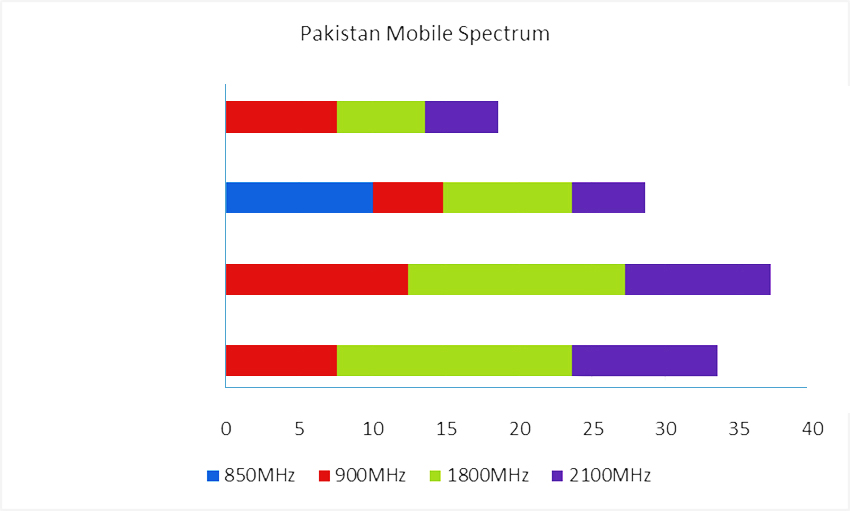

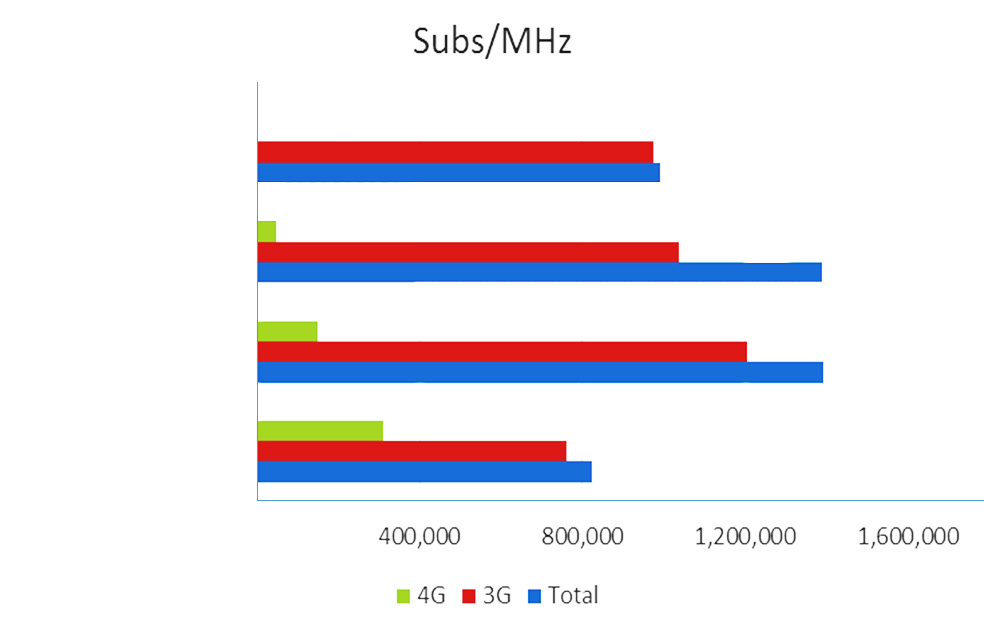

It is quite evident that Ufone having failed to get any substantial spectrum earlier in the NGMSA ranks much higher than others in spectrum requirement category.It is primarily because of this that its overall subscriber base is falling and its MBB subscription has also stalled due to limited data service offerings and Quality of service which is directly related to the small amount of available spectrum. Currently, Ufone has the lowest amount of overall spectrum available i.e. 18.6 MHz for both voice & data. It has 5Mhz in 2100 Mhz and at some places a refarmed spectrum in 900 Mhz available for MBB.

From Spectrum perspective, winning this auction is of utmost importance for Ufone as it will be a make or break situation for them

If Ufone wants to compete with other mobile operators especially in the mobile Data Services it shall have to get additional spectrum specifically in this coming auction so that it can compete or atleast stay in the race. Hypothetically, to accommodate similar number of mobile subscribers it requires the equal quantity of spectrum as others. In order to increase its customer base Ufone will also need to increase its spectrum starting from the forth coming auction. Hence, winning this auction from a spectrum perspective will be of utmost importance for Ufone as it will be a make or break situation for them.

