A Basic Guide for International Passengers Carrying Mobile Phones to Pakistan

Complete Guide and FAQs for International Passengers/Travelers Bringing in Smartphones Along.

PTA started blocking mobile devices that were “non-compliant”, after 1st December 2018. If you are an international traveler coming to Pakistan while carrying a mobile phone(s) with you for personal use or to gift it to someone, you might want to read this guide.

The purpose of this guide is to create awareness for all those who are traveling in and out of the country and to answer all the questions they might have about DIRBS, basically, what they need to do in order to keep using their mobile phones legally.

Starting with:

How many phones can an international Passenger bring in to Pakistan?

As per Government of Pakistan’s Law, an international passenger can bring in 5 (five) mobile phones per year to Pakistan for personal use.

What if you want to use an International SIM during your stay in Pakistan?

If you are planning to use an International SIM in your mobile phone, a SIM that isn’t provided by a Pakistani Mobile Operator, you do not need any sort of registration to do. You can freely use your international SIM during your stay for up to 60 Days.

What if you want to use a Local SIM?

For those international passengers, who plan to use a Local SIM, whether Zong, Ufone, Telenor, Mobilink or Warid, they need to register their Mobile Device IMEIs.

You can do that through:

- the online portal system i.e. https://dirbs.pta.gov.pk/drs/auth/login

- or by dialing *8484#

(each process is explained below, keep reading!)

Carrying a Single Phone Along? Do you need to pay duties for that as well?

Previously, 1 (One phone) was exempted from taxes/duties, while for others you needed to pay customs. But now, due to the misuse of Baggage Rule, you need to pay tax on each and every phone that you bring in to Pakistan along with yourself.

For example: If you are planning to bring 5 (five) mobile phones along for your personal use, you would need to pay duties and taxes on all 5 (five) of them. Clear?!

You can find out the taxes that you would have to pay at “Mobile Phone Taxes in Pakistan Calculator (Updated 2020)”

Do you need to register a phone that you bought and already used here before leaving the country?

No, If you have a phone that you bought here in Pakistan (PTA Approved) or used it here before December 2018, You do not need to go through the registration process for that particular mobile device.

How to register a phone that you are bringing into Pakistan for the first time as an International Traveler?

It is very simple, firstly

Find out the IMEI number of your Mobile Device

How to do that?

i. Dial *#06# from the dial pad of your device and note down each 15-digit IMEI (for dual SIM devices) supported by the device.

ii. If you have the box of your smartphone, the IMEI is printed on that.

iii. if your phone ran out of battery and you aren’t able to go through the code in order to find out the IMEI(s), also you do not have the box of the device along, you can simply remove the back cover/ battery of the phone, find and note your IMEI(s).

Now, there are 2 (TWO) ways you can register it.

1) Dial *8484#

You need to dial *8484# using a local Pakistani Network SIM and follow the steps.

