New PTA Taxes on iPhone 14 Series (Nov. 2023 Updated)

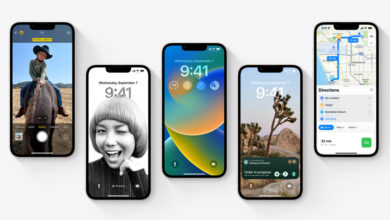

It is been over a year since the launch of the iPhone 14 Series including four models, the iPhone 14, 14 Plus, 14 Pro, and the 14 Pro Max. Unfortunately, in Pakistan, we need to pay double the prices of every phone when buying due to the insane PTA Taxes. Here are the latest PTA taxes on the iPhone 14, iPhone 14 Plus, iPhone Pro, and iPhone Pro Max in November 2023.

iPhone 14 PTA Tax

| Model | Tax on Passport | Tax on CNIC |

|---|---|---|

| iPhone 14 | PKR 107,325 | PKR 130,708 |

| iPhone 14 Plus | PKR 113,075 | PKR 137,033 |

iPhone 14 Pro PTA Tax

| Model | Tax on Passport | Tax on CNIC |

|---|---|---|

| iPhone 14 Pro | PKR 122,275 | PKR 147,153 |

| iPhone 14 Pro Max | PKR 131,130 | PKR 156,893 |

PTA Taxes on Apple iPhones and all other imported smartphones are decided by the FBR, and we think that they are ridiculously high. In comparison to the previous taxes, they have increased over 1 lac in the tax amounts. No one is willing to pay these huge amounts of taxes and there are lots who found alternate ways to use their phones without registering with PTA.

We would greatly appreciate it if the FBR reconsidered the tax rates on all smartphones. Instead of targeting the end users, they need to be bold and take steps against those who import mobile devices for commercial purposes and exempt those who import mobile devices for personal use.

Use Our PTA Mobile Taxes Calculator to know the taxes on all the latest smartphones.

FBR must reduce these taxes to a maximum of PKR 50,000 on CNIC on the most expensive smartphones available. Also, we urge every user to not pay these huge taxes and exercise their right to object! If the smartphone is IMPORTED AND USED FOR PERSONAL USE ONLY!

Follow us on Facebook & Instagram to get daily updates regarding taxes.

PTA Taxes Portal

Find PTA Taxes on All Phones on a Single Page using the PhoneWorld PTA Taxes Portal

Explore NowFollow us on Google News!