Jazz certainly has the highest chunk of spectrum available but since it also has the highest number of subscribers, Jazz can also use the additional spectrum in the near future for better quality of service and also to maintain its market position. Jazz can refarm some of the spectrum but since its number of the existing subscribers have crossed 50 Million, it would need to have an additional spectrum to accommodate new users specially for Data.

To compete with the Market leader, Telenor will need additional spectrum to reach the same level

Mobilink Jazz uses three frequency bands i.e. 900, 1800 and 2100MHz. For Data, it uses 10 Mhz of the 2100 Mhz for 3G and for 4G it has re-farmed 1800MHz of Warid. For a more competitive position in future, it will need to consolidate its 4G spectrum position and therefore, should strive to get additional spectrum. If it does participate in this auction or for that matter in a future auction, it will be able to maintain its growth spree. Technically, in that case it would be very advisable to also start working on aggregating the carriers to further improve the network data rates.

Telenor until last year only had 18.6 MHz and during the end of the year were able to secure an additional 10 MHz spectrum in 850 Mhz band in the 02nd round of auction in which it was the only participant. It had to take an unconventional spectrum for its MBB since its network choked for spectrum. Again, hypothetically speaking if Telenor has to match Jazz’s 37.2 Mhz it will need the additional spectrum to make it to 38.6 MHz and compete with the current market leader.

Though Telenor has split the existing 850MHz spectrum between HSPA and LTE, but with the new band they can utilize the whole 850 for LTE. It is important to note that Telenor was only a million subscribers behind Jazz before the merger. It has pursued the 3G services quite aggressively in the past; if it plans to follow the same strategy it will require additional spectrum. Also, its 4G services also need improvements since it is reportedly using only half the spectrum for 4G and the other half for 3G, which impact its service quality of 4G.

While, it is very difficult to access the spectrum requirement based on other factors without a proper QoS audit but some industry experts also see the density of subscriber as high level gauge to assess this parameter. As evident, all three operators i.e. Ufone, Telenor and Jazz have a very tight spectrum for their 3G services. However, when it comes to 4G Zong definitely has a very high subscriber’s density for 4G and if geographical considerations are normalized it would certainly need additional spectrum for its 4G & onwards technological growth.

Telenor’s appetite for additional spectrum of 10MHz bandwidth can be a supplementary resource for LTE only. They can aggregate the carriers of the different bands and provide the users with boosted data rate capabilities. This can be performed by using the 5MHz from both the bands.

Zong acquired handful of spectrum i.e. 20 MHz in the 01st round of NGMSA auction and theoretically should be the last to plan out for any additional spectrum requirement. However, as Zong is the largest 4G operator with more than 3 million subscribers and it has announced that in future all deployment and network growth will be focused on 4G LTE, therefore it will still need to require additional spectrum to pursue this strategy in much better way.

Financial Capacity/Capability:

In Pakistan all four operators are backed by strong international parent companies that are not bound by any financial constraints. In this regard, Telenor and Zong are the forerunners because Telenor has just recently closed its business in India to concentrate on emerging markets, Pakistan being one of them. Whereas, with ongoing CPEC, China’s has become even more interested in making further investments in Pakistan. Therefore, Zong’s investment may also come from political considerations and the price in the form of Spectrum investment could be a very small thing in the scheme of things.

If capacity & capability is considered the only parameter both Telenor and Zong rank high. Jazz on the other hand has recently invested in the merger so making further investment at such a short interval might not be on the cards. However, since the investment into Jazz is in kind and less in financial terms therefore the company still could surprise the market. Ufone, a Government of Pakistan and Etisalat’s subsidiary has not made any financial investment in the past few years specially in the NGMSA. While, both the shareholders are quite deep pocketed specially Etisalat that has considerable capacity for raising funds but this could be over shadowed by an extended conflict among the two parties about Etisalat’s remaining payment of USD 800 million that it owes to the Government of Pakistan.

Ufone’s shareholders may be conscious of the fact that if they do not make an investment now their value of existing investment could deplete very quickly

Since, it seems to be a now or never situation for Ufone, there could be some agreement by the shareholders especially from Etisalat to make arrangement for investment in the Spectrum. Both shareholders especially Etisalat may also be conscious of the fact that if they do not make an investment now their value of existing investment could deplete very quickly.