OR

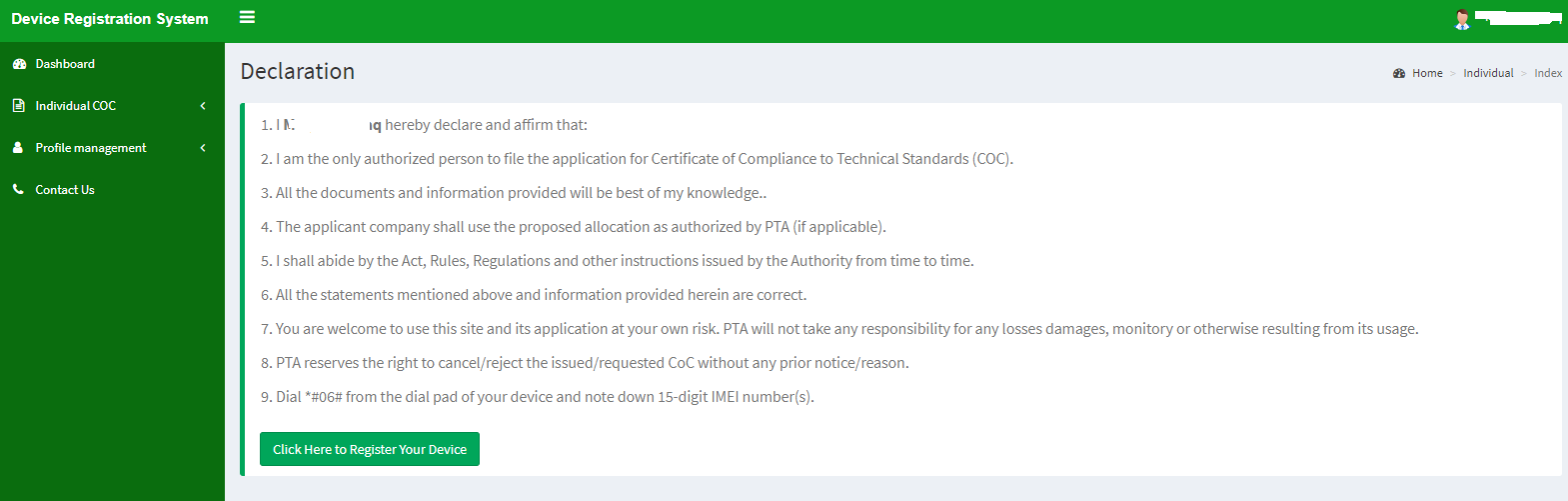

2) Registration via PTA online portal system:

Log on to dirbs.pta.gov.pk/drs/auth/login and create an account over there. This Guide will help you out.

What will you need?

-

- CNIC or NICOP Number

- Passport Number

- Local Pakistani Network Number (To Receive OTP Code)

- An Email Address (Needed to Register an Account on the DIRBS Portal)

Now follow these steps!

- Now Visit: dirbs.pta.gov.pk/drs/auth/login

Register a new account using the details mentioned above. - After registration, click the activation link at an email that you’ll receive from DIRBS.

- Now, login to the Dashboard!

- Click the “Click here to register your Device” Button and follow the instructions.

- After putting in all the details (including the IMEIs), you’ll get information about the tax that you’ll be required to pay.

- Print that and pay it in any bank nearby you.

That’s it, your mobile device will be registered within 24 Hours.

NOTE: Register your phone within 30 days of arrival to get a discount on the total tax.

Welcome to Naya Pakistan! 🙂

If you need to know more, we have more guides on DIRBS as well, check them out!

- Mobile Taxes Calculator (Updated 2020)

- Increase/Decrease in Taxes on Mobile Phone Imports – Mini Budget

- How to Verify the Status of Your Mobile Phone’s IMEI via SMS or APP?

- How to Bring Phone in Pakistan without Paying Tax?

- Overseas Pakistanis Can Bring only One Phone Free of Duty in a Year

- How to Check for an Invalid IMEI When Buying a Used Phone?

- How to Save Your Phone From PTA Blockage?!

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!

You can bring upto 5 phones. You do not have to pay tax at the airport. If anyone at the airport asks you to pay tax now, tell them you will pay it later through your relatives in pakistan at your own Convenience.

Hi, i heard that no mobile device is exempt of taxes now. Is it true or its the same like before?

Yes, true!

I want to ask that if i am bringing a phone from abroad for my personal use them do i need to pay tax for it??

Three year old baby can bring a new phone to pakistan duty free ?

Bahi me next month pak araha.. to kya 2 mobiles la sakhta? Airport pe puchen gey to nahi.. kya muje tax dena ho ga?

I am bringing a friends phone which is not opened and is packed. I’d really like to know whether i will have to pay tax on the phone or declare it or can i bring it in pak and then my friend can register the phone himself. Is this possible?

Assalamu alikum mae malaysia ma 6 saal se hu magar ab Pakistán jana hay or agr Mae khud k istamal k liye koi ek phone ly kr Pakistán jata hu us ek phone ka bhi tax dena hoga ??? Jitny

What if someone brings more than 5 phones in a year?

What if someone brings more than 5 phones a year?

Dear Fahad

. . . . . . . Assalam o Alikum and how r u.I want to know what is the tax on p smart 2019.