Corporate Ambitions:

Zong, Jazz and Telenor have shown great commitment in the past few years. Substantial investments were made by all three operators and each of them followed an aggressive expansion and up gradation strategy that shows each operators’ high level of corporate ambitions to expand and do well in Pakistan.

Zong is most ambitious operator among all as due to being the first China Mobile Operations outside of its territory. It not only actively participated in first NGSMA auction but it has also invested huge amount of money in network improvements and upgrade especially on LTE as compared to others who went for 3G expansions. Importantly, not only for corporate but this could be for strategic reasons as well since the Government of China is already very involved in making CPEC a reality.

Telenor Group’s ambitions for Pakistani market has enhanced further after its exit from the Indian market where it faced a series of letdowns

Zong being a Chinese entity could be quite aggressive in playing a vital role in making its presence more prominent. Resultantly, with the additional spectrum, it can support broadband data services such as IoT and other advance features that will better serve the economic activities expected from CPEC.

Telenor Pakistan is the second largest market for Telenor Group therefore; it ranks very high on Group’s priority list. Telenor Group’s great ambition for Pakistani market is also natural especially after its exit from the Indian market where it faced a series of let downs. The high EBITA margins and the innovative services that it was able to launch such as Easy Paisa etc., also makes Pakistan as one of its primary market. Keeping in view the growth trends, it also started its 4G services in the unconventional spectrum of 850 MHz band. Quite interestingly, Pakistan has also become the second largest market for Vimplecom after its merger with Warid. The changes in the company structure also speaks volume of the Group’s growing interest. Therefore, from corporates’ prospective Pakistan holds great importance for both these groups into their expansion.

Spectrum cost is quite high therefore, it is not feasible to participate in auction just to keep the competition out

Ufone on the other hand is a totally different story. As indicated earlier, the relationship between Government of Pakistan and Etisalat has seen my ups and downs in the past. Ufone went to first 3G/4G auction and came out with the least spectrum and even later-on it didn’t come up with any worthwhile strategy to improve situation except for refarming a small portion of the 900 Mhz spectrum for it Data services. Ufone like Telenor initially got only 5 MHz in 2100 MHz band but Ufone could not manage things well whereas, Telenor managed to become the largest 3G operator in a very short interval following the auction.

Asset Enhancement:

In mobile business, spectrum is the most important Asset; the more spectrum an operator has the better is its asset value. One of the main reason why Mobilink opted to acquire Warid was its spectrum that is now being used for Jazz’s 4G services.

While, it is natural that all operator would like to go for the additional spectrum but those with limited spectrum would be most interested. Therefore, the importance of the forthcoming auction is equally significant for all the players in terms of increasing their asset value. The 1800 MHz spectrum is most suited for 4G and Zong and Mobilink are planning to build their future strategies based on next generation LTE & LTE-A technology and services. Therefore, despite having bigger chunks in 1800 MHz, they can further enhance their assets through additional spectrum.

While Telenor and Ufone only have 8.8 and 6 MHz perspectively therefore, additional 10 MHz in 1800 band will certainly enhance their asset value and also prepare them better for the future. Importantly, Ufone with its smallest amount of spectrum will have to compulsorily take part in upcoming auction otherwise it will not only loose its market but if the shareholders plan to sell their assets, they won’t have much to bargain with either.

Holding out Competition:

Another important factor that influences the strategies of a company is the position of its competitors. Big players try to block smaller companies to create their monopoly. In this particular scenario Jazz and Zong are the major players and they could participate in this auction with the objective to block competition even if their current positions may not necessitate them take the spectrum.

Dominant factor for the operators will be to ease up spectrum congestion and Ufone seems to be the front runner to take up additional spectrum

Telenor and Ufone are not really in a position to block competition since Zong and Mobilink already have a stronger position in the market but they can definitely elevate their market position by acquiring additional spectrum. While, blocking competition is an objective that we see around the world but this may not be the case in Pakistan as the Spectrum cost is quite high for just to keep competition out.

Conclusion

The overriding factor for the current operators will probably be to ease up spectrum congestion and from that perspective Ufone seems to be the front runner for taking up the additional spectrum. It is for this reason we have explained in more detailed the various aspects of this parameter. We have also discussed the importance of other parameters as well that could also be the prime objectives for others to compete in the forthcoming spectrum auction. We have to wait and see how the smooth evolution to newer technologies continue to take place in the Pakistan mobile market. It is very likely that if Ufone secures the additional spectrum it can finally improve on growth trajectory.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!